Last Quarter of Last Year VD and Home Appliances Turned to Deficit

"Premium Products and Automotive Electronics-Centered Business"

[Asia Economy Reporter Moon Chaeseok] Samsung Electronics' VD (Visual Display) and Home Appliance divisions ultimately could not avoid losses in the fourth quarter of last year. Despite efforts to improve profitability with high-quality products, they faced losses due to a global demand decline and increased inventory.

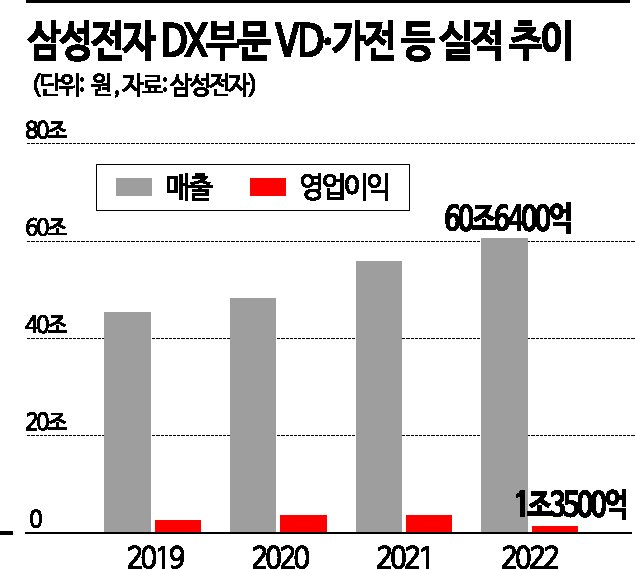

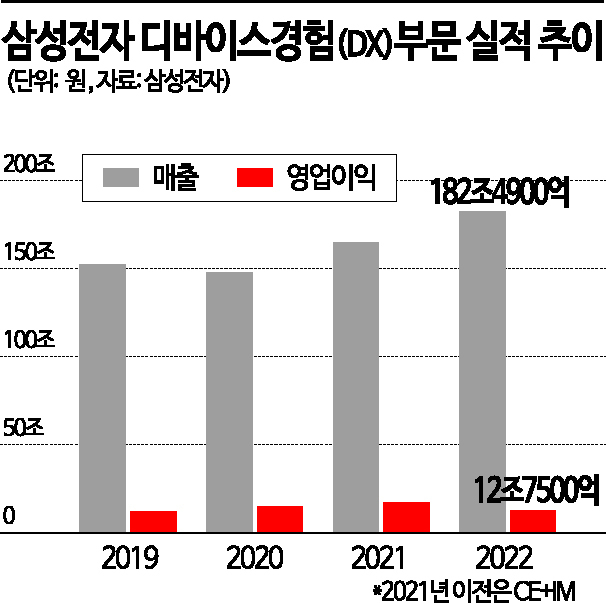

According to Samsung Electronics' announced performance for last year on the 31st, the DX division, which combines TV, home appliances, and mobile, posted an operating profit of 12.75 trillion KRW, down 26.3% compared to the same period last year. The VD and home appliance divisions' operating profit was 1.35 trillion KRW, a 62.9% decrease over the same period. Sales were 182.49 trillion KRW and 60.64 trillion KRW, respectively.

On the 6th, Samsung Electronics Seocho Building in Seocho-gu, Seoul. Photo by Jinhyung Kang aymsdream@

On the 6th, Samsung Electronics Seocho Building in Seocho-gu, Seoul. Photo by Jinhyung Kang aymsdream@

Narrowing down to the fourth quarter, the VD and home appliance divisions recorded an operating loss of 60 billion KRW. After five consecutive quarters of operating profits below 1 trillion KRW, they finally turned to a loss. Operating profits had sharply declined to 360 billion KRW and 250 billion KRW since the second quarter of last year. From the fourth quarter of 2021 to the first quarter of last year, they recorded between 700 billion and 800 billion KRW.

By division, VD performed relatively well, while home appliances showed weakness. The VD division's fourth-quarter sales were 9.16 trillion KRW. After recording between 7 trillion and 8 trillion KRW quarterly, it achieved better results in the fourth quarter. This indicates that home appliance profitability was lower. Sales decreased from the quarterly 7 trillion KRW range to 6.42 trillion KRW in the fourth quarter.

LG Electronics also reported an operating loss of 1.1296 trillion KRW in its H&A (Home Appliance & Air Solution) division, which handles home appliances, last year. Samsung Electronics explained, "VD saw increases in both sales and profits due to strong sales of premium products such as Neo QLED and large-sized models during the year-end peak season, but home appliances experienced a decline in profitability due to market deterioration and competition."

The problem is that the poor performance of home appliances is not solely due to a sharp drop in consumption caused by the recession, affecting both Samsung and LG. Rising logistics costs and expensive raw materials played a significant role. The strategy of increasing profitability by selling premium products did not work.

For example, the price of iron ore, which affects the price of steel?a major material for home appliances?rose 60.3% from $79.5 per ton (about 98,000 KRW) at the end of October to $127.4 per ton (about 157,000 KRW) on the 27th. Copper prices also increased. As of the 18th, the London Metal Exchange (LME) 3-month copper futures price was $9,435 per ton (about 11.61 million KRW). It recorded around $8,000 per ton (about 9.84 million KRW) in the second half of last year before showing an upward trend.

Although the situation is difficult, both companies plan to actively pursue new businesses such as premium products and automotive electronics to improve business profitability. Samsung Electronics stated, "VD plans to capture demand in the premium market centered on the 2023 Neo QLED," adding, "Home appliances will focus on expanding premium product sales by launching new products such as the Bespoke Infinite line and securing profitability through cost efficiency." LG Electronics also announced plans to increase exports of UP (Upgradeable) home appliances to advanced markets such as North America starting this year. UP home appliances are services that add new functions after purchase.

The automotive electronics business is an active new business for both Samsung and LG. Harman showed a rebound last year with an operating profit of 880 billion KRW and 370 billion KRW in the fourth quarter. This is the highest quarterly operating profit for two consecutive quarters. After maintaining around 100 billion KRW, it increased to 310 billion KRW in the third quarter and 370 billion KRW in the fourth quarter.

Samsung Electronics said, "Harman achieved record-high results for two consecutive quarters due to increased sales in the automotive electronics business and steady consumer audio sales," adding, "We plan to expand online and offline sales of the audio business and increase orders in the automotive electronics business focusing on digital cockpits and car audio." LG Electronics' VS division turned profitable for the first time in 10 years last year and currently holds an order backlog of 80 trillion KRW.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.