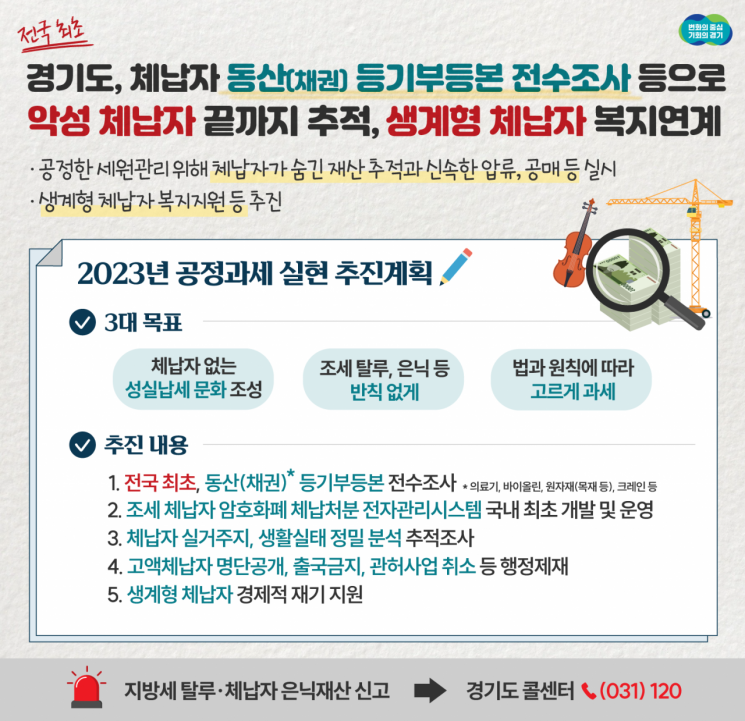

[Asia Economy (Suwon) = Reporter Lee Young-gyu] Gyeonggi Province is pushing a strong collection policy to seize and auction off delinquent taxes by conducting a full survey of movable property registry certificates of high-amount tax delinquents. Instead, for livelihood-type delinquents, the province plans to postpone tax disposition or continuously link welfare services.

On the 7th, Gyeonggi Province announced that it has set three major goals for this year: fostering a culture of sincere taxpayers with no delinquents, eliminating unfair practices such as tax evasion or concealment, and fairly taxing all assets according to law and principles, and that it will do its best to realize fair taxation.

Accordingly, the province will conduct the nation's first full survey of movable property (claims) registry certificates opened by delinquents for secured loans. Under the current "Act on Security for Movable Property and Claims," high-value movable properties (claims) such as medical devices, raw materials, and violins can be registered with a registry certificate like real estate.

From May to July last year, the province conducted a full survey of movable property registry certificates for 180,000 delinquents with provincial and municipal taxes overdue by more than 1 million won, securing registry data on 11,185 cases of movable property (claims) from 494 people, with a delinquent amount of 19 billion won.

Based on this, the province will proceed with direct collection through home (business place) searches, claim seizures, possession of goods, and appraisals.

The province plans to develop and apply a total of 10 new collection techniques this year.

It will also fully operate the "Electronic Management Program for Cryptocurrency Tax Delinquency Disposition," which the province developed for the first time in the country last year.

This system, patented by the province, uses the resident registration numbers of delinquents held by local governments to track mobile phone numbers and, based on this, conduct tracking investigations, seizures, asset transfers and sales, Korean won collection, and seizure cancellations of virtual assets held by delinquents.

Along with this, through the metropolitan delinquency team, the province plans to thoroughly analyze actual residences and living conditions to improve the accuracy of selecting subjects for tracking investigations, pursuing hidden assets of delinquents to the end. It will also conduct rapid delinquent tax collection through seizures, auctions, collections, and home searches, and is considering various administrative sanctions such as public disclosure of high-amount delinquent taxpayers, travel bans, and cancellation of licensed businesses.

However, for small-scale and livelihood-type delinquents, the province plans to support stable lives by stopping tax dispositions after asset inquiries, providing delinquency counseling, and linking welfare, housing, and job welfare services.

Ryu Young-yong, Director of the Tax Justice Division of the province, emphasized, "With signs of increasing delinquent taxes due to COVID-19 and economic recession, securing financial resources is urgent for the province's fiscal soundness and the welfare of residents. We will realize tax justice by not giving up on delinquents who maliciously evade tax obligations and collecting taxes using all available means."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)