January KOSPI Market Capitalization Turnover Rate at 7.4%... Trading Disappearance

Individual Investors Eye Stock Market Return Around February FOMC

[Asia Economy Reporter Minji Lee] The market has interpreted the results of the February Federal Open Market Committee (FOMC) regular meeting as dovish, leading to an assessment that the long-standing interest rate uncertainty weighing on global stock markets has been resolved. Accordingly, there is growing interest in whether the Donghak Ants, who had almost stopped visiting the domestic stock market, will return.

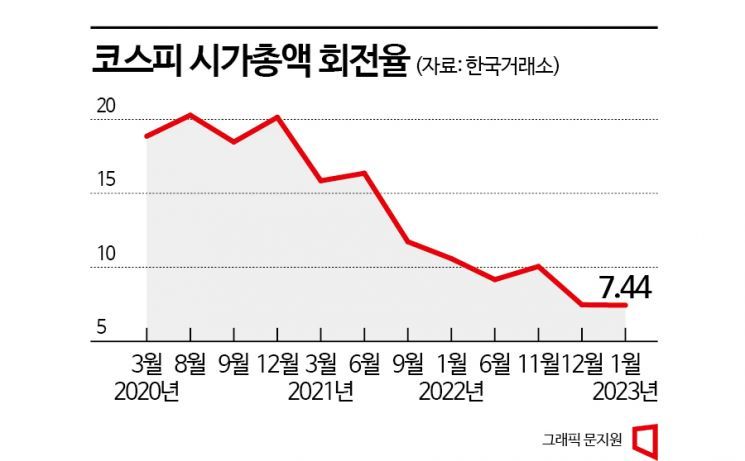

According to the Korea Exchange on the 3rd, the monthly KOSPI market capitalization turnover rate last month fell to 7.44%, the lowest level since the outbreak of COVID-19. This figure is significantly lower than the market capitalization turnover rate of 10.6% a year ago. The market capitalization turnover rate is calculated by dividing the total trading value by the average market capitalization, and a lower figure indicates less active trading. Even when the KOSPI declined last year due to high-intensity tightening, the average market capitalization turnover rate remained at around 8-9%. This means trading has contracted further this year. The daily average turnover rate of listed stocks on the KOSPI also dropped to 0.76%, lower than the daily average turnover rate of 0.92% two months ago.

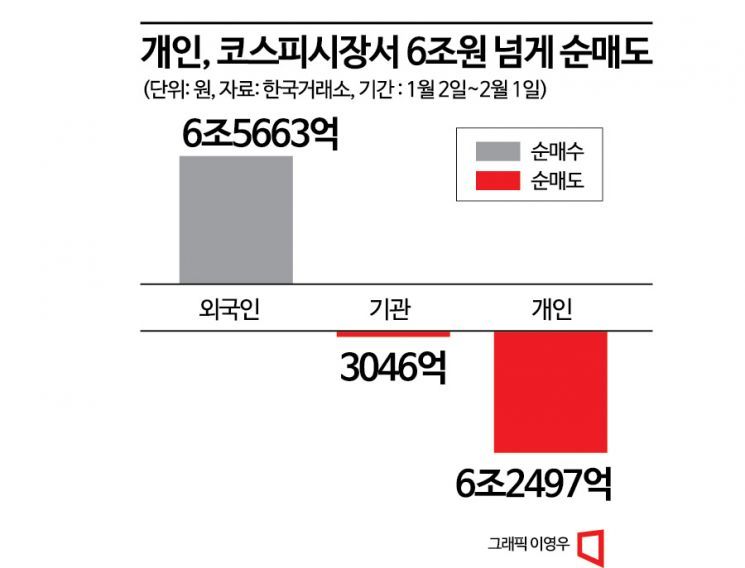

This year, the KOSPI has rallied more than 10%, rising from the 2200 level to the 2490 level. However, individual investors have not been aggressively participating. Foreign investors moved first, driven by expectations of a soft landing for the economy and the end of interest rate hikes, but individual investors responded with stock sales. In fact, until the day before, individual investors sold stocks worth 6.25 trillion won on the KOSPI. Investor deposit funds, which serve as standby funds for the stock market, have increased somewhat. As of the 10th of last month, it was 43.6692 trillion won, rising to 49.275 trillion won on the 31st.

The doubts of individual investors hesitating amid uncertainty about interest rate hikes seem to have somewhat eased with this February FOMC. Although the Bank of Korea signaled at its Monetary Policy Committee last month that domestic interest rate hikes had effectively ended, concerns remained as there were expectations that the US would not easily give up its intention to raise rates.

Jerome Powell, Chair of the US Federal Reserve (Fed), mentioned 'disinflation' for the first time at this FOMC and did not show the hawkish (monetary tightening) stance the market had anticipated. Securities firms advise caution against premature expectations of rate cuts, but the consensus is that the March FOMC will mark the last interest rate hike. The prevailing scenario is that after a 25 basis points (1bp = 0.01 percentage points) rate hike at the March FOMC, rates will be held steady. Jaekyun Lim, a researcher at KB Securities, said, "With the Fed’s rate hike stance coming to an end, the possibility of additional hikes by the Bank of Korea has further diminished," adding, "Since Chair Powell mentioned discussing the conditions for pausing rate hikes, it is understood that discussions on halting rate hikes have begun."

Market experts believe that the February FOMC has created conditions favorable for a KOSPI rise. Ilhyuk Kim, a researcher at KB Securities, evaluated, "Since the Fed did not take a hawkish stance, the desire for short-term profit-taking has decreased," and "a situation has been created where long-term funds can gradually flow in."

However, before making purchases, it is necessary to check the results of the January US employment data, the ISM Services Index, and the release of the February FOMC minutes. Kyungmin Lee, a researcher at Daishin Securities, explained, "For the KOSPI to rise further, upward revisions of earnings forecasts must precede, but downward revisions are inevitable for the time being," adding, "If the semiconductor industry improvement and expectations for China’s economic recovery, which were the driving forces behind the market rebound, diminish, further gains may become difficult."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)