The Securities Industry Estimates a Trillion-Won Scale Loss in Q1

[Asia Economy Reporter Park Sun-mi] Samsung Electronics' semiconductor division, which barely avoided a loss in its earnings report, has decided on conservative investment and production, anticipating that the market conditions in the first quarter of this year will also be unfavorable. The securities industry is leaving open the possibility that Samsung Electronics' semiconductor division could enter a loss range of around 2 trillion KRW in the first quarter of this year.

On the 1st, the securities industry weighed the possibility that Samsung Electronics' memory semiconductor production capacity (capacity), which affects the global semiconductor market, may be reduced, even though the company maintained its stance of 'no artificial production cuts' regarding semiconductor production cuts.

Song Myung-seop, an analyst at Hi Investment & Securities, explained, "Samsung Electronics' semiconductor division is optimizing line operations through equipment maintenance and relocation in existing lines and rapidly transitioning mature (legacy) process facilities to cutting-edge fine processes," adding, "In the short term, these processes negatively affect production growth rates."

During equipment maintenance and relocation in existing lines, wafer processing volume decreases, and when legacy processes are rapidly converted to advanced processes, production volume decreases during the initial yield slump period. Increasing the input of engineering wafers for R&D also means that the input of mass production wafers decreases by the same amount, so actual production volume may decline, according to his assessment.

Kim Dong-won, an analyst at KB Securities, also estimated that Samsung Electronics' actual production cuts (production facility relocation, enhanced line maintenance, expansion of R&D production capacity within facility investment) would have a greater effect than artificial production cuts (adjusting operating rates, reducing wafer input). He predicted, "Actual production cuts could impact memory semiconductor supply and demand improvements starting from June to July." He added, "Although Samsung Electronics stated that this year's facility investment would be similar to last year's, most of the investment is allocated to future investments (EUV, infrastructure) unrelated to memory supply this year," diagnosing that "in fact, this year's memory semiconductor facility investment will decrease by 13% compared to the previous year."

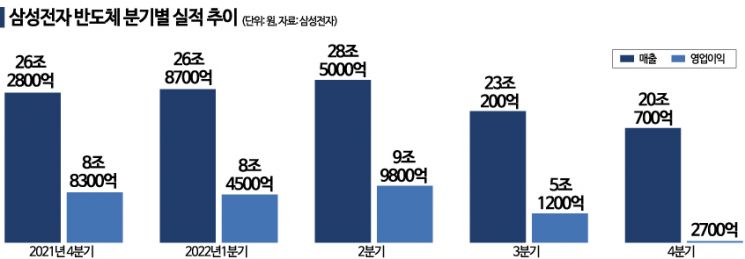

Samsung Electronics decided on a conservative investment and production stance for its semiconductor division because it expects the semiconductor market conditions to remain quite poor in the first quarter of this year. The semiconductor division, which barely avoided losses with an operating profit of 270 billion KRW in the fourth quarter of last year, is facing a continued decline in memory prices due to ongoing inventory adjustments by customers, making a return to losses in the first quarter of this year inevitable.

The securities industry estimates the loss scale to be in the 2 trillion KRW range. NH Investment & Securities forecasted a first-quarter loss of about 2.76 trillion KRW, and Kiwoom Securities also suggested 2 trillion KRW. Hi Investment & Securities and KB Securities projected approximately 2.1 trillion KRW and 1.9 trillion KRW, respectively.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.