Operating Loss of 1.7012 Trillion KRW in Q4 Last Year

Memory Prices See Largest Drop Since 2008

"Expect Industry Efforts to Balance Supply and Demand"

[Asia Economy Reporter Kim Pyeonghwa] SK Hynix recorded an earnings shock as it turned to a loss in the fourth quarter of last year due to the memory market downturn. The deficit reached 1.7 trillion won, which is more than 500 billion won larger than market expectations. The production line, which once earned over 6.4 trillion won per quarter and was said to be printing money rather than semiconductors, is now consuming money.

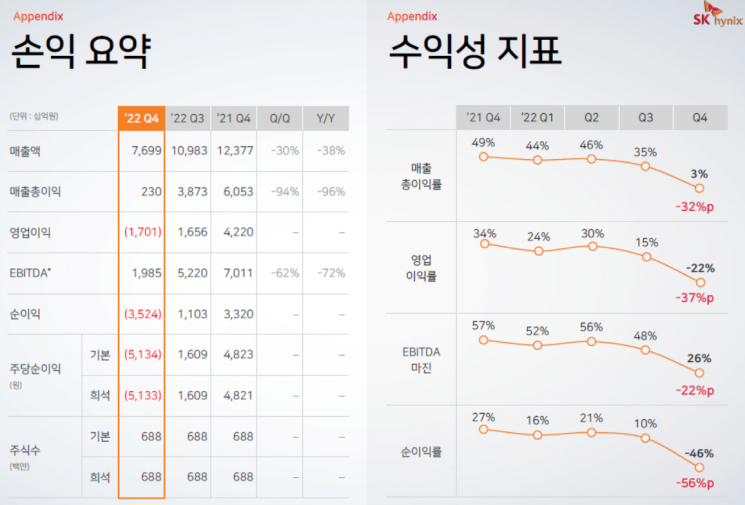

SK Hynix announced on the 1st that it recorded an operating loss of 1.7012 trillion won in the fourth quarter of last year on a consolidated basis. This is the first quarterly loss in over 10 years since the third quarter of 2012 (-24 billion won). The operating loss exceeded the securities firms' forecast of 1.2105 trillion won compiled by financial information company FnGuide. Considering that the highest quarterly operating profit was 6.4724 trillion won in the third quarter of 2018, it is almost unbelievable that it is the same company.

Sales in the fourth quarter of last year fell 38% year-on-year to 7.6986 trillion won. SK Hynix recorded its highest-ever quarterly sales of 13.811 trillion won in the second quarter of last year, just one year ago.

Operating profit for last year was 7.0066 trillion won, down 44% from the previous year. Compared to 2018, when annual operating profit was the highest at 20.8438 trillion won, it decreased by 66.39%. Last year’s sales increased by 4% to 44.6481 trillion won, while net profit dropped 75% to 2.4389 trillion won.

SK Hynix explained that memory demand declined due to reduced IT demand overall, customer inventory adjustments, and ongoing cost-cutting efforts. Naturally, inventory surged sharply, causing memory prices to fall and profitability to decline. Kim Woo-hyun, SK Hynix’s Chief Financial Officer (CFO), said, "The recent drop in memory prices is the largest since the fourth quarter of 2008," adding, "The sharp price decline has increased the scale of inventory valuation losses."

SK Hynix expects the sluggish market conditions to continue this year as well. It forecast wafer production to decrease compared to last year and the pace of process transitions to slow down. It also projected that DRAM bit growth (shipment increase rate converted to bits) will turn negative and NAND bit growth will approach zero this year.

Securities firms predict that SK Hynix will continue to post operating losses through this year. Although detailed forecasts vary, major securities firms expect losses in all four quarters. In this case, the period of hardship could be longer than Samsung Electronics, which is expected to post semiconductor losses in the first and second quarters. Some, including NH Investment & Securities, anticipate that SK Hynix could return to profitability as early as the fourth quarter.

SK Hynix is responding to market supply-demand balance by cutting production and reducing investments. As announced during the earnings release in October last year, it plans to reduce capital expenditures (CAPEX) by more than 50% compared to last year’s 19 trillion won. However, it will continue investments in mass production of high value-added products such as Double Data Rate (DDR)5, LPDDR5, and High Bandwidth Memory (HBM)3, as well as future growth. Regarding production cuts, wafer supply of low-profit products has been reduced since the fourth quarter of last year.

CFO Kim said, "The impact of industry-wide production cuts will become visible from the first quarter, and as investment reductions reduce future supply capacity, inventory normalization is expected within this year," adding, "We also expect an upturn beyond expectations next year." Since companies like the US-based Micron and Japan’s Kioxia have announced production cut plans, and Samsung Electronics revealed practical production cut plans such as equipment relocation the day before, it is expected that the supply-demand balance effect will soon appear.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.