Hankyung Research Institute Releases 'KERI Economic Trends and Outlook'

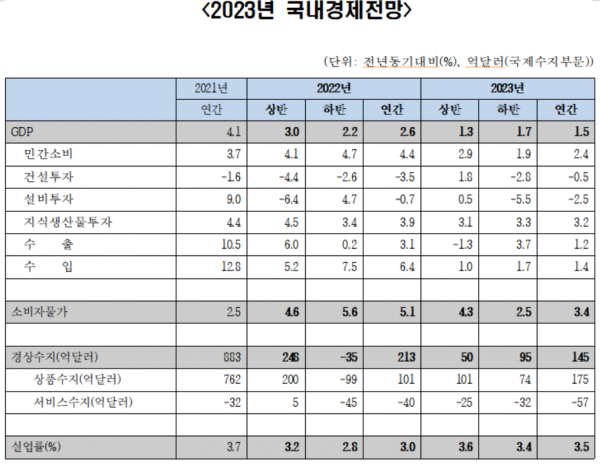

Private Consumption 2.4%, Facility Investment -2.5%, Construction Investment -0.5%

[Asia Economy Reporter Han Ye-ju] This year’s economic growth rate is projected at 1.5%. It is analyzed that the economy has officially entered a recession phase due to domestic demand contraction caused by high interest rates combined with export sluggishness from the global economic slowdown.

The Korea Economic Research Institute (hereinafter KERI) announced this on the 3rd through the report "KERI Economic Trends and Outlook: Q1 2023."

Amid the deepening global economic slowdown, it was judged that there is no domestic growth momentum to overcome this, leading to a downward revision from the previous 1.9% to 1.5%. Additionally, the side effects of rapid interest rate hikes are quickly materializing as consumption and investment contraction, and due to the worsening economic conditions intensified by COVID-19 and weakened policy support capacity, even growth in the high 1% range is considered difficult to expect.

Lee Seung-seok, a senior researcher at KERI, explained, "If the U.S. Federal Reserve continues its radical tightening stance or excessive private debt spreads into a financial market crisis, increasing uncertainty, the decline in growth rate could be even greater. Given the prolonged deterioration of economic conditions and the excessive fiscal spending during the COVID-19 period, the decline in policy support capacity makes the downward growth forecast inevitable."

In the domestic demand sector, private consumption, which holds the largest share, is expected to grow by 2.4%, a modest level of growth. This is 2.0 percentage points lower than the 4.4% private consumption growth rate in 2022. Private consumption, which had shown a recovery trend supported by expectations of economic recovery, is now led by sluggishness due to reduced real purchasing power from high inflation and weakened consumer sentiment from the economic slowdown. Combined effects of decreased income for self-employed individuals and the repayment burden of household debt that surged due to interest rate hikes are expected to cause a significant contraction.

Facility investment is forecasted to experience a negative growth of -2.5%, unable to avoid contraction despite continued aggressive investment in the semiconductor sector. This is due to increased uncertainty from the global economic downturn and the added burden of capital procurement costs caused by interest rate hikes. Construction investment is expected to grow by only -0.5%, as government-led building construction such as public redevelopment increases, but disruptions and discord at construction sites persist due to soaring raw material prices.

The consumer price inflation rate is projected at 3.4%, nearly 1.7 percentage points lower than in 2022, as international raw material prices gradually stabilize after the first half of the year and the strong dollar phenomenon also eases.

Real exports, which have driven economic growth so far, are expected to grow by only 1.2%, affected by the deepening global economic recession and sluggish semiconductor exports, the largest export item. This is 1.9 percentage points lower than the 3.1% export growth rate in 2022. Senior researcher Lee Seung-seok explained, "If the economic contraction in China, the largest export country, is greater than expected or if the performance of major export items other than semiconductors falls short of expectations, the export growth trend could weaken further."

Meanwhile, the current account balance is projected to remain around $14.5 billion as the goods balance shows poor performance and the service balance deficit expands.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.