[Asia Economy New York=Special Correspondent Joselgina] The calculation of the United States Federal Reserve (Fed), which holds the reins of monetary tightening, has become complicated once again. This is due to the release of a strong employment report immediately after Fed Chair Jerome Powell mentioned 'disinflation.' The market's widespread belief in a 'pause in rate hikes next month' has lost momentum, and investors' sentiments have become more complex amid the uncertain monetary policy path.

The Wall Street Journal (WSJ) reported on the 5th (local time) that investors increasingly expect the Fed to raise interest rates twice more this year following the release of the January employment report.

According to the Chicago Mercantile Exchange (CME) FedWatch, the federal funds (FF) rate futures market currently reflects over a 67% probability that the May benchmark interest rate will reach 5.0?5.25%. Initially, there was a strong expectation that the Fed would end the rate hike cycle at 4.75?5.0% with a final baby step (0.25 percentage point increase) in March, but now the outlook that additional hikes will not be limited to March alone is gaining traction.

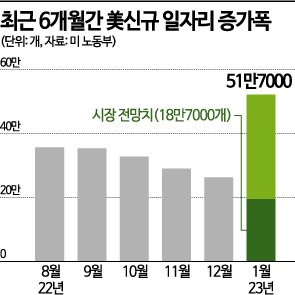

Recent economic indicators are cited as the background for this shift in sentiment. A representative example is the January employment report released on the 3rd. New jobs in January increased by 517,000, nearly three times the market forecast, and the unemployment rate dropped to 3.4%, the lowest since May 1969. On the same day, the Institute for Supply Management (ISM) reported that the January Services Purchasing Managers' Index (PMI) recorded 55.2, returning to expansion territory.

This has sharply increased uncertainty about the Fed's monetary policy. The judgment that "the economy has not yet slowed enough to reduce inflation" could provide grounds for the Fed to raise rates significantly again. In particular, an overheated labor market has always been a concern for the Fed in achieving its 2% inflation target.

Moreover, Chair Powell's diagnosis of the 'early stage of disinflation' while refraining from specific comments on future monetary policy has also contributed to increased uncertainty. At a press conference following the Federal Open Market Committee (FOMC) regular meeting on the 1st, Powell was asked when rate hikes would stop and what conditions would be required to shift to rate cuts, but he avoided a direct answer, saying, "It's not like flipping a light switch on and off."

The WSJ conveyed the mood, stating, "Investors are now confident that the Fed may raise rates higher than previously thought," and "As confirmed on Wall Street last year, good economic news can be bad news for the market." The soaring concerns about tightening have also dampened the tech stock rally in the New York stock market this year. On the 3rd, when the January employment report was released, the Nasdaq index, centered on tech stocks, closed down 1.59% compared to the previous session. Bond prices, which had risen on expectations that the Fed's rate hike cycle was nearing its end, also fell across the board.

However, there are also evaluations that the job increase far exceeding market expectations means the possibility of a 'soft landing' has increased. Former U.S. Treasury Secretary Larry Summers, who has warned of a recession risk, slightly revised his previous stance, saying, "The Fed's chances of achieving a soft landing have increased compared to a few months ago." However, he reiterated that inflation remains unacceptably high. Declining savings rates and forecasts of reduced durable goods demand are also threats to future consumption.

Market expectations that the Fed will cut the benchmark interest rate within the year remain strong. According to FedWatch, the federal funds rate futures market reflects the possibility of a 0.25 percentage point cut in November and December. Currently, investors are paying close attention to statements from key Fed officials, including Chair Powell, scheduled for the 7th.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.