[Asia Economy Sejong=Reporter Kim Hyewon] Domestic corporations and individual business owners who wish to receive tax credits for research and human resource development expenses can apply for a prior review from the National Tax Service (NTS). Taxpayers who file their corporate tax (income tax) based on the prior review results will be exempt from verification of the reported content and post-management of tax reductions. Even if taxation is imposed differently from the review results due to tax audits, the penalty for underreporting will be waived.

The NTS announced on the 30th that if a prior review application for research and human resource development expense tax credits is submitted and the results are notified before the corporate tax (income tax) filing deadline in March this year, the review results will be immediately reflected in the filing.

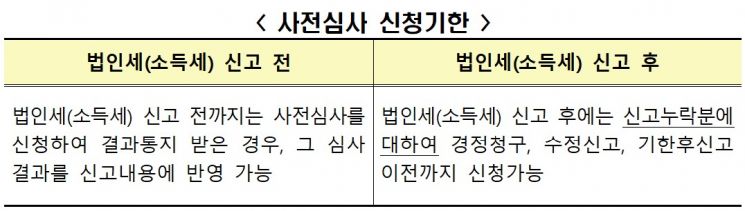

Prior review applications can be submitted year-round. After filing corporate tax (income tax), prior review can be applied for omitted tax credit claims through correction requests, amended returns, or late filings before the deadline.

What is the Prior Review System for Research and Human Resource Development Expense Tax Credits?

The research and human resource development expense tax credit is a tax support system that allows domestic taxpayers to deduct a certain percentage of the amount spent on research and human resource development during each tax year from their corporate tax (income tax).

Disagreements often arise between taxpayers and tax authorities regarding whether research and human resource development activities were conducted and the scope of deductible expenses. If tax audits reveal that the tax credit was incorrectly reported, not only the tax credits claimed over several years but also penalties may be imposed, so caution is required.

The prior review system, which allows the NTS to verify the appropriateness of the tax credit in advance, has been in effect since 2020. The number of prior review applications has increased from 1,547 cases in 2020 to 2,332 in 2021 and 2,439 in 2022.

Applications can be made not only for expenses already incurred by companies for research and human resource development but also for planned expenses. If there are multiple research projects, it is also possible to apply for only specific projects.

The NTS reviews the appropriateness of the tax credit from both technical and cost perspectives. It examines whether the research and development activities performed by the applicant qualify as research and development under Article 2, Paragraph 1 of the Restriction of Special Taxation Act, and whether the expenses incurred by the applicant fall within the deductible amounts specified in Article 10 of the same Act.

For example, Company A, which develops industrial power devices and produces prototypes, classified raw material purchase costs of OO billion won as material costs and applied for a tax credit. The NTS found that these costs included both prototype material costs and mass production material costs. Accordingly, costs of O billion won used for mass production were disallowed as deductible material costs. This is because deductible material costs are limited to samples, parts, raw materials, and reagents used for research purposes by dedicated departments or research service providers.

What Are the Benefits of Prior Review?

There are two main benefits when applicants file corporate tax (income tax) reflecting the tax credit amount based on the prior review results.

The content of the prior review application is exempt from verification of the reported content and post-management of tax reductions. This means exclusion from procedures such as written explanations and guidance for amended returns regarding suspected errors or omissions in specific items of the taxpayer’s report, as well as from post-management systems that verify compliance with legal obligations through written or on-site inspections.

Even if taxation is imposed differently from the review results due to subsequent tax audits, applicants can benefit from exemption from penalties.

The NTS explained, "This year, we enhanced convenience by allowing supplementary documents, which were previously only accepted by mail or in person, to be submitted through Hometax, and by developing an electronic screen where applicants can check the status of their prior review application."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.