Increase in Inventory Revaluation Losses Due to Memory Slump

Expansion of High-Value Products Amid Investment Cuts and Production Reduction

"Market Rebound Expected Next Year Due to Industry Production Cuts"

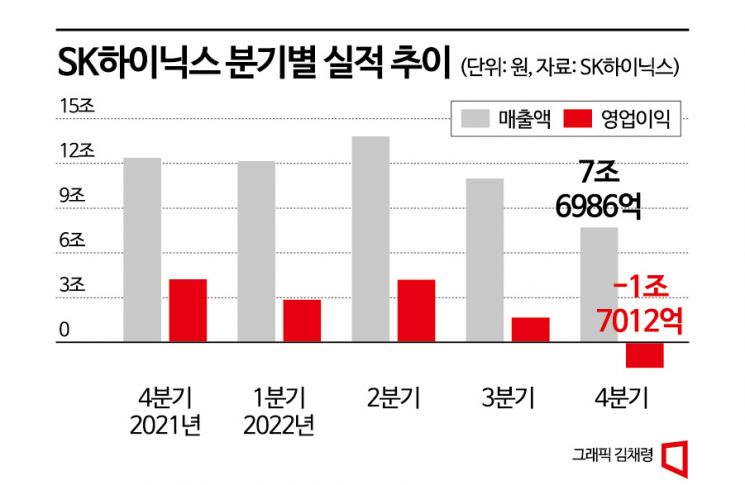

[Asia Economy Reporters Kim Pyeonghwa and Moon Chaeseok] SK Hynix turned to a loss in the fourth quarter of last year for the first time in 10 years due to a harsher cold wave than in the past. SK Hynix responded by reducing investments and wafer input volumes this year to overcome the sluggish market conditions. The company also announced plans to increase the supply of high value-added products. With the industry's production cuts continuing, there is a forecast that if inventory normalizes this year, the market could rebound next year.

On the 1st, SK Hynix stated during a conference call following the announcement of last year's performance that the company received a poor report card for the fourth quarter due to expanding macroeconomic uncertainties. As the economic downturn led to reduced demand across IT due to inflation and interest rate hikes, inventory in the market accumulated to unprecedented levels, and prices continuously fell, dragging down industry profitability.

Park Chandong, head of NAND marketing at SK Hynix, emphasized, "Overall customer inventory is similar to the downturn in 2019," adding, "Including supplier inventory, the industry's total inventory is at an all-time high." Given this situation, memory prices have dropped to about 50% of their peak. Due to the sharp price decline, SK Hynix's inventory valuation loss increased, recording approximately 600 billion to 700 billion KRW in the fourth quarter of last year.

SK Hynix expects inventory levels in the market to remain high for some time this year, including the off-season first quarter. This is the background for reducing investments and cutting production, as announced in October last year. SK Hynix plans to cut capital expenditures (CAPEX) by more than 50% compared to last year's 19 trillion KRW. Since the fourth quarter of last year, the company has been reducing wafer input volumes, focusing on low-profitability products. Accordingly, SK Hynix forecasts that this year's DRAM bit growth (the shipment increase rate converted into bit units) will decline compared to last year, and NAND bit growth will approach zero.

SK Hynix explained that since the memory industry, including itself, is participating in production cuts, related effects may appear from the first quarter. Furthermore, with reduced investment, supply capacity will decrease, so inventory could normalize within this year. Kim Woo-hyun, SK Hynix's Chief Financial Officer (CFO), said, "We expect an upturn next year that will exceed expectations."

In the process of creating market demand, SK Hynix will focus on high value-added products. The company plans to increase supply of Double Data Rate (DDR) 5, the latest DRAM standard, as the market is expected to grow significantly this year. SK Hynix explained that with Intel's recently released server CPU, Sapphire Rapids, spreading in the market, demand for server DDR5 DRAM will increase from the second half of the year. Next-generation products such as 1b nanometer DRAM and 238-layer 4D NAND will also be introduced in the second half to maintain product competitiveness. Additionally, the application of advanced extreme ultraviolet (EUV) equipment will be expanded.

SK Hynix announced that its consolidated sales in the fourth quarter of last year were 7.6986 trillion KRW, down 38% from the same period last year. It also recorded an operating loss of 1.7012 trillion KRW. There are forecasts, mainly from the securities sector, that SK Hynix may remain in the red until the second half of this year. SK Hynix's operating profit last year was 7.0066 trillion KRW, down 44%.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.