Authorities Prepare Improvement Plan for Hidden Financial Assets Prevention System

[Asia Economy Reporter Yu Je-hoon] Financial authorities have introduced a system improvement plan to strengthen financial companies' guidance and designate and operate dedicated organizations regarding consumers' 'hidden financial assets' such as deposits, savings, and insurance money that have matured but remain unclaimed.

The Financial Services Commission and the Financial Supervisory Service announced on the 31st that they have prepared this system improvement plan through discussions with the financial industry to prevent the occurrence of hidden financial assets across the entire financial sector. Accordingly, financial industry associations plan to revise consumer protection standards by March, and financial companies are expected to complete the designation of dedicated organizations and the development of IT systems by the first half of this year.

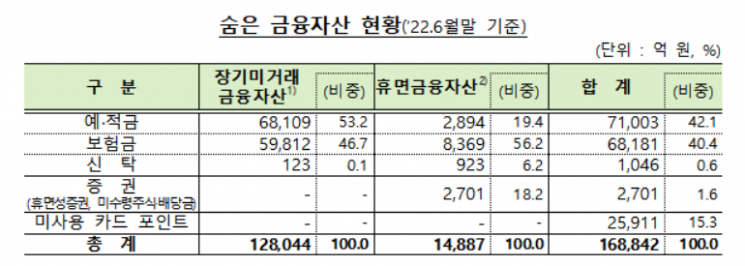

The reason financial authorities are pushing for system improvements is that despite establishing systems like 'My Account at a Glance' and 'Find My Insurance' to easily check and claim hidden assets, related financial assets continue to increase steadily. According to the authorities, as of the end of June last year, hidden financial assets across the entire financial sector, including long-term inactive financial assets and dormant financial assets, amounted to 16.8842 trillion KRW. By type, deposits and savings accounted for 7.1003 trillion KRW (42.1%), insurance money 6.8181 trillion KRW (40.4%), followed by unused card points at 2.5911 trillion KRW (15.3%), securities at 270.1 billion KRW (1.6%), and trusts at 104.6 billion KRW (0.6%).

Among hidden financial assets, deposits, savings, and insurance money, which make up the majority, see significant interest rate drops after maturity. If unclaimed, consumers lose potential earnings from reinvestment, and there is also concern about financial fraud exploiting long-term unused status.

Accordingly, the authorities will first strengthen customer guidance related to hidden financial assets. To prevent the occurrence of hidden financial assets, they will require guidance on disadvantages over time after maturity and automatic processing methods at maturity (automatic deposit into designated accounts or automatic reinvestment). Additionally, guidance will be provided once a year during the contract period and just before maturity, and consumers will be able to set or change automatic processing methods at any time upon maturity.

Furthermore, guidance on disadvantages over time after maturity as well as methods to check and claim hidden financial assets will be provided. Notifications will be made at maturity, before the first interest rate reduction after maturity, and at least once a year after one year past maturity. Consumers will be able to check and claim all financial assets at once through the Financial Supervisory Service’s Financial Consumer Information Portal.

The authorities have mandated financial companies to designate and operate dedicated organizations to ensure systematic management and prompt refund of hidden financial assets. These organizations will establish consumer protection standards and detailed procedures for managing hidden financial assets, develop improvement plans, and report their performance annually to internal consumer protection control committees.

The Financial Services Commission stated, "Going forward, the FSC, the FSS, and the entire financial sector will continue public campaigns to prevent and reduce hidden financial assets and strengthen guidance to financial consumers."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.