Breakthrough with High Value-Added Products in the Battlefield Sector

[Asia Economy Reporter Park Sun-mi] LG Innotek and Samsung Electro-Mechanics announced their dismal fourth-quarter results last year due to weak demand for IT devices such as TVs, PCs, and smartphones. The parts industry expects difficult conditions to continue this year and plans to find a breakthrough with high value-added products in the automotive electronics sector.

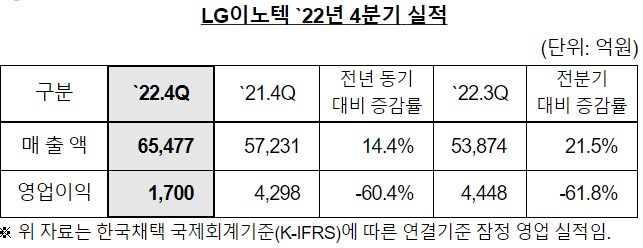

LG Innotek recorded sales of 6.5477 trillion KRW and an operating profit of 170 billion KRW in the fourth quarter of last year. Sales increased by 14.4% compared to the previous year, but operating profit decreased by 60.4%. The fourth quarter of last year was a period when China implemented lockdown measures to prevent the spread of COVID-19. Profitability worsened due to multiple adverse factors including production disruptions in key supply chains, weak IT demand for TVs, PCs, and smartphones caused by the global economic slowdown, and a decline in the KRW-USD exchange rate.

In particular, the printed circuit board materials business recorded sales of 391.5 billion KRW, down 8% from the same period last year. Sales declined due to weak IT demand and year-end inventory adjustments by customers. Generally, when demand in the downstream industry weakens, customers prioritize using existing inventory and do not place new orders for parts. From the supplier’s perspective, orders decrease and parts sales decline.

Although the fourth-quarter results were poor, thanks to strong performance in the first half, LG Innotek was able to achieve a record high for the full year 2022. Annual sales reached 19.5894 trillion KRW, and operating profit was 1.2718 trillion KRW.

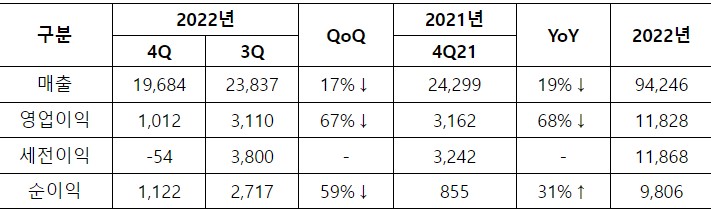

Samsung Electro-Mechanics also posted poor results last year due to weak IT demand for PCs and smartphones. On a consolidated basis, operating profit for the fourth quarter of last year was 101.2 billion KRW, down 68% compared to the same period last year. Sales for the same period were 1.9684 trillion KRW, down 19%. The sharp decline in the IT MLCC (multilayer ceramic capacitor) business, which is highly dependent on China, had a significant impact. The component division, which includes Samsung Electro-Mechanics’ core product MLCC, recorded fourth-quarter sales of 833.1 billion KRW, down 29% from a year earlier. Due to higher dependence on China than other divisions, it was hit hard by the decline in IT device demand within China. The optical communication solutions division recorded sales of 655.5 billion KRW, down 16% from the same period last year. Supply of automotive camera modules increased, but supply of IT camera modules decreased.

With performance improvement uncertain this year, the parts industry plans to focus on developing relatively resilient business sectors such as automotive electronics and servers.

In its earnings conference call, Samsung Electro-Mechanics stated, "Although the launch of new flagship smartphones by strategic customers in the first quarter of this year will have some effect, sales are not expected to improve significantly compared to the previous quarter due to weak demand for IT devices and delayed inventory adjustments by customers." However, it emphasized, "Promising related sectors such as automotive electronics and servers will maintain steady growth proactively. We will strive to pioneer growth markets and expand efforts to discover new customers and businesses for automotive MLCCs, automotive camera modules, and server package substrates."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.