Distribution Structure Greatly Influences Price

Recently, a chart known as the 'Henry Hub price' has become a hot topic among some netizens. Henry Hub refers to the natural gas futures price traded on the New York Mercantile Exchange (NYMEX), showing how expensive the commoditized natural gas currently traded on the international market is.

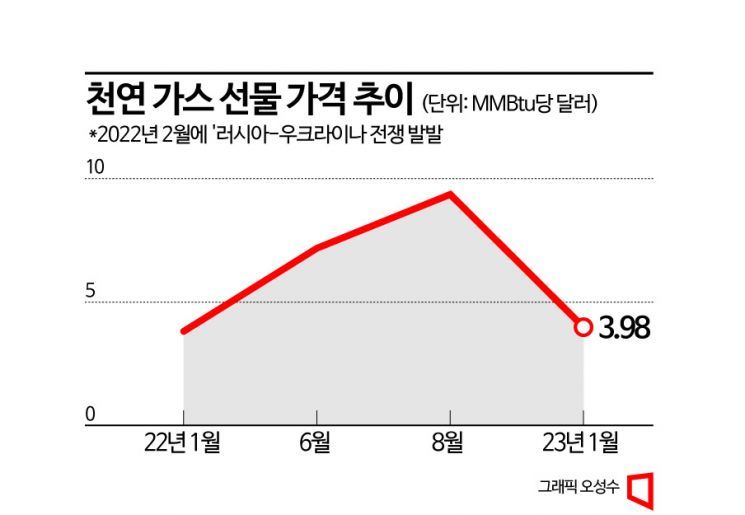

The issue is that Henry Hub prices skyrocketed following the Russia-Ukraine war but have recently fallen back to pre-war levels. Coinciding with the 'normalization' of gas prices, domestic heating gas fees have surged by nearly 40%. Some have expressed skepticism, saying, "In that case, wasn't there no need to raise heating costs at all?"

So why is there a gap between international gas prices and domestic gas prices? The cause lies in the 'distribution structure' of gas.

New York Gas Price Indicator is Based on the US Natural Gas Hub

Natural gas is a combustible gas naturally produced on Earth, mainly found alongside oil in oil fields or emitted from gas fields. Humans extract natural gas using drills and use it as a raw material in various industries such as chemicals, heating, and power generation.

The Henry Hub on the New York futures market is a representative gas price indicator. It is named after Henry Hub in Louisiana, a 'gas hub' where US natural gas transportation pipelines converge.

Although the New York market serves as a benchmark for international natural gas prices, the gas import costs of each country differ somewhat. This is because gas is a very difficult raw material to transport.

PNG·LNG... Gas Distribution Structures Vary Depending on the Environment

Price Trend of Henry Hub Natural Gas Futures at New York Mercantile Exchange. (*The graph has been simplified for easier understanding)

Price Trend of Henry Hub Natural Gas Futures at New York Mercantile Exchange. (*The graph has been simplified for easier understanding)

As explained earlier, natural gas is a 'combustible gas.' It cannot be transported by conventional means and requires special processing. The cheapest method is 'PNG (Pipeline Natural Gas),' where extracted gas is transported through pipelines. However, PNG is only feasible when the distance between the gas extraction site and the receiving city is short.

Countries thousands of kilometers away that want to import natural gas must use a different method than PNG. This is 'LNG (Liquefied Natural Gas),' mainly used in Japan, Korea, Spain, and the UK. LNG is natural gas in a gaseous state cooled to minus 162 degrees Celsius, compressing its volume to one 600th to liquefy it.

The liquefied gas is loaded onto special ships called 'LNG carriers' and exported overseas. But it doesn't end there. The LNG stored on LNG carriers is transferred to massive facilities called 'LNG terminals,' where it is converted back into gas form and transported to homes through pipelines. This process is managed by city gas corporations.

Ulsan LNG terminal under construction. LNG, which can only be maintained in a cryogenic state, is transferred from the LNG berth to a large terminal for storage. / Photo by Yonhap News

Ulsan LNG terminal under construction. LNG, which can only be maintained in a cryogenic state, is transferred from the LNG berth to a large terminal for storage. / Photo by Yonhap News

Unlike PNG, which can connect gas to factories and homes through a single pipeline, LNG requires four additional stages: fuel processing, shipping freight, LNG terminal storage, and regasification of LNG. This significantly increases operating costs and capital expenditures.

Because of this, gas prices in LNG-importing countries differ greatly from international gas prices and also vary depending on the location of the LNG-importing country. This is due to differences in freight costs and terminal efficiency in each country. For example, Korea's gas price benchmark is more appropriately the 'JKM (Japan-Korea Marker) LNG,' which reflects the price trend of physical LNG heading to Northeast Asia.

The 'energy crisis' in Central Europe, including Germany, also stems from this gas market structure. Germany, which relied on Russian PNG, cut off Russian gas imports after the war. Since Germany lacks LNG terminals, it had to receive gas using the relatively developed LNG terminal infrastructure in Spain or the UK.

When Germany, a major player in the European gas market, suddenly shifted demand to LNG, European LNG prices surged as well, forcing countries that did not use Russian PNG to bear the costs. The fragmented gas market experiences bottlenecks even with slight surges in demand.

Unpaid Bills Create a 'Gap' Between Raw Material Costs and Fees

Samsung Heavy Industries LNG carrier. Liquefied natural gas is stored in cryogenic cargo tanks. / Photo by Yonhap News

Samsung Heavy Industries LNG carrier. Liquefied natural gas is stored in cryogenic cargo tanks. / Photo by Yonhap News

Even though international gas futures and LNG prices differ, if the price of natural gas, the raw material for all gas products, has dropped, wouldn't the burden on Korea Gas Corporation and city gas companies be partially relieved? In fact, the JKM-LNG price (based on MMBtu) soared to $50 in the third quarter of last year but fell to the $26 range by mid-this month. So why are domestic gas fees increasing now?

Industrial gas fees, which implement a 'raw material cost linkage system,' have actually decreased slightly recently. However, residential gas prices do not fluctuate in line with raw material costs. Some of the raw material costs, labor costs, and operating expenses are borne by the gas corporation, allowing households to use energy at a cheaper price. The losses incurred from this are classified as 'unpaid bills.'

Over the past year, due to the volatility of natural gas prices caused by the war and other factors, unpaid bills have also surged dramatically. According to the gas corporation, as of the end of last month, unpaid raw material costs approach approximately 9 trillion won. There is a bleak forecast that to resolve this within the year, gas fees would need to increase by about three times the current level.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)