KOTRA Publishes Report on Japan's Food Consumption Trends Through '4 Key Keywords'

[Asia Economy Reporter Han Yeju] Amid the prolonged COVID-19 pandemic, the keyword 'SHE'S' is gaining attention as a food consumption trend in Japan. SHE'S represents four key concepts: ▲Simple ▲Health ▲E-commerce ▲Sustainability, while also reflecting the fact that women generally hold the leading role in food consumption in Japan.

KOTRA published a report titled 'Japan's Food Consumption Trends Seen Through Four Keywords' on the 30th. This report analyzes the current status and characteristics of the Japanese food market, introduces four food consumption trends and success cases that have changed due to the prolonged pandemic, and suggests strategies for Korean companies to successfully enter the Japanese food market.

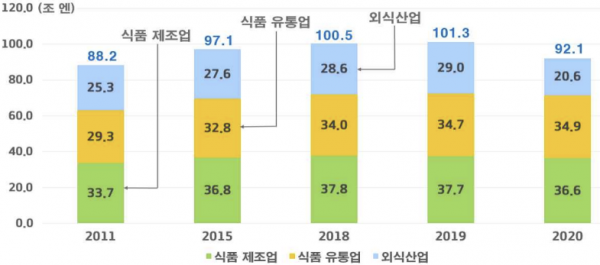

The size of the Japanese food market in 2020 was 92 trillion yen, decreasing since it recorded 100 trillion yen in 2018. Although the dining-out industry was severely contracted due to COVID-19, food distribution through large supermarkets and online shopping malls has increased due to rising home consumption and stockpiling demand, leading to a continuous expansion in the share of food distribution businesses. In 2021, Japan's annual food shipment scale was 29.9379 trillion yen, with the top five product categories totaling about 16 trillion yen, accounting for 53% of the whole.

Looking at Japan's food consumption trends through the four keywords, the demand for easy-to-cook frozen foods has accelerated even after COVID-19 due to social structural changes such as nuclear families and an increase in single-person households. In particular, female consumers, who lead food consumption at home, tend to prefer purchasing frozen foods. Recently, there has been growing demand for premium frozen foods that use rapid freezing technology to reproduce the taste and freshness of freshly made dishes. High-end frozen foods (so-called home restaurant convenience meals) that allow consumers to enjoy gourmet foreign restaurant dishes at home are gaining popularity.

Amid heightened health awareness among Japanese consumers during the pandemic, there is strong interest in functional foods that help reduce body fat and improve gut health. Sales of body fat reduction products (such as green tea that inhibits fat absorption, chocolates or gums that aid body fat reduction) are expected to maintain double-digit growth. Additionally, probiotic functional foods that not only improve intestinal environment but also offer benefits such as stress relief, improved sleep quality, and enhanced immunity are being launched one after another, attracting consumer attention.

Japan's food e-commerce market in 2021 recorded 4.4434 trillion yen, a 16.7% increase compared to 2019 before COVID-19, continuing its growth trend over the past five years. Especially recently, various companies such as delivery apps and SNS have entered the existing e-commerce market, opening a new quick commerce market that integrates delivery services and messenger functions.

Moreover, in Japan where gift-giving culture is important, the online gift market for non-face-to-face gift exchanges is gaining attention. In particular, social gift services that send premium frozen foods or dessert foods as social gifts via social media (SNS) messengers, or that allow the sender to choose a theme reflecting the recipient’s preferences, are becoming popular.

Japan discards 5 million tons of food annually, an amount exceeding the annual food aid volume that could feed the world's hungry population. As food waste emerges as a serious environmental and social issue, Japanese consumers are increasingly interested in food sharing and food upcycling products that reduce food loss.

Kim Samsik, head of KOTRA's Japan regional office, said, "The Japanese food market is highly competitive among companies, and consumers always demand new products, resulting in very short product lifespans and rapid trend changes. It is necessary to quickly incorporate new local consumer trend changes into product promotion strategies and target the Japanese market with differentiated products that are hard to find in Japan."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)