‘Q1 Slump, H2 Recovery’ Outlook is Common

LG Household & Health Care Duty-Free Sales Slump... Amore Products and Organization Restructuring

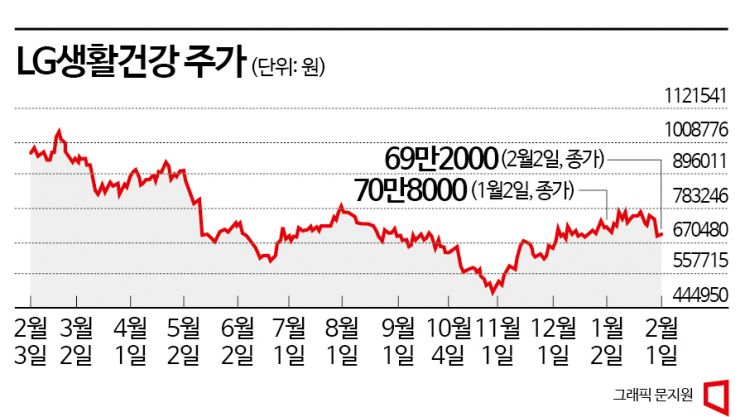

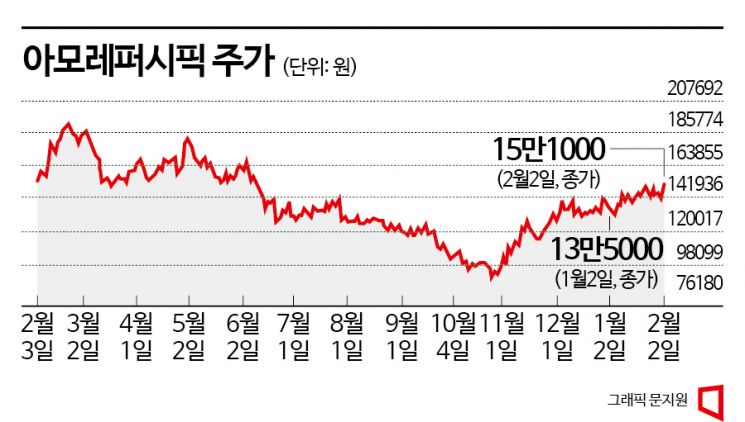

[Asia Economy Reporter Lee Seon-ae] The securities industry's views on LG Household & Health Care and Amorepacific, leading companies in the domestic cosmetics industry, are divided. Securities firms commonly expect both companies to underperform in the first quarter but recover in the second half of the year. However, their target stock prices diverged during this process. Some raised the target price for LG Household & Health Care, while others lowered it. In contrast, most raised the target price for Amorepacific.

According to the financial investment industry, the securities firms' target price forecasts for LG Household & Health Care were split between upward and downward revisions. Meritz Securities lowered LG Household & Health Care's target price from 900,000 KRW to 800,000 KRW. Shinhan Investment Corp. (890,000 KRW → 830,000 KRW) and DB Financial Investment (900,000 KRW → 850,000 KRW) also cut their target prices. This was based on the judgment that cosmetics sales at duty-free shops, a distribution channel with high operating profit margins, are declining.

Park Hyunjin, a researcher at Shinhan Investment Corp., analyzed, "The trend of sluggish sales and increased fixed cost burdens due to inflation is expected to continue for some time," adding, "It seems necessary to lower expectations for China's performance in the first quarter this year." He further stated, "Duty-free sales in the first quarter are expected to be 182.4 billion KRW, down 52.5 billion KRW from the previous quarter," and added, "It is inevitable to reduce the cosmetics operating profit estimate by 50%." Hanuri, a researcher at Meritz Securities, pointed out, "The stock price has already priced in expectations for performance recovery due to China's reopening, but the downward trend in performance has not yet been reflected." Kim Myungju, a researcher at Korea Investment & Securities, gave LG Household & Health Care a 'neutral' investment opinion, forecasting, "Cosmetics sales in the first quarter will be sluggish due to the restructuring of passenger commission fees within the duty-free industry and the resurgence of COVID-19 in China."

In contrast, Ebest Investment & Securities (700,000 KRW → 870,000 KRW) and Samsung Securities (590,000 KRW → 770,000 KRW) raised their target prices for LG Household & Health Care. They emphasized the need to focus on the effects of China's reopening, which will fully materialize after the second quarter. Park Eun-kyung, a research fellow at Samsung Securities, said, "LG Household & Health Care's sales this year are slightly adjusted to 7.77 trillion KRW, an 8% increase from the previous year, and operating profit is adjusted to 832.3 billion KRW, a 17% increase, but the target price is raised by 54%," evaluating, "Over the past three months, the global cosmetics sector's valuation has risen by 25% to an average of 32 times due to expectations for China's reopening, and given the current situation where a China-specific boom is expected, there is significant room for the stock price to rise." Orina, a researcher at Ebest Investment & Securities, also forecasted, "Expectations for China's reopening and consumption stimulus will grow after March," adding, "Performance improvement will become more pronounced toward the second half of the year."

The securities industry's target prices for Amorepacific were divided between maintaining and raising. Meritz Securities raised Amorepacific's target price from 170,000 KRW to 200,000 KRW, judging that as restructuring enters its final stage, profit expansion will begin. Hanuri, a researcher at Meritz Securities, analyzed, "In the fourth quarter of last year, sales decreased by 17.9% year-on-year to 1.0878 trillion KRW, while operating profit increased by 123% to 57 billion KRW, exceeding market expectations," and stated, "Given the recovery in China and strengthened profitability, the current valuation burden is not considered high, and as restructuring enters its final phase, profit expansion will accelerate."

Hana Securities also raised the target price from 140,000 KRW to 200,000 KRW and upgraded the investment opinion from 'neutral' to 'buy.' Park Eun-jung, a researcher at Hana Securities, explained, "Amorepacific streamlined its offline channels in China and optimized its corporate human resources in 2021, and last year, it reorganized its product portfolio and went through processes to cultivate key products," adding, "The profitability improvement in the fourth quarter of last year is the result of the efficiency efforts initiated in 2021." She further stated, "This year, a leap is expected across all key regions and channels in Korea, China, the United States, and Japan," forecasting annual sales of 4.8 trillion KRW and operating profit of 400 billion KRW, which are estimates of a 16% increase in sales and a 91% increase in operating profit compared to the previous year.

Korea Investment & Securities (180,000 KRW) and Kiwoom Securities (172,000 KRW) maintained their current target prices. Jo So-jeong, a researcher at Kiwoom Securities, emphasized, "Amorepacific has relatively high exposure to the Chinese market," adding, "Demand in the Chinese market is expected to recover from the end of the first quarter to the second quarter, and the rebranding effect of the main brand Sulwhasoo is expected to become visible from March, so it is necessary to lower profit expectations for the first quarter."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)