35% ↓ Compared to Early Last Month... Business Operator Change Report Rejected

PayProtocol Files Injunction Request with Court

[Asia Economy Reporter Lee Jung-yoon] As the domestic virtual asset payment service Paycoin approaches its service termination, the price of Paycoin is showing a downward trend. Major domestic virtual asset exchanges have designated Paycoin as a watch-listed item and plan to decide whether to lift the designation or end final trading support, which could increase volatility depending on the outcome. Paycoin refers to the virtual asset payment service operated by Payprotocol, a subsidiary of the electronic payment gateway (PG) company Danal, as well as the circulating coin.

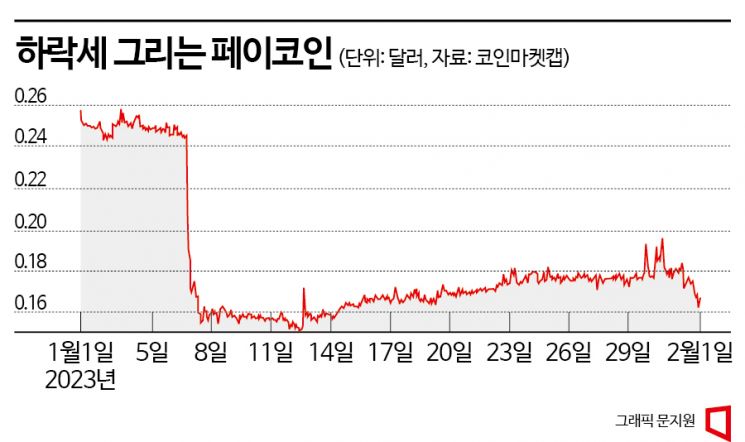

According to CoinMarketCap, a global virtual asset market status relay site, as of 3:05 PM on the 1st, the price of Paycoin was recorded at $0.1657 (approximately 204 KRW), down 7.92% from the previous day. It had recorded $0.2569 (approximately 316 KRW) until early last month but has plunged more than 35% since then.

The reason Paycoin is showing such weakness is that the domestic payment service is scheduled to end after the 5th. On the 6th of last month, the Financial Intelligence Unit (FIU) under the Financial Services Commission rejected the change report for the virtual asset operator Payprotocol, which operates the Paycoin service. Since the service essentially involves transactions between virtual assets and cash, it was required to secure a real-name verified deposit and withdrawal account from a bank for anti-money laundering purposes, but this ultimately failed, leading to the rejection of the change report.

Users of the Paycoin service can use their held Paycoins to make payments at affiliated merchants through the application. They can also convert Bitcoin into Paycoin for use. Paycoin stated that there are about 3 million users of the service. Due to the nature of virtual assets, the value of Paycoin fluctuates constantly, but users can use Paycoin like cash both online and offline. Payprotocol inserted points as an intermediary means instead of directly purchasing Paycoins from users and immediately paying cash to merchants.

Previously, Danal paid cash to merchants and received Paycoins from Payprotocol. Danal Fintech, a subsidiary of Danal, operated this and generated profits. However, since buying and selling of virtual assets occurred and other companies besides the operator Payprotocol participated in this process, it was judged that a virtual asset operator requiring reporting was involved. Accordingly, Payprotocol decided to perform all functions itself and submitted a change report to the FIU for virtual asset trading, not as a virtual asset wallet or custody operator.

However, the FIU judged that "a real-name verified deposit and withdrawal account at a bank is required not only for direct exchanges between virtual assets and money but also for indirect exchanges using intermediaries." Although Paycoins are purchased from merchants and points are paid as compensation, this was interpreted as an indirect transaction between Korean won and virtual assets. FIU and Payprotocol had discussed meeting these requirements by December 30 of last year, but the change report was rejected due to failure to meet the reporting requirements.

As a result of the rejection, Payprotocol is considered to have operated without submitting a change report under the Act on Reporting and Using Specified Financial Transaction Information (the Special Financial Information Act). This may result in imprisonment for up to three years or a fine of up to 30 million KRW. The FIU granted a period until the 5th of this month to allow for necessary time for guidance to protect users and merchants and technical measures related to service termination.

After the rejection decision, negative factors piled up for Paycoin. Upbit, Bithumb, and Coinone, which supported Paycoin trading, designated Paycoin as a watch-listed item based on significant impact on the service in consultation with the Digital Asset Exchange Association (DAXA). An Upbit official stated, "After designation as a watch-listed item, a detailed review of the digital asset is generally conducted to decide whether to extend the watch-list designation, lift it, or end final trading support." Currently, among DAXA member exchanges operating KRW markets?Gopax, Bithumb, Upbit, Korbit, and Coinone?Paycoin is traded on Upbit's Bitcoin market, Bithumb's KRW and Bitcoin markets, and Coinone's KRW market. Although Paycoin was listed simultaneously on Upbit's KRW and Bitcoin markets, it has not been tradable on the KRW market since June 2021 due to internal criteria not being met to maintain the KRW market pair.

Despite the difficult situation, Payprotocol has secured user protection and trust through coin burns and other measures. The problems that emerged with the global exchange FTX borrowing funds using its self-issued coin FTT also had an impact. Previously, there were evaluations that the major holders of Paycoin had a high concentration, indicating low distribution. Payprotocol announced that it would burn 2.041 billion Paycoins in four rounds out of the total issuance of 3.941 billion Paycoins. It is known that Payprotocol holds 2.9 billion Paycoins and has disclosed three coin burns through the User Protection Center.

Despite the FIU decision, Payprotocol plans to continue efforts to secure a real-name verified deposit and withdrawal account at a bank. The Paycoin team stated, "We will do our best to complete the issuance of the real-name verified deposit and withdrawal account currently in progress by the 5th," and added, "We will strive to ensure that there is no disruption to the use of the Paycoin service." Additionally, Payprotocol filed a main lawsuit with the Seoul Administrative Court against the FIU director, requesting a suspension of execution and cancellation of the rejection of the change report for the virtual asset operator, citing minimum measures for users as the reason.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.