Amorepacific Group's Annual Operating Profit Down 23.7% YoY

LG Household & Health Care's Operating Profit Falls 44.9% YoY... Halved

Amorepacific and LG Household & Health Care, the two giants of the domestic cosmetics industry, both reported disappointing results last year. This was due to the resurgence of COVID-19 and lockdowns in China, where they had a high sales dependency. However, the industry expects that with China's reopening of economic activities gaining momentum this year, domestic consumption in China will recover, leading to improved performance.

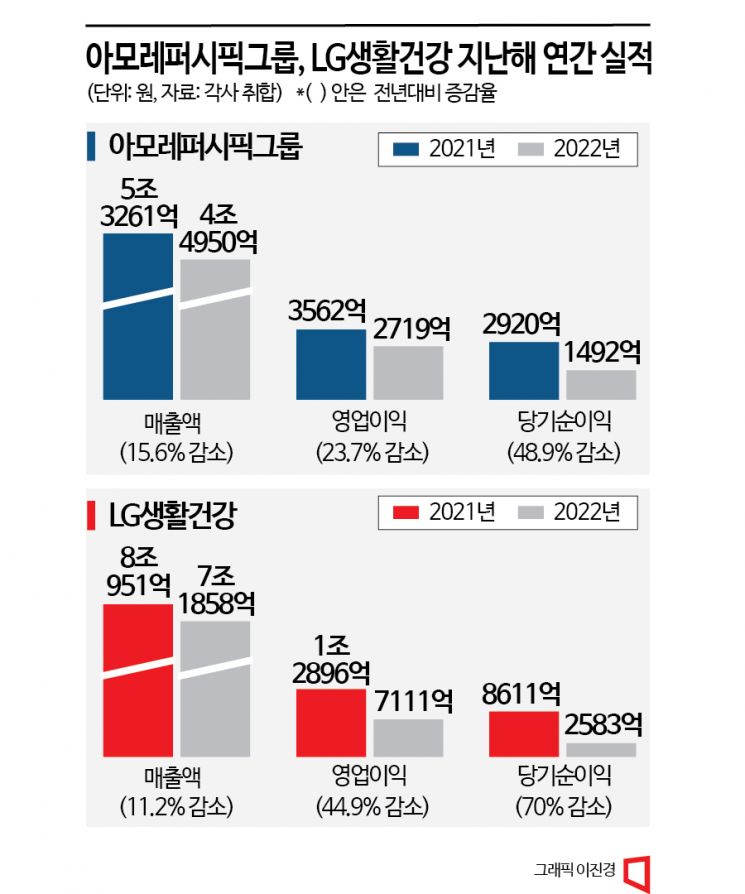

According to the Financial Supervisory Service's electronic disclosure system on the 2nd, Amorepacific Group's operating profit last year was 271.9 billion KRW, down 23.7% from the previous year. During the same period, sales decreased by 15.6% to 4.495 trillion KRW, and net profit fell 48.9% to 149.2 billion KRW. The domestic business of its main affiliate, Amorepacific, saw sales decline by 16.1% year-on-year to 2.5813 trillion KRW due to sluggish duty-free sales. Sales in the Asian region also dropped 17.1% compared to the previous year.

LG Household & Health Care also experienced negative annual sales growth for the first time in about 18 years since 2004. Last year's sales were 7.1858 trillion KRW, down 11.2% from the previous year, and operating profit fell 44.9% to 711.1 billion KRW. LG Household & Health Care explained that deteriorating market conditions and weakened consumption in China led to poor performance in duty-free stores and local Chinese sales.

These companies are accelerating diversification into overseas markets such as the United States and Europe to move away from their China-centric business structures.

Amorepacific expanded its online and offline distribution networks in North America and Europe, resulting in sales increases of 83% and 37%, respectively, compared to the same period last year. In September last year, it acquired the U.S. beauty brand Tata Harper, securing a mid- to long-term growth engine.

LG Household & Health Care is also acquiring and merging U.S. cosmetics-related brands such as The Avon and The Cr?me Shop to capture the North American market. As a result, sales in the U.S. beauty business reached 192.2 billion KRW last year, up 23.3% year-on-year, demonstrating growth potential.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.