"Feeling Uneasy About Shared Prosperity"... Rising Interest in Immigration

Concerns Over Capital Outflow and Decline in Yuan Value

As China relaxes its previously strict COVID-19 prevention policies, inquiries about immigration from wealthy Chinese individuals are surging. There are even forecasts that Chinese capital outflows could lead to a decline in the value of the yuan.

Wealthy Chinese Dissatisfied with 'Common Prosperity'

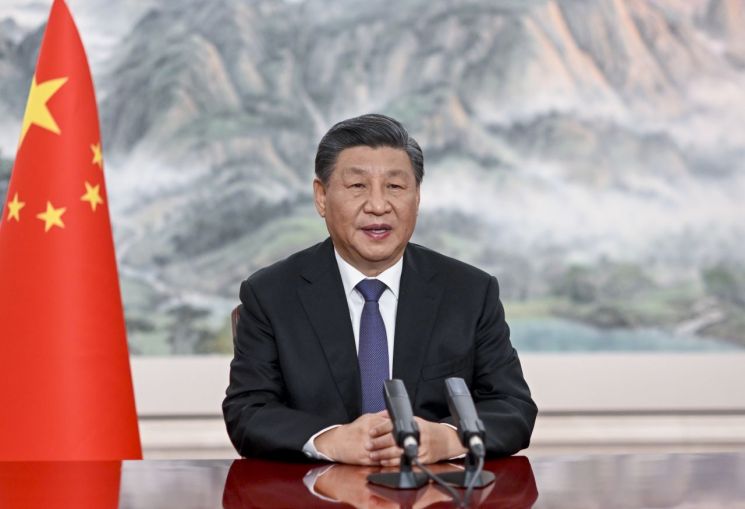

Chinese President Xi Jinping delivering a virtual congratulatory speech at the Biodiversity Conference on the 16th of last month.

Chinese President Xi Jinping delivering a virtual congratulatory speech at the Biodiversity Conference on the 16th of last month. [Photo by Yonhap News]

Bloomberg reported on the 25th (local time) that "after the Chinese government abandoned its 'zero COVID' policy at the end of last year, many wealthy Chinese began traveling abroad to look for real estate listings or finalize immigration plans." The outlet added that there are projections that over $150 billion (approximately 185 trillion won) of Chinese capital could flow overseas this year.

One speculation for the surge in overseas migration efforts by wealthy Chinese is dissatisfaction with the 'Common Prosperity' policy. Common Prosperity is a key initiative by President Xi Jinping promoting "prosperity for all," but wealthy Chinese have felt uneasy as crackdowns on the tech industry and education have intensified. Due to strict quarantine regulations, overseas travel was previously restricted, keeping many confined within China, but now those restrictions have been lifted.

Officials from international migration advisory firms stated that inquiries from Chinese individuals seeking overseas real estate and businesses have increased since December last year, when the zero COVID policy was lifted. Sobirovs, a Canadian immigration law firm, reported a surge in immigration consultation appointments, while overseas real estate brokerage IQI Juway noted that inquiries from Chinese buyers decreased by 26% in 2021 and 11% in 2022 but increased by 55% this year.

The interest of Chinese people in immigration is also reflected in numbers: on the 26th of last month, when China reopened its borders, the number of searches for "immigration" on the Chinese social networking service WeChat surged to approximately 110.7 million, about five times the previous day.

"Catching Wealthy Chinese"... Busy Financial Institutions

As overseas migration by Chinese increases, capital outflows accelerate as well. Alicia Garcia Herrero, chief economist at French investment bank Natixis, said, "Before the COVID-19 pandemic, annual capital outflows of about $150 billion (approximately 185 trillion won) occurred due to Chinese people going abroad," and predicted, "This year, the scale will be even larger due to overseas immigration demand." She analyzed that capital outflows would impact labor, productivity, and growth.

Financial institutions are also accelerating efforts to attract wealthy Chinese attempting to migrate overseas. JPMorgan Chase and Julius Baer Group have stationed Chinese-speaking staff in San Francisco, USA, and Zurich, Switzerland, respectively, to smoothly welcome wealthy Chinese seeking to relocate.

There is also analysis that increased demand for dollars due to overseas travel and immigration could put downward pressure on the yuan's value. Chen Zhu, a finance professor at the University of Hong Kong, forecasted, "If millions of Chinese travel abroad this year, China's foreign exchange reserves could decrease by tens of billions of dollars." He added, "Tourism outflows, which did not occur in the past three years due to COVID restrictions, could reach $100 billion to $200 billion (approximately 123 trillion to 246 trillion won) this year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.