National Pension 5th Financial Projection Preliminary Results

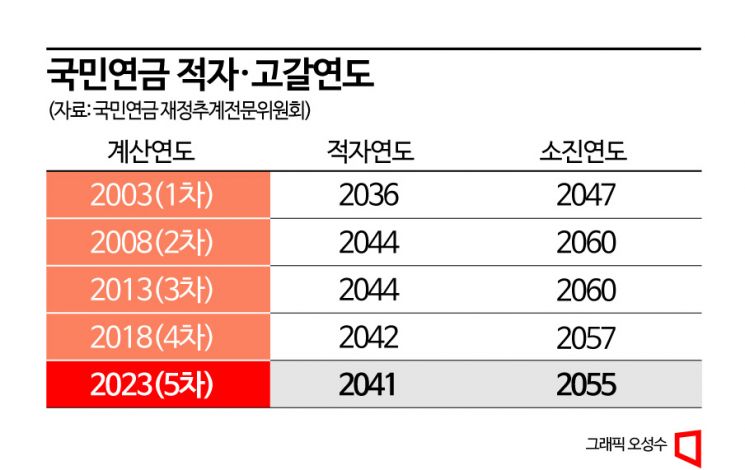

Deficit Year 42→41, Depletion Year 57→55

Severe Low Birthrate and Aging, Lack of Pension Reform as Causes

[Asia Economy Sejong=Reporter Song Seung-seop] Due to the rapid decline in birth rates and aging population, the deficit and depletion year of the National Pension Fund have come sooner. As pension reform is delayed, the insurance premium rate that citizens will have to bear in the future will rise from the current level of 9% to as high as the 30% range. Even if financial stabilization measures are implemented, the premium rate is expected to rise to the 20% range. The political sphere plans to announce a pension reform plan based on these results.

According to the preliminary results of the 5th financial projection announced by the National Pension Financial Projection Expert Committee on the 27th, the National Pension Fund will start running a deficit in 2041, one year earlier than the 4th calculation conducted in 2018. This means that the pension fund will reach its maximum size of 1,755 trillion won in 2040 and then gradually start to decrease. The deficit will continue to grow, and the National Pension Fund will be completely depleted by 2055. The depletion point has been moved up by two years from the previously expected 2057.

Deteriorating Demographics and Slowing Economic Growth... Increased Burden on the State and Citizens

The insurance premium rate that citizens must bear has increased by 1.66 to 1.84 percentage points compared to previous forecasts, now ranging from 17% to 24%. The committee calculates and presents the necessary premiums based on various financial targets; to maintain a reserve ratio of 1, premiums of 17.8% in 2025 and 20% in 2035 must be paid. The reserve ratio refers to the size of reserves relative to pension expenditures, with a ratio of 1 meaning the fund can pay pensions for one year without collecting premiums. If the reserve ratio is 5, premiums of 18.7% to 21.8% are required, and to avoid a deficit, premiums need to be between 19.5% and 22.5%.

The pay-as-you-go cost rate is expected to soar from the current 6% to 35% by 2078, an increase of more than 5 percentage points compared to the 4th calculation. The pay-as-you-go cost rate refers to the premium rate required to cover pension payments for the year solely with that year's premium income. Although the premium rate is expected to gradually decrease afterward, it is projected to remain in the 30% range. If the pension system operates solely on premiums without changing the payment structure, citizens will have to pay 30% of their monthly salary to the National Pension Fund starting 50 years from now.

Pension benefit expenditures relative to Gross Domestic Product (GDP) are expected to increase from 1.7% this year to the 9% range starting in 2070. This means that one-tenth of GDP will need to be spent on the National Pension Fund. This indicator is predicted to peak at 9.4% in 2080.

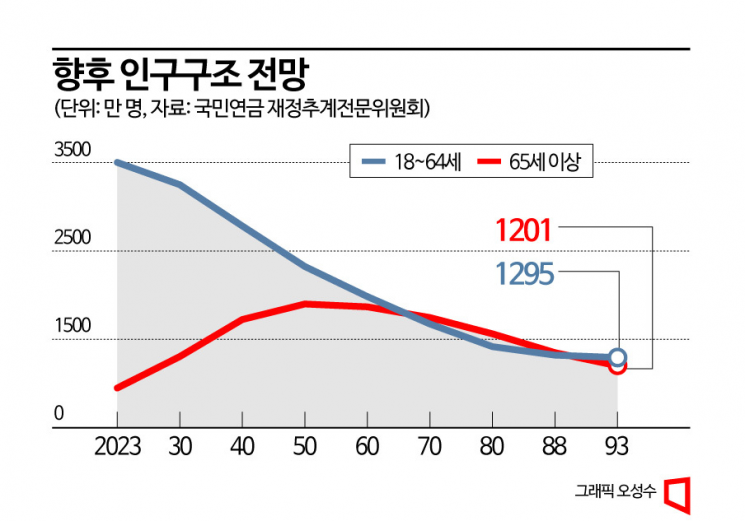

The earlier onset of pension deficits and depletion is due to the worsening domestic demographic outlook. The total population is projected to decrease from 51.56 million this year to 27.82 million by 2093. During this period, the population aged 18 to 64 will decline from 35.01 million to 12.95 million, while the elderly population aged 65 and over will increase from 9.5 million to 12.01 million. Around 2050, the elderly population alone will reach 19 million. The ratio of elderly population to the 18-64 age group will peak at 110.9% in 2081, up from the current 27.1%.

Accordingly, the number of contributors paying into the pension will sharply decrease from 21.99 million this year to 8.61 million in 2093. In contrast, the number of elderly pension recipients will surge from 5.27 million to 15.76 million in 2062 and remain at 10.3 million in 2093. The dependency ratio, which indicates the number of elderly pension recipients relative to contributors, is expected to reach 143.8% in 2078. This year, it is about 24%.

16 Years of Pension Reform Stalemate... "If the System Isn't Changed, Premiums Will Rise Further"

The committee pointed out that the delay in pension reform has led to higher premium rates. Lee Seuran, Director of the Pension Policy Bureau at the Ministry of Health and Welfare, explained, "The financial evaluation assumed all factors except premiums remain the same," adding, "As pension reform has been delayed, the required premium rate has increased compared to the 4th calculation." He emphasized, "If financial stabilization measures are not taken, premiums are expected to rise further."

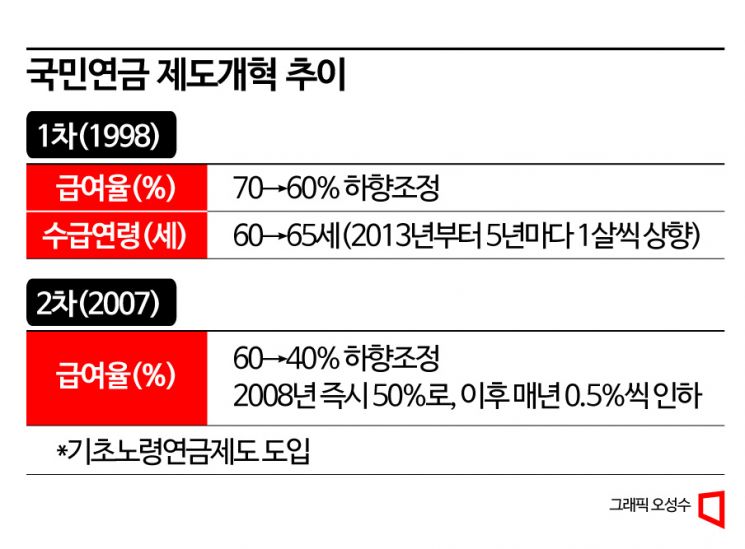

So far, the National Pension Fund has undergone institutional reforms only twice, in 1998 and 2007. By lowering the replacement rate from 70% to 40% and raising the pensionable age from 60 to 65, the deficit and depletion points of the National Pension Fund were delayed. However, since then, pension reform has not been implemented, and the depletion and deficit points have been brought forward again. Attempts to implement financial stabilization measures such as "an immediate premium increase to 11% with a 45% income replacement rate" or "a premium increase to 13.5% with 1.5 percentage points raised every five years and a 40% income replacement rate" have also failed.

The government is expected to accelerate pension reform discussions based on these results. The financial calculation, usually conducted every five years in March, was brought forward by two months this time as a measure to speed up reform. The National Assembly's Special Committee on Pension Reform's private advisory committee plans to release a reform proposal by the end of this month, and the special committee aims to prepare a draft based on the recommendations by April.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.