After Two Years of Record-Breaking Surge, a Reversal Decline

This Year's Short-Term Surge and Move-In Volume Affect Decline Extent

[Asia Economy Reporter Kim Hye-min] 'From a short-term surge to an all-time high decline.' Over the past three years, the jeonse market has experienced a rollercoaster trend. The jeonse prices, which soared to record highs for two years following the implementation of the Lease Protection Act in 2020, were all returned last year.

In particular, with 2021 marking the year when jeonse prices surged sharply, this year, when lease contracts expire, it is expected that the issue of returning jeonse deposits will emerge as a social problem, especially in regions where jeonse prices skyrocketed over the past two years. Experts have identified Incheon, Daegu, and Sejong as crisis areas.

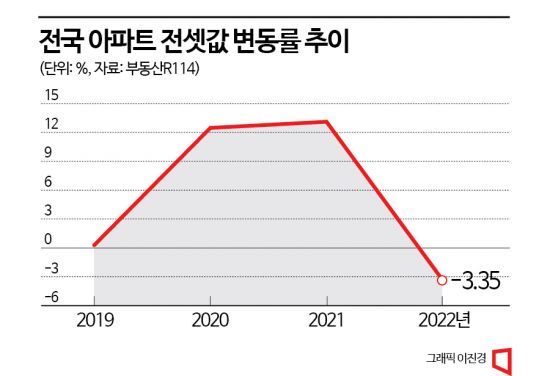

According to Real Estate R114 on the 31st, nationwide jeonse prices fell by 3.35% last year compared to the previous year. This is the largest decline since the first price survey began in 2001. The only previous instance of jeonse prices falling by more than 3% was in 2004 (-3.24%).

What stands out is that after recording an all-time high increase over the past two years, prices reversed sharply downward. Jeonse prices surged for two years following the introduction of the Lease Protection Act (including the right to request contract renewal, rent ceiling system, and rent reporting system) at the end of July 2020. Prices rose 12.47% in 2020 and 13.11% in 2021. The cumulative change over two years reached 36.31%.

As a result, new contracts reflecting price increases of over 35% and renewal contracts rising only about 5% due to the rent ceiling system coexisted, creating dual or multiple price levels. However, with the jeonse deposits elevated over two years and a strong preference for monthly rent due to sharp interest rate hikes last year, jeonse demand massively declined, and the trend of jeonse price reversal has been gaining momentum since last year.

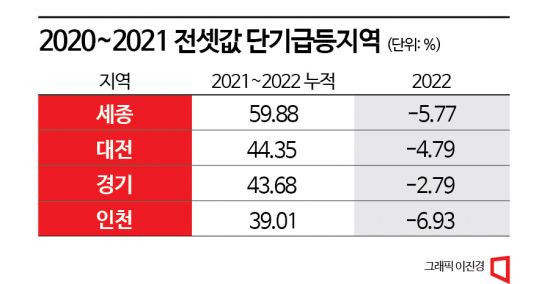

This year, the atmosphere is not much different from last year, and the extent of price declines is expected to vary by region depending on short-term surge areas and the scale of new housing supply. First, regions where jeonse prices rose significantly are likely to return the increases as they are. In fact, last year, areas with large short-term price surges experienced significant price reversals. A representative example is Sejong City. Sejong, which had a cumulative jeonse price increase of 59.88% from 2020 to 2021, saw a 5.77% decline last year, the second-largest drop nationwide. However, since Sejong is scheduled to have 3,092 new housing units this year, the risk of a sharp decline is not expected to be high.

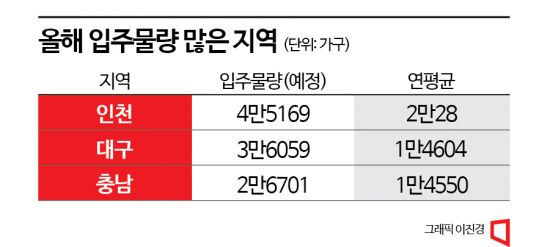

Incheon is a place where a short-term surge is combined with a housing supply bomb. After jeonse prices rose 39% over the past two years, Incheon experienced a sharp 6.93% drop last year. Meanwhile, this year, a record-breaking 45,169 new housing units are scheduled to be supplied. The average annual supply from 2010 to 2022 was 20,028 units, so this year’s supply is about twice that amount.

Daegu, Chungnam, and Gyeonggi also have relatively large new housing supplies planned compared to past averages. Daegu, where jeonse prices rose 15.94% over the past two years, will see 36,059 new units move in this year, nearly 2.5 times the average annual supply (14,604 units). Chungnam, another representative short-term surge area where jeonse prices rose 29.52% over the past two years, is scheduled to have 26,702 new units move in this year, double last year’s number.

Yoon Ji-hae, chief researcher at Real Estate R114, said, "When a relatively large volume of new apartment supply floods the market at once compared to the average annual supply, the possibility of reverse jeonse increases, leading to a greater price reversal. If a large supply coincides with a short-term surge, the issue of returning jeonse deposits could emerge as a social problem."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.