Stock Value Rises Uncommonly After Strong Earnings Announcement

Gains Over 5% in a Day

Acceleration of Electrification Transition Plans

Entering a Bullish Phase

Partial Treasury Stock Cancellation Also Effective

[Asia Economy reporters Choi Dae-yeol and Woo Su-yeon] On the 26th, when Hyundai Motor Company announced its business performance for the previous year, the company's stock price rose more than 5% compared to the day before. Institutional investors and foreigners net bought about 100 billion won. Including the gains on that day, Hyundai Motor's stock price has risen more than 16% since the beginning of the year, outperforming the KOSPI's increase rate of 11% during the same period.

Considering that the stock price rarely rose even after announcing good performance, this increase in stock value is seen as an unusual event in the market. On July 21 last year, when the company announced its largest half-year performance to date due to exchange rate effects, the stock price was 189,000 won, the same level as the day before.

Similarly, in the third quarter of last year, when the company posted solid results, the stock price closed at 161,500 won, down 3.3% on the day of the earnings announcement. Even about ten years ago, when overseas sales increased and the company achieved record-high performance at the time, the situation was similar. In 2011 and 2012, Hyundai recorded the highest sales and operating profit consecutively, but the stock price fell for three days immediately after the earnings announcements the following year, dropping about 7-8% compared to the day before the announcement.

The expectation of record-high performance drives the stock price up. However, it is common knowledge in the investment industry that the stock price falls when the company actually announces record-high results. Revealed good news is no longer good news. Past performance does not guarantee the future. Samsung Electronics, which had good performance early last year due to favorable market conditions, also saw its stock price decline or remain flat after releasing preliminary figures.

The market believes that Hyundai Motor's stock price is showing an unusual trend because the company's future value is being recognized as it accelerates its transition to electrification. Yoo Ji-woong, a researcher at Daol Investment & Securities, analyzed, "Operating profit exceeded market expectations, and the possibility of an increase for the full year is higher, indicating that the stock price has entered a strong phase." Song Seon-jae, a researcher at Hana Securities, said, "Despite negative variables such as exchange rate decline and increased incentives, stock price gains can occur as the company proves that sales volume is better than expected while controlling costs."

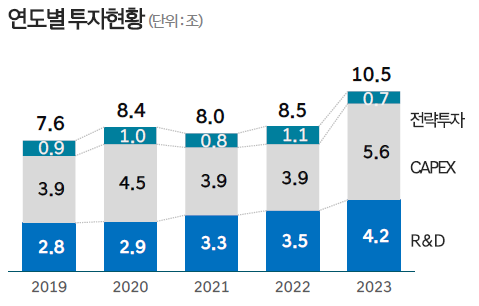

The company’s move to retire some treasury shares and increase dividends, among other measures to boost the stock price, proved effective. Additionally, having established itself as the world's third-largest automaker last year and accelerating its electrification transition plan, the company’s future value has been recognized. Despite anticipating a challenging market environment this year, the company announced an aggressive investment plan exceeding 10 trillion won, the largest annual investment ever. Given the upheaval in the global automotive industry, the company judged that failing to invest timely could lead to falling behind.

By investment sector, facilities and equipment investment increased by 1.7 trillion won from last year to 5.6 trillion won. This includes building a new electric vehicle-dedicated line at the domestic Ulsan plant and starting construction of a group-level electric vehicle-dedicated factory in the U.S. in the first quarter of this year. The funds will also be used to convert or improve equipment at existing domestic and overseas plants.

Research and development (R&D) investment also increased by 700 billion won from last year to 4.2 trillion won. The company believes that the importance of R&D has never been greater, focusing on technologies necessary for electrification transition such as batteries and electric vehicle platforms, as well as software-defined vehicle (SDV) development. Hyundai Motor Group Chairman Chung Eui-sun recently encouraged employees by saying, "Vehicle electronics are advancing rapidly; let's create products that are more meticulous and comprehensive than those of IT companies."

Despite the increased likelihood of demand slowdown worldwide due to inflation and interest rate hikes, the company set its sales target for this year at 4.32 million units, more than 10% higher than last year. Annual sales revenue is also expected to increase by more than 10%. In particular, the company plans to further increase the proportion of electric vehicles. Koo Ja-yong, Hyundai Motor's Executive Vice President in charge of IR, said, "The global electric vehicle sales target for this year is 330,000 units, a 54% increase from last year. We will ensure smooth supply of key models by region, optimize production, and increase the local production and procurement ratio of major parts in the U.S. and Europe."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.