Due to the semiconductor cycle characteristics, frequent V-shaped sharp rebounds

Factors such as artificial intelligence and augmented reality also to boost memory demand

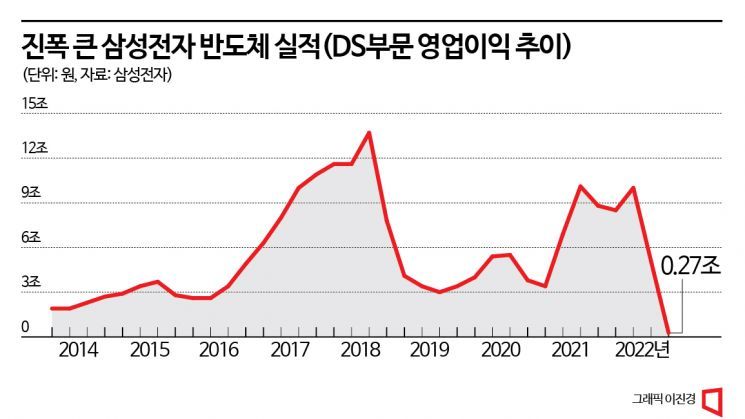

[Asia Economy Reporter Park Hyungsoo] Both semiconductor giants Samsung Electronics and SK Hynix could not escape the harsh downturn in the semiconductor industry. On the 31st, Samsung Electronics announced its quarterly operating profit by business division, revealing that the semiconductor sector recorded its lowest quarterly operating profit since 2014 (2.7 billion KRW in Q4 2022). Following this, on the 1st, SK Hynix disclosed that its operating loss in Q4 last year was 1.7012 trillion KRW, turning to a deficit compared to the same period in 2021 (4.2195 trillion KRW). This marks the first time in 10 years since Q3 2012 that SK Hynix has posted a loss.

Meanwhile, Samsung Electronics stated that it would not engage in direct or artificial production cuts such as reducing wafer input, suggesting that the oversupply situation in semiconductors is likely to continue for the time being. If the reduction is limited to technical adjustments like line rearrangement, the bottom of the semiconductor market cycle could be delayed accordingly.

Although the semiconductor market winter seems to be prolonged, foreign investors made a different choice. Foreigners massively purchased Samsung Electronics and SK Hynix stocks in the domestic stock market throughout January. According to the financial investment industry on the 1st, foreigners net bought 2.2221 trillion KRW worth of Samsung Electronics shares and 632.3 billion KRW worth of SK Hynix shares during January this year. Approximately 45% of the total net purchase amount of 6.3704 trillion KRW by foreigners in the KOSPI market in January was allocated to semiconductor stocks.

45% of Foreigners' Net KOSPI Purchases in January Were Semiconductor Stocks

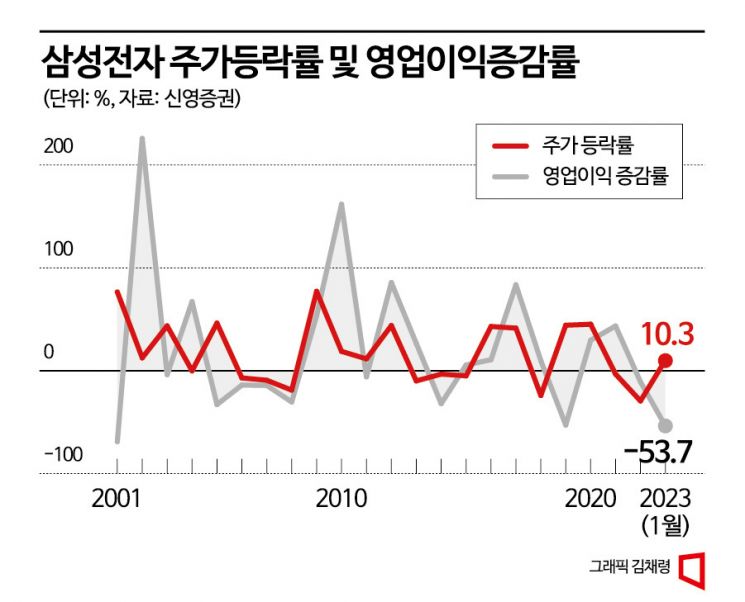

While the semiconductor market outlook might only improve in the second half of this year, what exactly did foreign investors see to move in this way? Kim Hakgyun, Research Center Head at Shin Young Securities, explained, "Since the 2000s, Samsung Electronics' operating profit has decreased by more than 30% five times, but in 2001, 2005, and 2019, the stock price actually rose significantly." He analyzed that although the amplitude of the semiconductor market cycle is very large and the profit decline is substantial, once the cycle changes, a V-shaped sharp rebound is possible, which fueled such expectations. Kim added, "Stock prices ultimately reflect earnings, but earnings are not figures confirmed immediately; they are expectations for the future."

Looking at Samsung Electronics' past operating profit trends, there were five occasions with decreases over 30%: 2001 (-69.1%), 2005 (-32.9%), 2008 (-30.4%), 2014 (-32.0%), and 2019 (-52.8%). In 2008, when the global financial crisis caused the KOSPI to fall below 900 points, Samsung Electronics' stock price dropped 18.9% annually. In 2014, the KOSPI fell 4.8%, and Samsung Electronics' stock price declined by 3.3%. Even during periods of profit decline, Samsung Electronics' stock price tended to follow semiconductor market outlooks 9 months to 1 year ahead.

Kim Dongwon, a researcher at KB Securities, said, "Since 2000, the signals for the bottom of the semiconductor downturn cycle in both market conditions and stock prices were the visible effects of production cuts, inventory reduction, and slowing price declines." He added, "Considering the semiconductor industry's 20-year history of repeated cycles, this year will be no exception." He further stated, "We expect the effects of production cuts to appear from Q2 this year. Since semiconductor stock prices reflect market conditions more than six months in advance, Samsung Electronics' stock price will likely form a bottom in Q1, the worst period for the market."

Technical analysis also shows that foreign investors' investment strategies had a high success rate. Kim Mingyu, a researcher at KB Securities, explained, "Semiconductors, which underperformed the market for two consecutive months at the end of last year, outperformed the KOSPI's rise in January. In technical analysis, a strong rebound that overwhelms previous underperformance is an important event as it indicates a possible trend reversal."

Recently, the semiconductor sector's trend was weak in November and December last year but rebounded strongly in January this year. Over the past 20 years, there have been 14 instances where semiconductor stock prices underperformed the market for two consecutive months and then rebounded. KB Securities' analysis of stock price trends 3 and 6 months later showed average outperformance of market returns by 7.3 and 11.6 percentage points, respectively. This suggests that the semiconductor sector's rebound in January this year could be a signal of a trend reversal.

Private bankers (PBs) who assist wealthy clients with asset management are also recommending semiconductor stocks such as Samsung Electronics as promising investments this year. Hwang Seonah, Branch Manager of KB Securities Gold & Wise The First WM Branch, said, "The semiconductor sector has been continuously difficult and is currently going through a downcycle," but added, "The stock market always reflects conditions in advance, so Q1 will be the worst." She continued, "Once corporate earnings are released and negative factors are reflected, it will be a buying opportunity for semiconductor stocks. It is a growing industry, and this year is a good time to invest." Oh Ina, Head of NH Investment & Securities Premier Blue Gangbuk Center, also analyzed, "The semiconductor market is expected to turn around. I believe Q1 earnings will be the bottom."

"Passing Through the Worst Cycle... Stock Prices Reflect Six Months Ahead"

If the historically high inventory levels can be quickly cleared, the semiconductor market recovery could appear faster than expected. This is also cited as a reason why foreigners are buying semiconductor stocks ahead of domestic institutional investors or individuals. Foreigners, who are more enthusiastic about ChatGPT in the U.S. than in Korea and feel the global IT companies' AI investment competition, are likely to view semiconductor demand recovery more optimistically.

Kim Younggeon, a researcher at Mirae Asset Securities, explained, "The AI investment competition that started with ChatGPT will lead to increased demand for server semiconductors," adding, "The demand increase for graphics processing units (GPUs) for ultra-large AI models is a positive factor for the DRAM market." He emphasized, "On the 21st of last month, Amazon announced it will invest 35 billion USD in data centers by 2040. The popularization of ChatGPT directly stimulates GPU demand and indirectly promotes DRAM-centered memory demand."

Alongside AI, augmented reality (AR) devices are also considered promising factors. The latest AR devices introduced at the 'CES 2023, the world's largest electronics and IT exhibition,' generally adopted DRAM LPDDR 12GB or more and 256GB storage. This DRAM is more than twice as powerful as that used in flagship smartphones. Apple is rushing to launch AR devices. If Apple recreates the iPhone phenomenon with AR devices, it could act as a catalyst for DRAM demand recovery.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.