Largest Scale Since Statistics Compilation... 10 Trillion Won Outflow in One Month

Insurance Investment Products Lost Value? ... Urgent Need for New Growth Engines

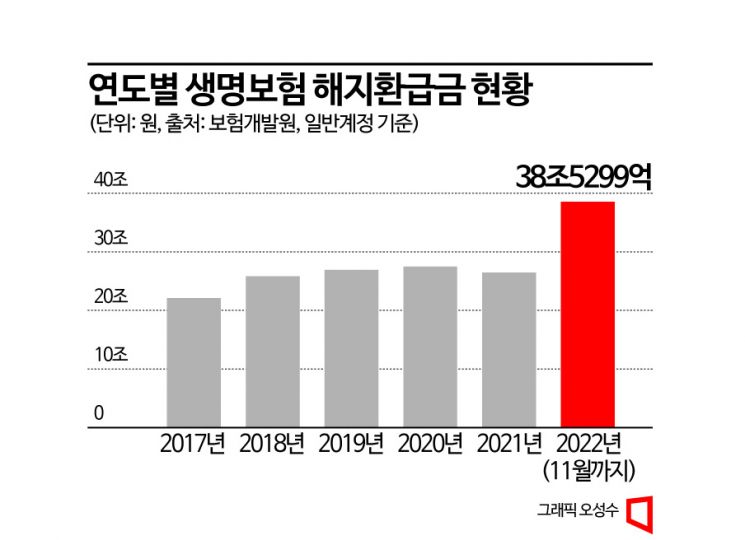

[Asia Economy Reporter Minwoo Lee] Last year, life insurance surrender payments exceeded 38 trillion won. It appears that insurance is losing its appeal as an investment asset, leading to an unprecedented scale of 'surrender rush.' It is evaluated that the number of people turning to other investment assets such as bank deposits and stocks in the high-interest rate era has increased significantly. Amid the trend of increasing single-person households and declining birth rates, there are concerns that life insurance companies urgently need to find new sources of revenue.

According to the Insurance Development Institute on the 7th, the surrender refund amount of domestic life insurance companies from January to November 2022 was 38.5299 trillion won (based on the general account). This already far exceeded the total surrender refund amount in 2021 (26.448 trillion won). It is the largest scale since related statistics began to be compiled in 2000. Compared to 22.1086 trillion won at the end of 2017, it increased more than 1.7 times in about five years. In particular, nearly 9 trillion won was withdrawn in just one month between October and November last year. This represents an unprecedented scale of 'insurance surrender rush.'

What is the reason behind such a rapid withdrawal of subscribers? Some suggest that the number of cases needing 'urgent cash' has increased. However, this is considered a partial analysis. The amount of refund caused by the loss of insurance effectiveness due to non-payment of premiums peaked at 2.8223 trillion won in 2020 (based on the general account), then decreased to 1.2349 trillion won in 2021 and 1.1797 trillion won in 2022 (January to November). Those who had to surrender due to difficult circumstances have not changed significantly.

Ultimately, the analysis that insurance has lost its value as an investment product gains strength. It is said that insurance surrenders occurred as funds moved to other financial products in sectors such as deposits and savings with relatively higher interest rates amid rising market interest rates. In fact, during the period of the largest outflow of funds in October-November last year, 5% range fixed deposit products appeared one after another due to competition in bank deposit interest rates. The financial authorities even requested restraint on excessive interest rate competition. A representative of a major life insurance company explained, "The increase in life insurance surrender payments, especially concentrated at the end of last year, is seen as an effect of switching from savings-type insurance due to the rapid rise in interest rates," adding, "While various complex factors such as livelihood-related surrenders and concerns over rapid increases in interest rates and inflation are reflected, fundamentally, switching interest rates seems to be the biggest factor."

The bigger problem is that there is no clear solution. To reduce livelihood-related insurance surrenders, measures such as temporary suspension of premium payments or insurance policy loans can be offered, but these are only stopgap measures. On the other hand, arbitrarily raising the interest rates of savings-type insurance could cause negative spreads, potentially harming the soundness of insurance companies.

Ultimately, there is advice that life insurance companies must urgently find new sources of revenue. As single-person households increase and the overall population decreases, the main customer base of life insurance itself is shrinking, so fundamentally, the attractiveness of insurance products must be enhanced. Seokho Lee, Senior Research Fellow at the Korea Institute of Finance, stated, "Insurance companies themselves need to improve various inefficient aspects to increase productivity and secure the capacity to enhance price competitiveness and product competitiveness," adding, "Government policies should also open the way for insurance companies to create new sources of revenue by improving various regulations rather than providing temporary support measures, which will break the vicious cycle."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![From Hostess to Organ Seller to High Society... The Grotesque Scam of a "Human Counterfeit" Shaking the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)