[Asia Economy Reporter Ryu Tae-min] The vacancy rate of Seoul's Grade A office buildings, which had been declining consecutively, has risen again after six quarters. This is interpreted as a result of decreased demand from companies feeling burdened by rapidly rising rents due to insufficient supply compared to demand and the impact of interest rate hikes.

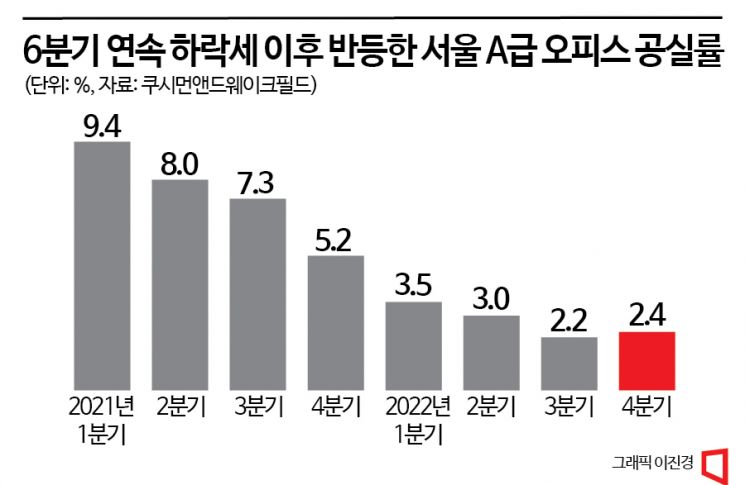

According to the office market report published by Cushman & Wakefield on the 2nd, the average vacancy rate of Seoul's Grade A office buildings in the fourth quarter of last year was 2.4%, up 0.2 percentage points (p) from the previous quarter. This marks a rebound in the vacancy rate, which had been falling for six consecutive quarters since the first quarter of 2021.

The vacancy rate of Seoul's Grade A office buildings had been continuously decreasing since the first quarter of 2021 (9.4%) two years ago. In the fourth quarter of the same year, it dropped by 4.2%p to 5.2%, and thereafter, in the past year, it recorded an unprecedentedly low vacancy rate by falling consecutively for three quarters from 3.5% to 3.0% and then to 2.2%.

The recent increase in vacancy rate was largely influenced by the rise in vacancies in the downtown and Yeouido areas. The vacancy rate in the downtown area rose by 0.4%p from 3.3% in the third quarter of last year to 3.7% in the fourth quarter. This is the first increase in the downtown area's vacancy rate in 10 quarters. During the same period, the Yeouido area’s vacancy rate increased by 0.2%p from 1.5% to 1.7%.

This decline in Grade A office vacancy rates contrasts with the overall vacancy trend of Seoul offices. According to the Korea Real Estate Board, the overall office vacancy rate in Seoul continued to decline from 9.6% in the third quarter of last year to 9.4% in the fourth quarter.

The increase in vacancies in major offices is attributed to the sharp rise in rents. Over the past two years, while corporate leasing demand increased, the supply of large buildings to support this demand was insufficient. Since new office supply is limited, a landlord-favorable market has persisted.

Moreover, as landlords’ financing burdens increased due to consecutive interest rate hikes starting last year, they passed these costs onto tenants, causing rents to rise steeply. According to Cushman statistics, the average rent increase rate for Seoul offices last year was 7.3%. Compared to the 1.6% increase in the same period the previous year, this is more than 4.5 times higher.

As a result, companies are relocating offices or downsizing, leading to a rise in vacancy rates. A Cushman official explained, “Companies feeling the burden of rent have been observed moving their offices to relatively cheaper areas or buildings or reducing their leased space,” adding, “There are even cases where shared officetels are sought as an alternative.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.