Lotte Department Store Main Branch Foreign Sales Up 590%

Galleria Luxury Hall 500%... Sales Share Recovers to 5% Range

Economic Downturn and Overseas Tourist Recovery... Growing Influence of Luxury Goods

Luxury Brands: Price Up, Channels Down... Duty-Free Shops Concerned

French luxury brand Louis Vuitton announced a price increase of 8~20% on the 18th of this month, sparking a buying frenzy in China. Following the news of another price hike just over two months after the last one in December, popular handbag models quickly sold out, and customers waited over an hour just to enter stores. After China lifted its 'Zero COVID' policy, overseas shopping through travel has resumed in earnest. Domestic department stores have also seen an increase in 'big-spending overseas customers' lining up to purchase before the price hike.

Returning Foreigners... Department Stores Return to 'Luxury'

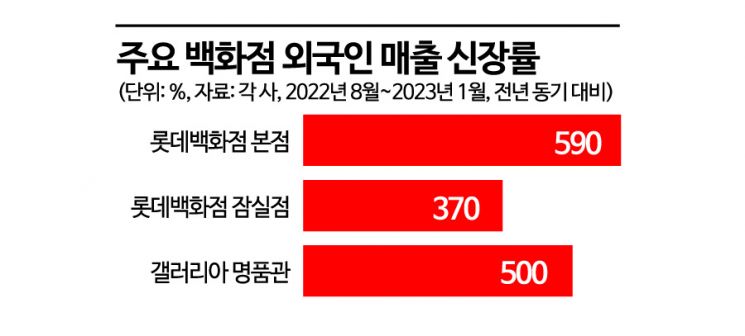

Since the endemic declaration last year, the number of overseas tourists has been gradually increasing and is expected to expand significantly this year. According to Lotte Department Store on the 7th, over the past six months from August last year to January, foreign sales growth rates at their flagship and Jamsil stores?popular locations among foreign tourists?recorded 590% and 370% respectively compared to the same period the previous year. This indicates a recovery in foreign sales that had sharply declined during the COVID-19 pandemic.

Galleria Department Store's luxury hall also saw foreign sales increase by more than 500% over six months. The main nationalities of foreign customers were ranked as China, followed by Southeast Asia, the United States, and Japan. Notably, the number of Chinese customers has been gradually increasing since the end of last year. It is expected that the growth rate will accelerate once group tours resume. A department store official stated, "Before the COVID-19 outbreak, foreign sales accounted for more than 15% of luxury hall sales, but due to the prolonged pandemic and reduced travel demand, this share once dropped below 1%. However, over the past six months, with the increase in foreign tourists due to the endemic, this proportion has risen to over 5%."

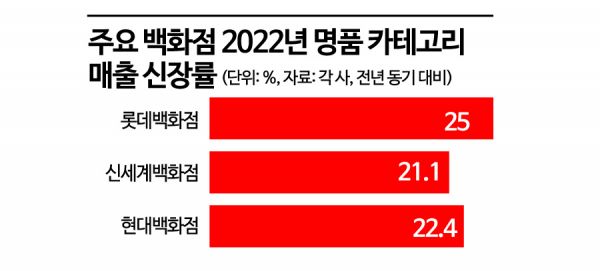

Industry insiders expect major department stores to focus even more on strengthening their luxury assortments this year. During the COVID-19 period, when domestic sales were dominant, department stores concentrated on discovering new brands and enhancing experiential content targeting the MZ generation (Millennials + Generation Z), who are new and future customers. However, amid growing concerns about an economic downturn this year, it is analyzed that department stores will put more effort into boosting luxury shopping for domestic and foreign VIPs, whose spending is less affected by the economy and who contribute significantly to sales. Last year, luxury category sales growth rates at major department stores such as Lotte, Shinsegae, and Hyundai were 25%, 21.1%, and 22.4% respectively, despite the high base effect from COVID-19 'revenge consumption.' The return of foreign customers, especially from China, supports this analysis. Luxury items overwhelmingly dominate foreign shoppers' purchases. According to Galleria's luxury hall data, the average spending per Chinese customer before COVID-19 reached 3 million KRW. Meritz Securities predicts that between 750 billion and 1.5 trillion yuan of Chinese savings will shift to luxury and other consumption following the reopening of the economy.

Luxury Brands Raise Prices and Limit Channels... Duty-Free Shops Face Growing Challenges

Luxury brand policies have also changed through the COVID-19 period. As liquidity increased and potential customers with greater purchasing power emerged globally, brands have raised prices multiple times annually while restricting sales channels to enhance product value and scarcity. Louis Vuitton is a representative example. Following five price increases in Korea in 2021, Louis Vuitton raised prices twice more last year.

Louis Vuitton is critical of Chinese daigou (informal resellers) who buy large quantities of products at domestic duty-free shops and resell them in China. The brand has announced plans to operate duty-free shops mainly at airports and has withdrawn from domestic locations such as Lotte Duty Free Busan and Jeju, and Shilla Duty Free Jeju, gradually suspending downtown store operations. Bernard Arnault, chairman of Louis Vuitton Mo?t Hennessy (LVMH), to which Louis Vuitton belongs, recently publicly criticized resellers who purchase products overseas and sell them at discounted prices in China. The stance is similar among other luxury brands. The duty-free industry is deeply concerned because the business is sustained by economies of scale, and securing major luxury brands is a key competitive factor. They are reluctantly operating by paying high commissions to daigou since daigou sales account for the majority of total sales.

Industry experts expect the influence of luxury brands in the domestic distribution sector to strengthen further amid concerns about an economic downturn coinciding with the resumption of overseas travel after COVID-19. A distribution industry official said, "Department stores face a challenging year as they compete with online platforms through experiential content while simultaneously expanding luxury assortments to attract high-spending consumers. Duty-free shops need to be more proactive in expanding overseas markets for mid- to long-term sales diversification."

On the 22nd, when the number of daily users at Incheon Airport exceeded 120,000 for the first time since the COVID-19 pandemic, the duty-free area of Terminal 1 at Incheon Airport was crowded with travelers.

On the 22nd, when the number of daily users at Incheon Airport exceeded 120,000 for the first time since the COVID-19 pandemic, the duty-free area of Terminal 1 at Incheon Airport was crowded with travelers. Yeongjongdo - Photo by Jinhyung Kang aymsdream@

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.