[Asia Economy Reporter Ryu Tae-min] The Seoul apartment auction market, which had been neglected, is regaining popularity. It is interpreted that real demand buyers seeking to purchase their own homes have flocked as the winning bid prices have dropped due to consecutive auction failures. In particular, the winning bid rate and the number of successful bids have more than doubled in a month, creating a fiercely competitive bidding atmosphere.

People are bidding at the Southern District Court auction in Sinjeong-dong, Yangcheon-gu, Seoul.

People are bidding at the Southern District Court auction in Sinjeong-dong, Yangcheon-gu, Seoul. [Photo by Ryu Taemin]

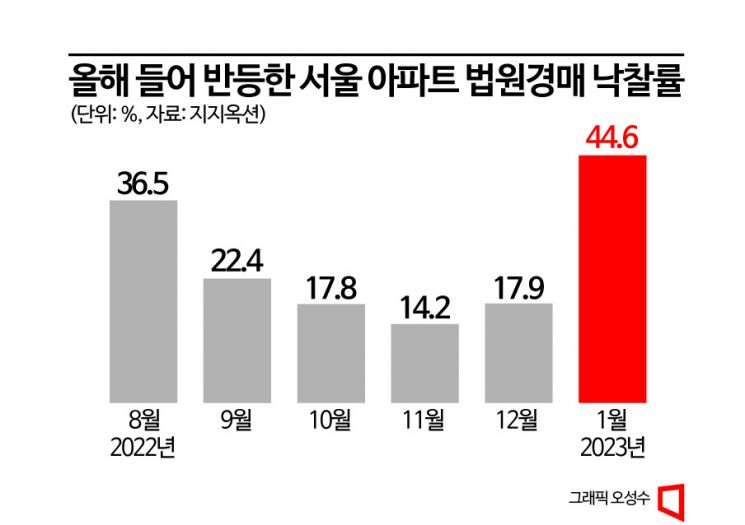

According to court auction specialist company Gigi Auction on the 31st, the average winning bid rate for Seoul apartments auctioned in court this month was 44.6%. This is 26.7 percentage points higher than December last year (17.9%). Compared to the average of the second half of last year, 22.57%, it is about twice as high. The winning bid rate refers to the ratio of items with a decided winning bidder among the auctioned items. For example, a winning bid rate of 44.6% means that out of 10 auctioned items, 4.5 found new owners.

The number of successful bids also surged. This month, the total number of successful bids for Seoul apartments was 50, more than double the 24 cases in December last year. This is the highest number in two and a half years since July 2020. The average number of bidders was 5.8, the highest since April last year (6.6).

The significant rise in the winning bid rate is due to the drop in bid prices caused by consecutive auction failures. Since the second half of last year, the apartment auction market has experienced a cold wave, with auctioned items consecutively failing to sell. In fact, in November last year, the winning bid rate dropped to 14.20%, meaning only 1.4 out of 10 items found new owners.

In reality, even high-priced homes in the Gangnam area, which had been popular as ‘one solid home’ for several years, are now commonly experiencing one or two auction failures. A 144㎡ (exclusive area) apartment in Hyundai, Apgujeong-dong, Gangnam-gu, Seoul, went up for auction on the 11th but failed to attract any bidders and was auctioned off. A 162.6㎡ unit in Tower Palace, Dogok-dong, Gangnam-gu, also failed to find a buyer in two auctions held in November last year and on the 10th of this month. With no interested buyers, this property was eventually withdrawn from auction on the 13th.

‘Half Price’ After 2-3 Auction Failures... ‘Jumjum’ Craze Spreads Regardless of Region

As multiple auction failures accumulate, price competitiveness emerges. In real estate auctions, the minimum bid price decreases each time an auction fails. For example, in Seoul courts where the auction failure reduction rate (the rate at which the minimum price decreases after a failed auction) is 20%, an auctioned property with an appraised value of 1 billion KRW will start at a minimum bid price of 800 million KRW in the second auction if it fails in the first auction. If it fails again in the second auction, the minimum bid price for the third auction will be set at 640 million KRW, which is 20% less than 800 million KRW.

In the metropolitan area, including Incheon and Gyeonggi regions, the auction failure reduction rate is steeper at 30%. For an auctioned property with an appraised value of 1 billion KRW, the minimum bid prices are 700 million KRW after the first failure, 490 million KRW after the second, and 343 million KRW after the third. Properties that have failed three times drop to about one-third of their appraised value.

In fact, the winning bid rates in Incheon and Gyeonggi regions also showed a slight rebound this month. The winning bid rate for Incheon apartments rose 4.7 percentage points from 23.10% in December last year to 27.80% this month. In Gyeonggi, it increased by 2.3 percentage points from 25.00% to 27.30% during the same period.

Real Demand Buyers Seeking ‘Home Ownership’... Complexes with 76 Bidders Appear

Properties with price competitiveness due to consecutive auction failures are attracting many bidders. On the 18th, 45 bidders competed for an 84.8㎡ unit in Hanshin Apartment, Mok-dong, Yangcheon-gu, Seoul, creating a heated atmosphere. This property, with an appraised value of 1.603 billion KRW, had its minimum bid price lowered to 827.03 million KRW after failing three times in September, November, and December last year. Eventually, it found a new owner at 1.06777 billion KRW. The second and third highest bids were 1.051 billion KRW and 1.04999 billion KRW respectively, showing fierce bidding competition.

In Gyeonggi Province, on the 25th, 76 bidders competed for a 60㎡ unit in Hyundai Apartment, Pungdeokcheon-dong, Suji-gu, Yongin-si. This property was sold at 548.29 million KRW, which is 180.3 million KRW higher than the minimum bid price of 367.99 million KRW. In Incheon’s Bupyeong-gu, Cheongcheon-dong, a 78㎡ unit in Woorim Phil-Yu Apartment attracted 42 bidders and was sold at 281 million KRW, 85 million KRW higher than the minimum price of 196 million KRW.

It is particularly analyzed that auction bidding is being driven more by real residential demand than investment demand. Joo Hyun Lee, senior researcher at Gigi Auction, explained, “As consecutive auction failures lower bid prices, more real demand buyers are entering auctions to purchase their own homes. Due to interest rate hikes and price declines, the housing market outlook is bleak, so investment demand seems to have decreased compared to before.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)