Low Public Offering Price Attracts Undervaluation... Individual Buyers Surge

Low Lock-up Ratio Raises Concerns Over Institutional Sell-off

[Asia Economy Reporter Minji Lee] Publicly offered stocks, which had been shunned due to the cooling investor sentiment, are continuing their upward rally thanks to the beginning-of-the-year effect. It is analyzed that the number of investors aiming to buy shares at a low price, attracted by the undervaluation due to the low corporate valuation, has increased. However, since most of the recently listed stocks have institutional lock-up ratios of less than 5%, there is a significant concern that profit-taking sell-offs may flood the market.

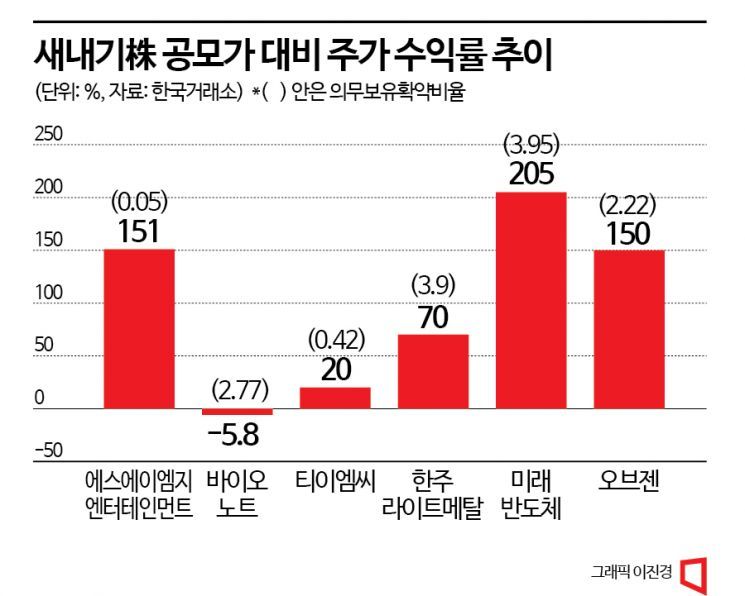

According to the Korea Exchange, on the 31st, Mirae Semiconductor closed the session at 18,310 won, up 205% from the public offering price (6,000 won). Publicly offered stocks listed since last month have shown a sharp rise compared to their offering prices. They were recorded as Obzen (150%), Hanju Light Metal (70%), SAMG Entertainment (151%), and TEMC (20%). The only stock trading below its offering price was Bionote (-5.8%).

The rise in publicly offered stocks is closely related to the stock market's upward trend driven by the beginning-of-the-year effect. Since the start of the year, the KOSPI has risen by over 10%, with improved investor sentiment toward risk assets due to expectations of a soft economic landing and interest rate cuts. Additionally, as the valuation of recent IPOs has become stricter, many companies were listed at offering prices lower than the hopeful price bands proposed at the time of listing, highlighting their undervaluation appeal.

However, considering that the lock-up ratios of newly listed stocks since last month are less than 5%, the overhang burden is considerable. SAMG Entertainment, listed last month, has a lock-up ratio of only 0.05%, while Bionote (2.77%), TEMC (0.42%), Hanju Light Metal (3.9%), Mirae Semiconductor (3.9%), and Obzen (2.22%) all remain in the low single digits.

Lock-up agreements are conditions set by institutions to receive more shares of publicly offered stocks, promising not to sell the shares for a certain period. For example, when institutions are allocated shares at the same price, the allocation is based on the net asset value of their funds, and institutions that commit to longer lock-up periods (15 days, 1 month, 3 months, 6 months) receive bonus points to be allocated more shares. Therefore, the higher the lock-up ratio, the fewer shares are available for sale immediately after listing, reducing the risk of price decline. Conversely, institutions without lock-up agreements can flood the market with shares whenever they reach a certain profit level. This is why it is unwise to jump in recklessly just because of undervaluation appeal.

An ECM (Equity Capital Market) official from a securities firm said, “Although the stock prices of publicly offered shares are good, institutional investors are viewing the valuation of IPOs tightly and consider the price prediction difficult,” adding, “It is necessary to check the circulating shares such as major shareholders’ stakes, but a low lock-up ratio means that the supply pressure can increase at any time,” urging caution.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)