Concerns Over Intensifying Competition for Securing Liquefied Natural Gas (LNG)

[Asia Economy Reporter Seo So-jeong] An analysis has emerged that if energy supply disruptions worsen in the future amid the deterioration of fiscal soundness in the European region due to COVID-19 and the energy crisis, fiscal vulnerability could significantly increase, especially in countries like Italy.

On the 29th, the Bank of Korea stated in its Overseas Economic Focus report titled "Current Status of Europe's Energy Crisis Response and Fiscal Soundness Assessment" that "Countries with higher gas dependency experience greater economic slowdown and increased fiscal demand due to energy supply disruptions, and particularly, highly indebted countries face a significant risk of heightened market concerns about fiscal soundness."

European Union (EU) countries implemented policies worth approximately 200 billion euros (1.2% of GDP) last year to mitigate the shock of soaring energy prices. These policies were characterized mainly by a high proportion of universal price policies, the introduction of windfall taxes, and indirect support at the EU level.

According to the report, the prevailing forecast for this year in the Eurozone is that the Ukraine crisis will continue and the current level of energy supply disruptions will persist. However, it is also possible that supply disruptions could worsen, causing gas prices to surge and rationing to be implemented.

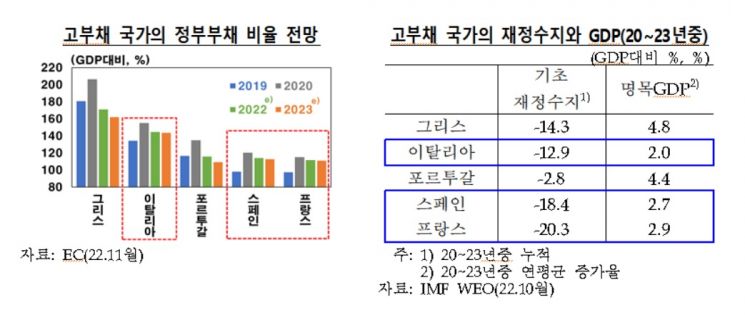

The European region's fiscal soundness has significantly deteriorated in response to the COVID shock and energy crisis. Although the Eurozone's fiscal deficit and government debt ratio (relative to GDP) somewhat improved recently after reaching record highs in 2020 (-7.0% and 97.0%, respectively), they still remain well above pre-pandemic levels. Last year, the response to the energy crisis contributed to an increase (+2.7 percentage points), maintaining a high fiscal expenditure growth rate (4.0%) that exceeds pre-pandemic levels.

By country, government debt ratios in highly indebted countries such as Italy, Spain, and France have risen considerably compared to pre-pandemic levels. In particular, excluding energy crisis response expenditures, the government spending growth rates last year in Italy and Spain were only about -0.5% and 0.5% year-on-year, respectively.

The Bank of Korea expects fiscal burdens in the European region to increase this year due to strengthened domestic tightening policies and economic sluggishness, and anticipates that fiscal soundness within the region will be significantly affected depending on the degree of future energy supply instability.

First, if energy supply disruptions continue at the current level and energy-related government spending does not expand beyond existing plans, fiscal soundness is expected to improve somewhat. Under this scenario, the government debt ratios of highly indebted countries such as Italy and Spain are projected to continue their downward trend since 2021.

However, if energy supply disruptions worsen and fiscal responses expand, fiscal vulnerability in the European region could significantly increase, especially in highly indebted countries with high gas dependency like Italy. Given that concerns about fiscal soundness in highly indebted countries remain substantial and demand for government bond refinancing is high, additional fiscal spending could exacerbate fiscal vulnerability and amplify market concerns.

Lee Hong-hoo and Choi Young-woo, researchers from the Bank of Korea’s US-Europe Economic Team, said, "If energy supply disruptions in the European region worsen and fiscal vulnerability increases, there is a possibility of negative spillover effects on South Korea’s real and financial economy through global energy and financial markets." They added, "With China’s economic recovery expected, if energy supply disruptions in Europe worsen, demand for liquefied natural gas (LNG) could further increase, intensifying competition for securing supplies and expanding price volatility." They emphasized, "During the European fiscal crisis, South Korea’s exports to Europe significantly declined, and substantial European funds flowed out of the domestic capital market, increasing financial market volatility. Therefore, it is necessary to pay close attention to related risks."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)