[Asia Economy Reporter Ryu Tae-min] As the consecutive interest rate hikes deepen the decline in housing prices, the number of transactions sold at prices lower than the official appraisal price has surged.

The appearance of apartment complexes in Gangbuk areas such as Seongbuk-gu, Seoul.

The appearance of apartment complexes in Gangbuk areas such as Seongbuk-gu, Seoul. [Photo by Yonhap News]

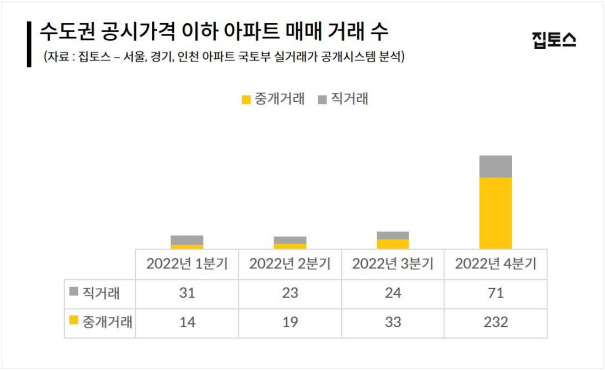

On the 28th, real estate brokerage firm Jiptos analyzed the apartment sales status in the metropolitan area through the Ministry of Land, Infrastructure and Transport's actual transaction price disclosure system. It was found that 303 transactions in the fourth quarter of last year were conducted below the minimum official appraisal price for the same area. This figure is more than five times the 57 apartment transactions below the official appraisal price in the third quarter of last year. Excluding 71 direct transactions such as gifts among the 303 cases, the total number of brokerage transactions reached 232.

There were also cases where the transaction price was more than 240 million KRW lower than the official appraisal price. A 101.83㎡ (exclusive area) apartment in Seohee Yungchang Apartment, Seocho-gu, Seoul, was brokered for 934.8 million KRW in December last year. This is 245.2 million KRW lower than the minimum official appraisal price of 1.18 billion KRW for the same area. In Gaepo Jugong 6 Complex, Gangnam-gu, an 83.21㎡ unit was brokered for 1.9 billion KRW in December last year, about 100 million KRW lower than the minimum official appraisal price of 2.08 billion KRW.

In the Gyeonggi and Incheon areas, actual transaction prices below the official appraisal price continued. A 121.82㎡ unit in Humansia Cheonggye Village, Uiwang-si, Gyeonggi, was brokered for 700 million KRW in December last year, nearly 200 million KRW lower than the minimum official appraisal price of 894 million KRW. An 84.97㎡ unit in Hillstate Lake Songdo 2nd Complex, Yeonsu-gu, Incheon, was also traded for 630 million KRW in November last year, 72 million KRW lower than the minimum official appraisal price.

The official appraisal price is the assessed price determined annually on January 1st through appraisal by the government for taxation purposes. It is used as a standard for 67 administrative systems including property tax, comprehensive real estate tax, health insurance premiums, and basic pension. When the official appraisal price realization rate decreases, the burden of holding tax is reduced.

Jin Tae-in, head of the apartment brokerage team at Jiptos, pointed out, "The official appraisal price is one of the important factors in appraisal when applying for jeonse loans or guarantee insurance. If the official appraisal price is higher than the actual transaction price, the loan or guarantee amount compared to the market price is increased, which can cause 'empty jeonse' or bad debts." He added, "Since the official appraisal price is used as the basis for calculating holding tax, if it is excessively high compared to the actual asset value, it can increase the burden on ordinary real demand buyers," emphasizing the need for downward adjustment of the official appraisal price.

On the 25th, the Ministry of Land, Infrastructure and Transport announced that the official appraisal prices for standard land and standard houses in 2023 were lowered by 5.92% and 5.95%, respectively, compared to the previous year. Experts expect that the official appraisal prices for multi-family housing, which will be available for viewing from March 17, will also fall by double digits, leading to holding taxes dropping below the 2020 level.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.