Fixed Transaction Average Price Falls Below $2

[Asia Economy Reporters Sunmi Park and Haeyoung Kwon] Memory semiconductor prices continued their downward trend this month, falling further compared to the end of last year.

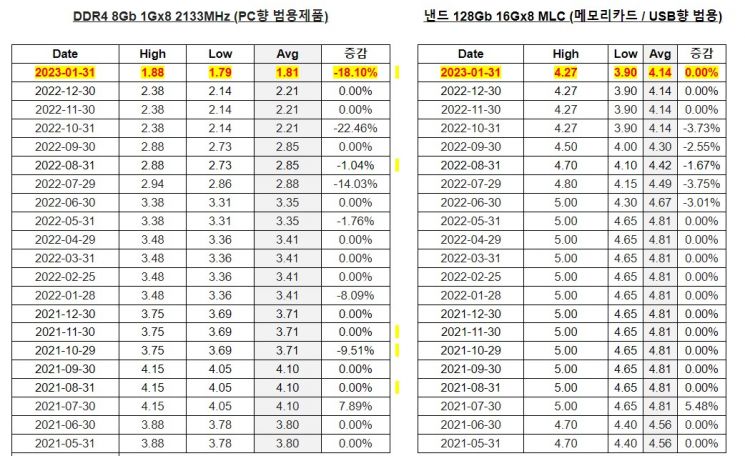

On the 31st, market research firm DRAMeXchange announced that the average fixed transaction price for PC DRAM general-purpose products (DDR4 1Gx8) in January was $1.81. Prices had stagnated at $2.21 for three months from October to December last year before dropping below $2. The fixed transaction price refers to the contract transaction amount between semiconductor manufacturers and IT companies and is considered a key indicator of the semiconductor market situation.

DRAM prices peaked at $4.10 in July 2021 but have now fallen below the $2 mark. Compared to a year ago, prices have halved. With DRAM prices declining from the first month of the new year, there is growing weight to the possibility that the price weakness trend will continue into the first quarter of this year.

The NAND price situation is similar. The fixed transaction price for general-purpose products for memory cards and USBs (128Gb 16Gx8 MLC) averaged $4.14 this month, maintaining the same level for four consecutive months. NAND products had declined for five consecutive months from June to October last year and have been stabilizing at the bottom for four months.

The price outlook is not optimistic. Taiwanese market research firm TrendForce forecasted that DRAM prices will fall by 20% in the first quarter and 11% in the second quarter of this year. NAND flash is also expected to drop by 10% and 3% respectively during the same period. DRAM and NAND flash prices had already fallen by 23% and 28% respectively in the fourth quarter of last year, and this price weakness is expected to continue into the first half of this year. Memory semiconductors are widely used in electronic products such as smartphones, PCs, and servers, and are regarded as a barometer of the semiconductor market.

TrendForce assessed that, considering the contract situation for the first quarter of this year, larger-scale production cuts are necessary in the memory semiconductor industry to avoid further price declines. To mitigate the impact of the semiconductor downturn, companies like SK Hynix and Micron have already been implementing production cut plans. As memory semiconductor demand slows and inventories accumulate, they are reducing both semiconductor production and investment with a determined attitude.

Micron plans to cut DRAM and NAND flash production by more than 20% and reduce capital expenditures by over 30% this year. They have even announced drastic measures to cut 10% of their total workforce. SK Hynix also stated in its third-quarter earnings conference call last year that it would reduce investment by more than 50% and focus production cuts on low-profit products.

However, Samsung Electronics has stated that it has not yet implemented any artificial production cuts. Samsung Electronics' semiconductor (DS) division recorded an operating profit of 270 billion KRW in the fourth quarter of last year, a 96% plunge compared to the same period the previous year, barely avoiding a loss.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.