Major Gas Stocks Rise 9-25% Since Year-End

Gas Corporation's Monopoly Supply Sees Raw Material Costs Increase, Sales Only Grow

[Asia Economy Reporter Son Sun-hee] With record-breaking cold waves and energy price hikes coinciding in the new year, city gas company stocks have surged. However, there are concerns that the sharp rise in stock prices is not supported by corresponding earnings, suggesting that investors should exercise caution.

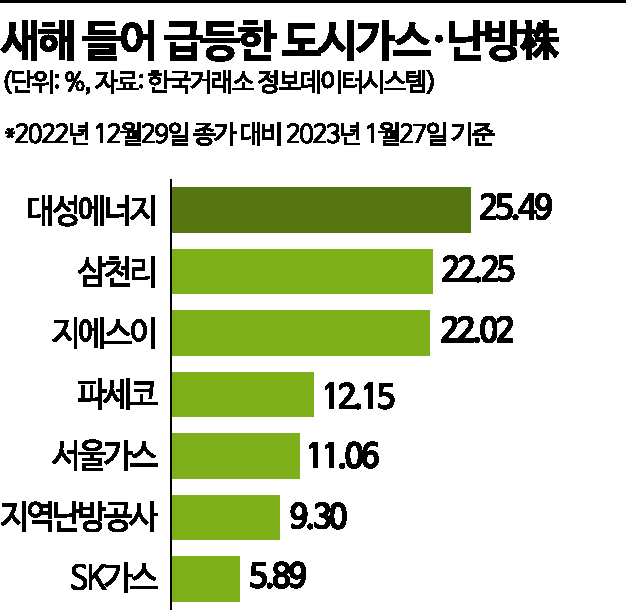

According to the Korea Exchange on the 30th, Daesung Energy, a city gas supplier for Daegu and nearby areas, saw its stock price rise about 25.5% compared to the end of last year (as of the closing price on January 27). During the same period, city gas and heating-related stocks such as Samchully (22.2%), GSE (22.0%), Seoul Gas (11.1%), and Korea District Heating Corporation (9.3%) all showed a simultaneous upward trend. Although not directly related to gas, heating mat manufacturer Paseco also recorded a high stock price increase of 12.2% since the beginning of the year. This is interpreted as a result of investors’ attention being drawn to city gas suppliers and heating product-related sectors due to the recent 'heating bill bomb' issue.

Snow has accumulated on the gas meter in the gosiwon area of Dongja-dong, Yongsan-gu, Seoul. Photo by Yonhap News

Snow has accumulated on the gas meter in the gosiwon area of Dongja-dong, Yongsan-gu, Seoul. Photo by Yonhap News

In particular, Daesung Energy, which experienced the largest stock price increase, saw its stock price fluctuate between the high 8,000 won to low 9,000 won range at the beginning of the year, then surged to the 11,000 won level in one day on the 26th, hitting the daily price limit. The trading volume on that day alone was about 114.8 billion won, 90 times that of the previous day (1.27 billion won). However, when looking at Daesung Energy’s actual earnings, questions arise about the stock price surge. Daesung Energy’s annual operating profit decreased from 26.3 billion won in 2020 to 16 billion won in 2021, and only reached 9.6 billion won cumulatively by the third quarter of last year.

Just because heating costs have skyrocketed does not mean city gas companies’ earnings immediately increase. Domestic gas companies receive gas supplied exclusively by Korea Gas Corporation and distribute it to each region. Although retail heating costs are described as 'bomb-level,' the price of the raw material, liquefied natural gas (LNG), has soared to 'nuclear bomb-level.' International LNG prices have increased 4.5 times in the past year and more than 10 times compared to two years ago. Although the government has reluctantly raised heating costs, the increase falls far short of the rise in raw material costs, resulting in Korea Gas Corporation’s unpaid accounts for residential and general-use city gas raw materials reaching 9 trillion won.

Ultimately, even if retail heating prices rise, the wholesale price also increases to resolve Korea Gas Corporation’s unpaid accounts, so city gas companies’ profits do not increase. Hana Securities researcher Yoo Jae-sun pointed out, “The increase in residential-use rates by Korea Gas Corporation may slow the accumulation of unpaid accounts,” but added, “From the perspective of city gas retail operators, the wholesale price increase will act to increase sales without affecting operating performance.”

Meanwhile, the stock price of Korea Gas Corporation, the exclusive supplier of natural gas, has fallen 4.97% since the end of last year. Although the government has expressed its intention to resolve unpaid accounts through city gas price hikes in the second quarter, stock price forecasts are mixed. Shinhan Investment Corp. researcher Park Kwang-rae said, “With the rise in selling prices and rate bases, profit growth is expected to continue this year,” setting a target price of 59,000 won. Conversely, NH Investment & Securities researcher Lee Min-jae lowered the target price to 45,000 won, stating, “While unpaid accounts can be reduced when oil and natural gas prices fall, impairment losses may occur in overseas resource development, which is negative.”

The situation is not much different for Korea District Heating Corporation, whose stock price rose nearly 10% at the beginning of the year as a heating-related stock. Contrary to the optimistic stock price driven by heating cost issues, the corporation’s operating profit shrank from 13.3 billion won in 2020 to 4 billion won in 2021 and is estimated to have turned to a 37 billion won deficit last year. Although sales increased from 209.9 billion won in 2020 to 253.7 billion won in 2021 and 359.3 billion won in 2022, the surge in costs prevented profits. The market expects a deficit of about 22 billion won to continue this year. Since heat charges are linked to city gas residential-use rates, performance improvement is not expected in the near term. Shin Young Securities researcher Kwon Deok-min forecasted, “The cost burden has expanded due to the sharp rise in energy prices, and since this cannot be passed on to selling prices, deficits will continue.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.