Statistics Korea '2022 Annual Domestic Population Movement'

6.15 Million Movers, Lowest Since 1974

Migration Rate at 12%, Lowest in 50 Years

The reconstruction site of Dunchon Jugong Apartment in Gangdong-gu, Seoul./Photo by Hyunmin Kim kimhyun81@

The reconstruction site of Dunchon Jugong Apartment in Gangdong-gu, Seoul./Photo by Hyunmin Kim kimhyun81@

[Asia Economy Sejong=Reporter Song Seung-seop] Last year, the population mobility rate dropped to its lowest level in 50 years. This appears to be due to many citizens refraining from taking out loans to buy new homes or move, amid high interest rates and a downturn in the real estate market. Despite this, the exodus from Seoul to nearby metropolitan areas continued, driven by the high housing prices in Seoul.

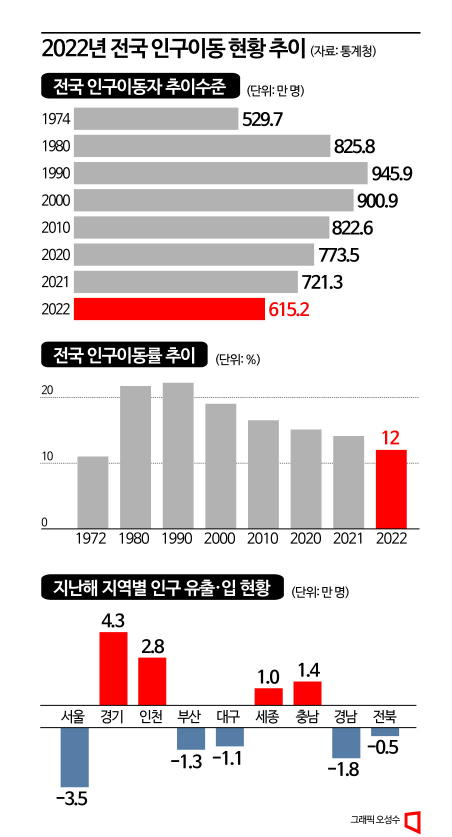

According to the '2022 Annual Domestic Population Movement' data released by Statistics Korea on the 30th, the number of people who moved last year was recorded at 6,152,000. This is the lowest in 48 years since 1974, when 5,297,000 people moved. Considering that the population at that time was only about 34 million, this is a record low figure. It means that the majority of the population avoided moving and stayed in their current residences.

The number of movers sharply decreased compared to the previous year. It dropped by 14.7% (1,061,000 people) from 7,213,000 in 2021. This is the largest decline in 46 years since 1976, when the number of movers decreased by 24.8%. The population mobility rate, which expresses the number of movers per 100 people, fell by 2.1 percentage points to 12.0% compared to the previous year. This mobility rate is also the lowest since 1972 (11.0%).

The reluctance to move to other regions is interpreted as being related to real estate issues. The base interest rate, which started at 1.25% last year, soared to 3.25% by the end of the year, pushing mortgage loan rates to the 7% range, while jeonse and monthly rent loan rates remained in the 5-6% range. Additionally, the real estate market froze due to the Gangwon Legoland incident and the unstable PF loan market, leading more people to decide to stay in their current residences.

Let's Go Where Housing Is Cheaper... The Exodus from Seoul Continues

No Hyung-jun, head of the Population Trends Division, explained, “From January to November 2022, the number of housing sales was 480,000, about 50% less than 961,000 during the same period the previous year. The housing market was less active, and as a result, the demand for moving related to housing decreased significantly, leading to a sharp decline in the number of movers.”

According to reasons for moving surveyed by Statistics Korea, in 2021, 2,714,000 people moved for 'housing' reasons, but this number decreased by 598,000 in one year to 2,116,000. Although this accounted for a large share of 34.4% of all moving reasons, it showed the largest decrease by reason. The next most common reasons were 'family' with 1,459,000 people and 'job' with 1,440,000 people.

The movement from Seoul, where housing prices are high, to the relatively affordable metropolitan area continued. About 60.0% of those who moved out of Seoul relocated to Gyeonggi-do, while the rest moved to Incheon and Gangwon regions. In Gyeonggi-do, 51.6% of the incoming population came from Seoul, while Incheon and Gangwon received 28.3% and 24.2% respectively from Seoul.

By region, Seoul saw a net outflow of 35,000 people, meaning 35,000 more people left than entered. This population outflow from Seoul has continued for 33 years. On the other hand, Gyeonggi-do's population increased by 43,000, and Incheon also grew by 28,000. The highest net inflow rates were in Sejong City (2.7%) and Incheon City (1.0%), while the largest net outflow rates were in Ulsan (-0.9%) and Gyeongnam (-0.6%).

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)