Presidential Report to the Fair Trade Commission on the 26th

Review of Geumsan Separation Regulations... "Not a Regulatory Tightening"

Opposition from Opposition Parties, Labor Unions, and Civic Groups Mounts

[Asia Economy Sejong=Reporter Song Seung-seop] The Yoon Seok-yeol administration is beginning discussions to ease the ironclad regulation of Geumsan Separation. As the boundaries between industries have blurred, the need to adjust the barriers between financial capital and industrial capital has grown. However, there is still significant opposition to easing the regulations to a level that would have a broad impact, meaning there are many hurdles to overcome.

According to the presidential work report materials from the Fair Trade Commission on the 26th, the government plans to explore the medium- to long-term development directions of the Geumsan Separation system under the Fair Trade Act and the holding company system. Yoon Soo-hyun, Vice Chairman of the Fair Trade Commission, said, “We plan to discuss the Geumsan Separation regulation in a broad framework,” adding, “Since this is about medium- to long-term development directions, it is difficult to specify anything immediately, but it is not a direction toward strengthening regulations.” This is interpreted as an intention to review easing the Geumsan Separation regulations.

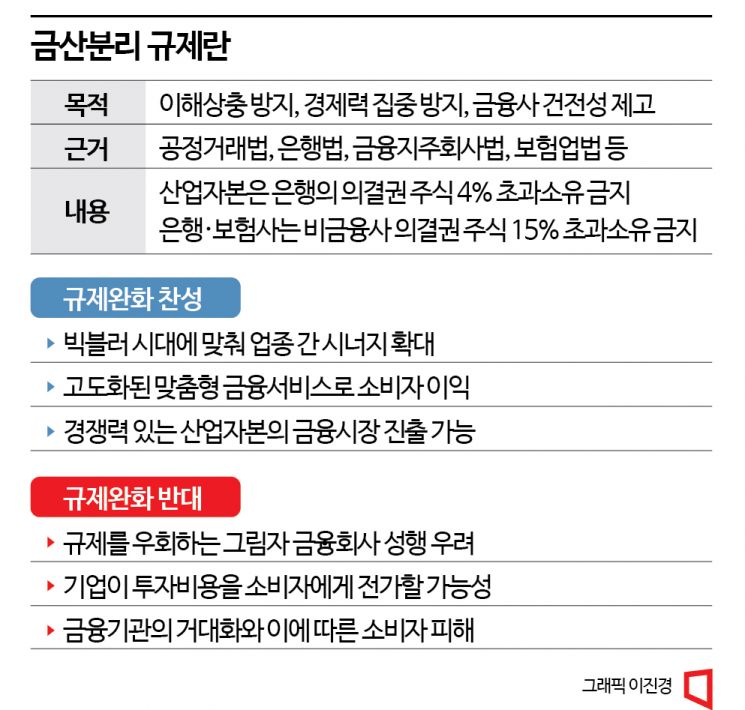

Geumsan Separation is the principle that financial capital and industrial capital should not own or control each other's industries. It was introduced to prevent banks from becoming the private vaults of large corporations or financial holding companies from funneling funds to their non-financial affiliates. In Korea, related regulations were established in 1982 when the Bank Act explicitly included provisions on Geumsan Separation. Currently, except for internet banks that receive special exemptions, industrial capital cannot hold more than 4% of financial capital shares in Korea.

Voices from the industrial and financial sectors have been strong, arguing that regulations should change as the environment rapidly evolves. They advocate easing Geumsan Separation regulations to promote industrial development and strengthen competitiveness. Accordingly, the Financial Services Commission held the 1st Financial Regulation Innovation Meeting in July and discussed easing Geumsan Separation as a key agenda. Mainly, they decided to expand the scope of non-financial subsidiaries allowed so that financial capital can engage in various businesses such as IT, real estate, software, and design.

The Fair Trade Commission is expected to focus on discussing ways for industrial capital to own financial capital in line with this. Since 2021, general companies have been allowed to own corporate venture capital (CVC) firms that are financial companies, and further loosening of related regulations is one of the representative easing policies. Vice Chairman Yoon explained, “The easing of Geumsan Separation regulations promoted by the Financial Services Commission is somewhat different from that of the Fair Trade Commission,” adding, “General holding companies cannot own accelerators (startup incubators), but we are pushing to include these under CVC as well.”

Will Opposition to Easing Geumsan Separation Regulations Be Overcome?

An accelerator refers to a comprehensive incubation service company that discovers early-stage startups and provides investment along with business space and mentoring. If this regulation is eased, large corporations with abundant financial resources could have accelerators as affiliates and provide multifaceted growth support measures to startups.

The holding company system has also been brought to the discussion table. Kim Jeong-gi, Director of the Corporate Group Bureau, explained, “The holding company system was introduced during the IMF crisis and has had various ups and downs, but it has been in operation for 25 years, which is too long,” adding, “We will review changes and operational status of holding companies and discuss how to proceed in the medium to long term.”

The problem is the opposition. The principle of Geumsan Separation is one of the most contentious issues among domestic regulations. The opposition parties, labor unions, and consumer civic groups argue that easing Geumsan Separation regulations will only increase side effects. Representative concerns include companies passing increased investment costs onto consumers or the proliferation of 'shadow banking' that operates similar financial businesses but is not properly regulated. There are also criticisms that the emergence of massive industrial and financial capital will undermine economic and financial soundness.

There has been a case where Geumsan Separation regulations were eased despite opposition but then reversed. Former President Lee Myung-bak allowed industrial capital to hold up to 9% of voting shares in financial capital in 2009. However, amid the wave of economic democratization, the National Assembly passed the 'Strengthening Geumsan Separation Act' in 2013, reducing the holding limit back to 4%, nullifying the change within four years.

The stance of rejecting the easing trend of Geumsan Separation has already been made clear. Park Han-jin, Secretary General of the Financial Labor Union, stated last month at the Bank Hall in Jung-gu, Seoul, “We have set the response to the government’s easing of Geumsan Separation as a major struggle direction for the Financial Labor Union in 2023,” adding, “One of the ten core pledges in the upcoming Financial Labor Union executive election scheduled for March 2, 2023, is to uphold the principle of Geumsan Separation.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)