President's Report to the Fair Trade Commission on the 26th

Reviewing 'Same Person' Designation for Foreign and Dual Nationals

[Asia Economy Reporter Eunju Lee, Sejong=Reporter Seungseop Song] The Fair Trade Commission (FTC) is re-pursuing a plan to designate 'black-haired foreigners' as the same person. This is because there are cases where individuals effectively operating like domestic companies are not regulated due to holding foreign nationality, and the number of third- and fourth-generation chaebols with foreign or dual nationality continues to increase. The criteria for large business groups will also be linked to the gross domestic product (GDP) instead of just total assets.

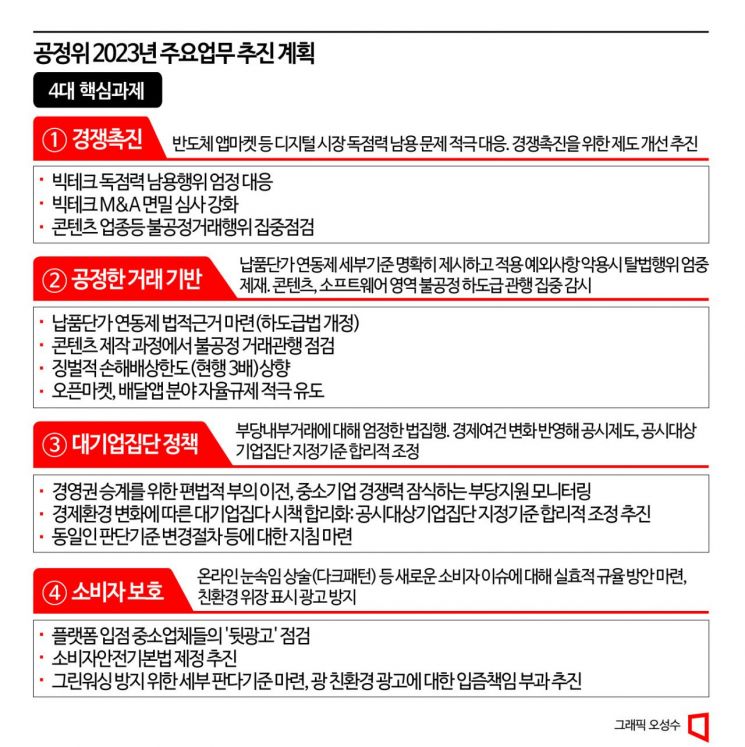

On the 26th, the FTC reported the 2023 major work plan containing these details to President Yoon Suk-yeol. Yoon Su-hyun, Vice Chairman of the FTC, explained, "There are quite a few cases where the spouse or second- or third-generation descendants of the same person are foreigners or dual nationals," adding, "It is not a critical issue if we do not proceed immediately, but it is not something that can be left unattended indefinitely, so we are preparing for it."

The term "same person" refers to one shareholder who is considered a natural person or a corporation under the Fair Trade Act. It was introduced in 1987 to prevent the sprawling management of chaebols and large corporations. Every May, when the FTC announces the same person, regardless of rank or ownership stake, that individual is regarded as the person who effectively controls the company. It is a kind of 'head' concept, and related regulations are also centered around the same person.

The FTC's intention to designate foreigners as the same person is to enhance predictability and efficiency. The current Fair Trade Act does not explicitly define the same person. In 2021, controversy arose when Kim Beom-seok, Chairman of Coupang's Board, was not designated as the same person. Although it was acknowledged that Kim effectively secured control over the company, criticism was raised that he avoided the same person regulations simply because he held U.S. nationality.

Disclosure Target Large Business Groups, From 5 Trillion KRW in Assets to GDP-Linked Method

To designate foreigners as the same person, the opposition opinions of the Ministry of Foreign Affairs and the Ministry of Trade, Industry and Energy must be overcome. The Ministry of Foreign Affairs opposed on the grounds of potential friction between countries, and the Ministry of Trade, Industry and Energy opposed due to concerns about FTA (Free Trade Agreement) provisions and foreign investment. If a foreigner is designated as the head of a large corporation, they would be subject to various reporting and data submission obligations and even regulations against private interest appropriation, raising concerns about complications in diplomatic and trade procedures.

Regarding this controversy, Vice Chairman Yoon acknowledged, "We implemented it through legislative notice but suspended it because consensus with related ministries was not reached, and we have been continuing consultations with the Ministry of Trade, Industry and Energy," adding, "It is difficult to say that the Ministry of Trade, Industry and Energy has agreed." He further explained, "The Ministry of Trade, Industry and Energy requests that the FTC proceed in a way that does not violate international norms."

Considering changes in the economic environment, the criteria for designating disclosure target business groups will also be adjusted. Since 2009, Korea has set the standard for disclosure target business groups at 'total assets of 5 trillion KRW or more.' This standard will be linked to GDP or the threshold amount itself will be raised. The reason is that the economy has grown and consistency with the criteria for mutually restricted investment business groups must be considered. The criteria for mutually restricted investment business groups will change from the current total asset size of 10 trillion KRW to 0.5% or more of the nominal GDP in 2024.

Along with this, the disclosure criteria for internal transactions will also be raised. The current disclosure target threshold is transactions of 5 billion KRW or more or 5% or more of capital. This will be changed to transactions of 10 billion KRW or more or 5% or more of capital (excluding transactions under 500 million KRW). The FTC explained, "This is to ensure that market monitoring can focus on large-scale transactions."

Group status disclosures will be reorganized by removing items with low information utility and rationally adjusting excessive disclosure frequencies. Of the 12 items that must be disclosed quarterly, 8 will be converted to annual disclosures.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)