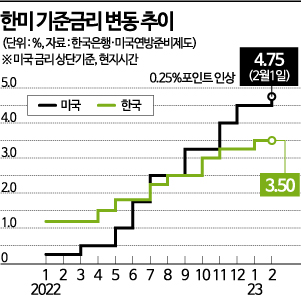

US Interest Rate Hike Widens Gap to 1.25%P

As Expected but High Inflation Burden

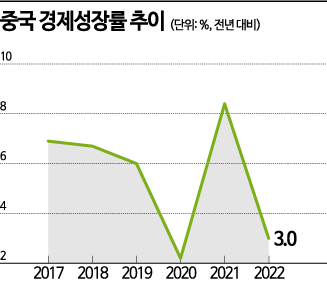

Uncertainty Continues Over China's Economic Recovery

Revenge Spending Could Stimulate Oil and Other Commodities

Deputy Prime Minister and Minister of Economy and Finance Choo Kyung-ho is presiding over the Emergency Macroeconomic and Financial Meeting held at the Bankers Hall in Myeong-dong, Jung-gu, Seoul on the 2nd. Photo by Hyunmin Kim kimhyun81@

Deputy Prime Minister and Minister of Economy and Finance Choo Kyung-ho is presiding over the Emergency Macroeconomic and Financial Meeting held at the Bankers Hall in Myeong-dong, Jung-gu, Seoul on the 2nd. Photo by Hyunmin Kim kimhyun81@

[Asia Economy reporters Seo So-jeong and Moon Je-won] The U.S. Federal Reserve (Fed) raised its benchmark interest rate by an additional 0.25 percentage points on the 1st (local time), widening the interest rate gap between South Korea and the U.S. to 1.25 percentage points. This has deepened the Bank of Korea's (BOK) dilemma ahead of this month's monetary policy decision. While the Fed's move to moderate the pace with a typical rate hike range provides some room for maneuver in South Korea's monetary policy, the ongoing tightening stance means the interest rate gap between the two countries could widen further. In particular, with the January consumer price inflation rate remaining in the 5% range amid high inflation and persistent uncertainty over the speed of China's economic recovery?a key variable for the Korean economy this year?the BOK's calculations ahead of this month's rate decision are expected to become more complex.

◆ Interest Rate Gap Between Korea and the U.S. Widens to 1.25 Percentage Points = As expected, the Fed raised the upper bound of its benchmark interest rate to 4.75% at the Federal Open Market Committee (FOMC) meeting, expanding the interest rate gap between South Korea and the U.S. to a maximum of 1.25 percentage points. Considering that the historical maximum interest rate gap between the two countries was 1.50 percentage points, if the Financial Monetary Policy Committee scheduled for the 23rd freezes South Korea's benchmark rate at 3.50%, it would maintain the largest rate inversion since October 2000. According to Fed Chair Jerome Powell's remarks, if the Fed continues with a couple more rate hikes and raises the rate to the projected 5.00?5.25% range this year, and given that the BOK has indicated a final rate level of 3.50?3.75%, the maximum interest rate gap could widen to 1.75 percentage points, a scenario that cannot be completely ruled out. Although the foreign exchange market has recently stabilized, if the interest rate gap between Korea and the U.S. widens again, there is a possibility of foreign capital outflows, which would put upward pressure on the won-dollar exchange rate.

Especially as inflation, which had been slowing, shows signs of rising again, it adds to the burden of monetary policy decisions. The BOK held a price situation review meeting chaired by Deputy Governor Lee Hwan-seok on the day, noting that the January consumer price inflation rate rose to 5.2%, which was "in line with expectations," and forecasted that "February will also show an inflation rate around 5%." The BOK explained that the January consumer price inflation rate was somewhat higher than the previous month due to electricity rate hikes and price increases in agricultural, livestock, and fishery products caused by cold waves. The core inflation rate remained at 4.1%, the same as the previous month, as the rise in industrial product prices expanded but the upward trend in dining-out prices slowed. Deputy Governor Lee said, "Consumer prices are expected to show an inflation rate around 5% this month as well," adding, "There is high uncertainty regarding the future inflation path related to international crude oil and raw material prices following China's reopening, as well as domestic and international economic trends."

Kim Jeong-sik, Professor Emeritus of Economics at Yonsei University, said, "Looking at inflation alone, the BOK is likely to raise the benchmark interest rate by 0.25 percentage points in February, but concerns about the economy and domestic real estate decline are growing, so the possibility of the BOK freezing the rate this month is higher." He added, "Given that the U.S. has slowed the pace of rate hikes and the final U.S. rate is expected to be around 5%, the interest rate gap between Korea and the U.S. is 1.5 percentage points. Considering the recent rapid stabilization of the exchange rate, I do not think there is a significant concern about capital outflows." However, Professor Kim expressed concern about the continued net foreign purchases of domestic stocks despite the recent trade deficit. He pointed out, "The January trade deficit reached $12.69 billion, the largest monthly deficit on record, threatening the current account, yet foreign stock investment continues. This is not perceived as a risk signal by domestic investors, so if major foreign investors suddenly withdraw from the domestic stock market at some point, market volatility could increase."

◆ China's Reopening Emerges as a Key Variable in Monetary Policy = The speed of China's economic recovery is also emerging as a major variable in South Korea's monetary policy. Recently, the International Monetary Fund (IMF) significantly raised its forecast for China's economic growth this year from 4.4% to 5.2%. Bank of Korea Governor Lee Chang-yong stated at the BOK-Korea Chamber of Commerce seminar held the previous day, "We expected China's economic growth rate in the fourth quarter of last year to be around -2%, but it was 0%. We also expect this year's growth rate to be around 5%." However, Governor Lee added, "It is uncertain how much recovery effect our economy can receive from China's technical rebound." While China's reopening is expected to have a significant positive effect on the global economy, from the perspective of inflation in major countries, there are both downward factors such as easing supply chain disruptions and upward factors such as increased demand for raw materials. There are also concerns that China's pent-up consumption could lead to increased demand for raw materials like oil, potentially pushing inflation up again.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)