Net Buying of Secondary Battery Stocks by Foreigners and Institutions Over the Past Month

Price Gains Expected to Increase Further After IRA Detailed Enforcement Decree Is Finalized Around March

[Asia Economy Reporter Kwon Jaehee] Investment sentiment in secondary battery stocks, which had been subdued due to concerns about an economic recession and a decline in electric vehicle demand, is noticeably reviving. The electric vehicle leader Tesla posted a fourth-quarter 'earnings surprise,' and foreign and institutional investors in the domestic stock market have jointly purchased secondary battery-related stocks, driving the stock price rise.

According to the Korea Exchange on the 7th, LG Energy Solution, the leading secondary battery stock in the domestic market, hit its lowest intraday price of 421,000 KRW on February 4th this year and closed at 525,000 KRW on the 6th. It rose about 25% in a month. Samsung SDI also recorded its lowest intraday price of 524,000 KRW on the 6th and closed at 701,000 KRW on the same day, marking about a 23% increase. During the same period, battery material companies such as POSCO Chemical (28%), L&F (24%), and EcoPro BM (32%) also saw significant stock price gains.

The strong performance of domestic secondary battery-related stocks this year owes much to the 'earnings surprise' from Tesla, the world's number one electric vehicle company. Tesla announced that its net profit for Q4 2022 was $3.69 billion (approximately 4.6346 trillion KRW), a 59% increase compared to the same period last year. Despite widespread expectations that electric vehicle demand would decline due to growing recession concerns amid global interest rate hikes, Tesla defied these worries with a 'surprise performance.' Tesla also projected delivering 1.8 million vehicles this year, raising investor expectations. This represents a 37% increase compared to the record high of 1.31 million units in 2021.

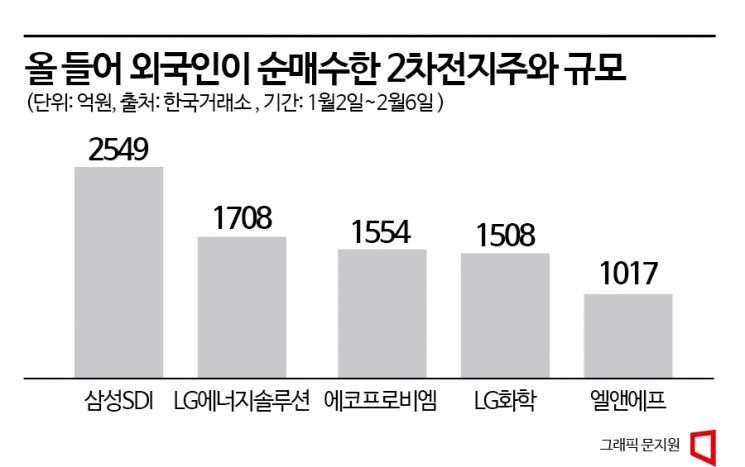

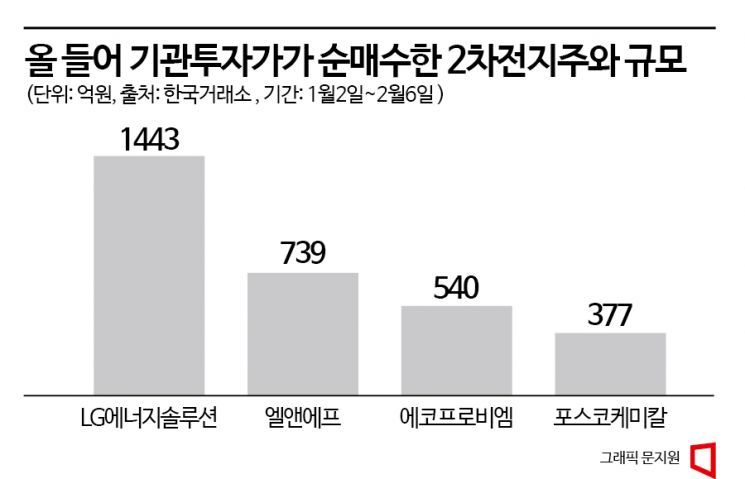

The joint buying by foreign and institutional investors also propelled the stock prices of domestic secondary battery-related stocks. From January 2 to February 6 this year, many secondary battery-related stocks were among the top net purchases by foreigners and institutions. Foreign investors heavily bought Samsung SDI (254.9 billion KRW), LG Energy Solution (170.8 billion KRW), EcoPro BM (155.4 billion KRW), LG Chem (150.8 billion KRW), and L&F (101.7 billion KRW). During the same period, institutional investors net purchased LG Energy Solution (144.3 billion KRW), L&F (73.9 billion KRW), EcoPro BM (54.0 billion KRW), and POSCO Chemical (37.7 billion KRW).

In the securities industry, it is expected that once the detailed enforcement decree of the U.S. Inflation Reduction Act (IRA) is finalized around March, the stock prices of secondary battery companies will enter a full-fledged upward phase. DS Investment & Securities raised Samsung SDI's target price from 800,000 KRW to 890,000 KRW. All 15 securities firms that issued reports on LG Energy Solution this year gave a 'buy' investment opinion with target prices ranging from 520,000 to 718,000 KRW.

Researcher Cho Cheolhee of Korea Investment & Securities analyzed, "Large-scale orders for domestic secondary battery companies are expected due to the U.S. IRA legislation." Researcher Lee Anna of Yuanta Securities forecasted, "In the case of LG Energy Solution, the scale of external growth will be significant this year due to the full-scale start of mass production in the U.S."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)