Profitable Turnaround in Front-end Business, Growth Expected Again This Year

Full Effort to Secure Profitability Through Cost Structure Improvement

"LGD OLED Business Expansion, a Help to Us"

[Asia Economy Reporters Kim Pyeonghwa and Moon Chaeseok] LG Electronics is focusing on its automotive components business, which turned profitable last year after 10 years of investment and now accounts for more than 10% of total sales. The company plans to increase its revenue and improve profitability by expanding its presence in emerging markets such as electric vehicles and enhancing its cost structure. In the TV business, LG aims to leverage the premium effect centered on organic light-emitting diode (OLED) technology. In the home appliances sector, efforts will focus on reducing various costs including logistics expenses and improving the cost structure.

Expanding Automotive Components Business with New Revenue Sources

On the 27th, following the announcement of last year’s results, LG Electronics expressed optimism about increasing profits in the VS Business Division, which handles the automotive components business, during a conference call. Despite uncertain market conditions such as declining automobile demand and a weakening dollar, the company expects business growth this year through existing and new orders.

The finished vehicle market contracted due to the spread of COVID-19 but has recently been recovering. The market expects finished vehicle production to increase by 3.5% this year compared to last year. LG Electronics has set a goal to achieve a growth rate in the automotive components business that exceeds that of finished vehicles. The plan is to increase profits by securing new revenue sources such as electric vehicles in addition to finished vehicles.

Kim Jooyong, LG Electronics VS Management Director, said, "With a surge in new orders in 2022, the VS Division recorded an order backlog of about 80 trillion KRW. This year, we expect the order backlog to continue growing through securing new orders, driven by growth in the electric vehicle market and the LG Magma joint venture."

Looking at LG Electronics’ automotive components order backlog from last year, infotainment products accounted for the mid-60% range of the total. Electric vehicle parts made up 20%, and automotive lamps accounted for the mid-10% range. LG plans to diversify its automotive components offerings and improve profitability. It will expand production capacity for electric vehicle drive components supplied to global automakers and improve the cost structure.

Focusing on OLED TVs... "Already Compliant with European Regulations"

LG Electronics aims to increase premium sales centered on OLED in its TV business (HE Business Division), which saw declines in both sales and operating profit last year. Lee Jeonghee, LG Electronics HE Management Director, explained, "We will drive performance growth through the world’s first wireless OLED launch and OLED Evo marketing," adding, "We plan to maintain the price premium of OLED compared to LCD." The company will also defend profitability by maintaining a healthy level of inventory.

Regarding LG Display, the panel supplier, ceasing its LCD business and recently undergoing restructuring, LG Electronics stated that the impact on the company is not significant. This is because LG Electronics has secured multiple panel suppliers besides LG Display, improving its supply chain. LG Electronics also suggested that LG Display’s focus on OLED production instead of LCD could help expand the ecosystem by ensuring stable OLED panel supply.

LG Electronics has also completed its response to European environmental regulations. It has finished developing all OLED and LCD TV models to comply with Europe’s power consumption standards and is preparing to launch these products. Since OLED products are inherently energy-efficient, LG Electronics explained that operating in the European market will not pose significant difficulties.

This Year’s CAPEX in the Mid-2 Trillion KRW Range

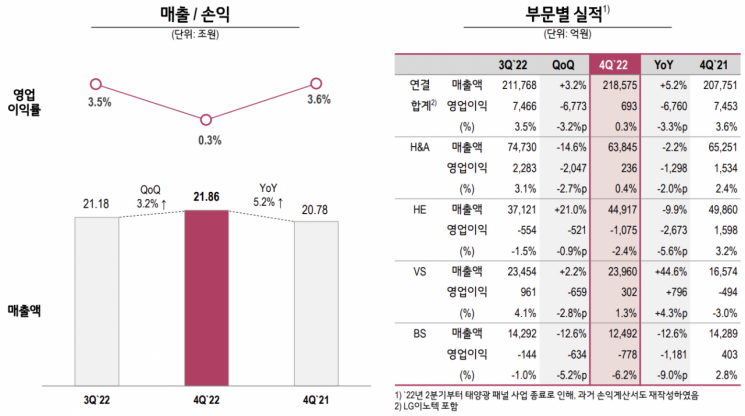

In the home appliances business (H&A Business Division), which experienced negative growth in the fourth quarter last year, LG plans to enhance the premium effect. Since logistics and raw material costs had dragged down operating profit, the company will focus on improving the cost structure. It expects significant cost reductions this year. The easing of logistics costs is anticipated to begin showing effects from the first quarter.

LG Electronics stated, "This year’s CAPEX (capital expenditure) is expected to be in the mid-2 trillion KRW range, similar to last year." It added, "We will invest in strengthening existing business capabilities, intelligent manufacturing innovation, discovering new businesses, and diversifying our portfolio," and explained, "We will minimize unnecessary investments to respond to economic downturns and global slowdowns, while securing financial soundness."

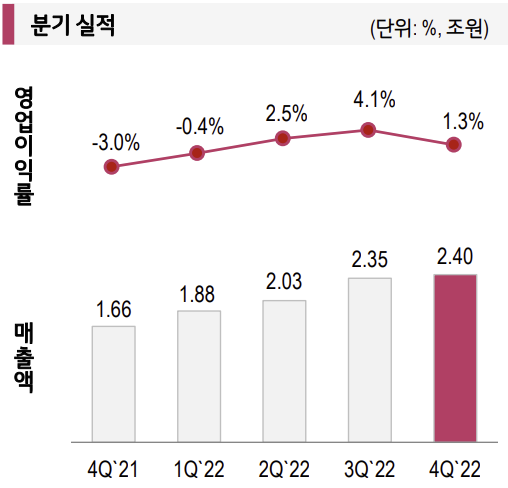

LG Electronics recorded consolidated sales of 83.4673 trillion KRW last year, a 12.9% increase from the previous year. For the first time ever, annual sales exceeded 80 trillion KRW. However, operating profit declined by 12.5% to 3.551 trillion KRW due to deteriorating profitability in the second half of last year. Operating profit in the fourth quarter fell sharply by 90.7% to 69.3 billion KRW.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.