Ministry of Economy and Finance Announces 'Real Estate Tax System Improvement Measures'

[Asia Economy Sejong=Reporter Lee Jun-hyung] The comprehensive real estate tax for public housing developers such as Korea Land and Housing Corporation (LH) will be significantly reduced. This comes as the government has decided to lower tax rates to ease the comprehensive real estate tax burden on public housing developers. The disposal deadline for 1-household 1-home owners living in replacement housing due to reconstruction, etc., to receive capital gains tax exemption special cases will be extended from the existing 2 years to 3 years.

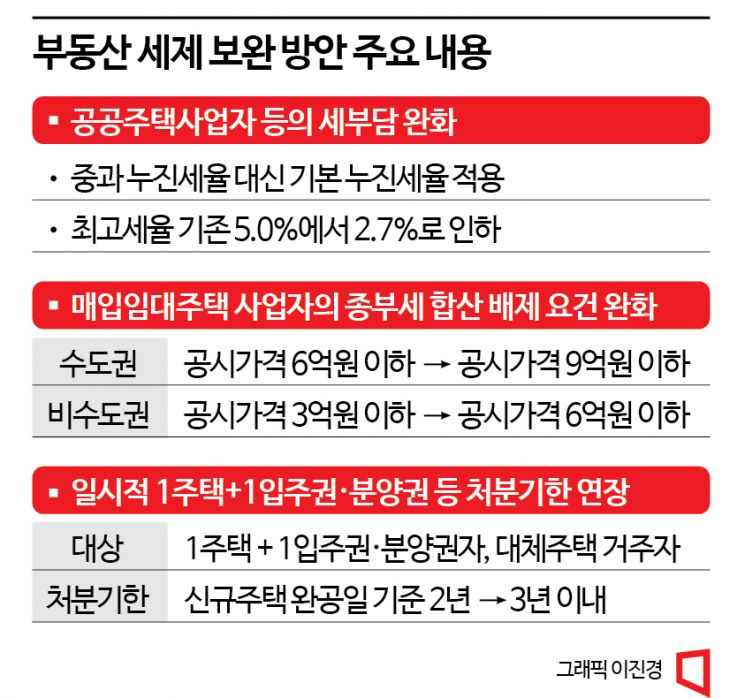

According to the Ministry of Economy and Finance on the 26th, the government decided to promote the 'Real Estate Tax System Supplementary Measures' at the Emergency Economic Ministers' Meeting held at the Seoul Government Complex on the morning of the same day. The core of the measures discussed that day is to ease the comprehensive real estate tax burden on public housing developers such as LH and Seoul Housing Corporation (SH). The Ministry of Economy and Finance first decided to apply the basic progressive tax rate (0.5~2.7%) instead of the heavy progressive tax rate (0.5~5.0%) even when public housing developers hold three or more houses. The applicable targets include eight entities such as public housing developers, public interest corporations, redevelopment and reconstruction project implementers, and social enterprises.

That is not all. The Ministry of Economy and Finance also decided to apply comprehensive real estate tax aggregation exclusion for up to 2 years from the date of sale conversion implementation when public rental housing that public housing developers intend to convert to sale after the rental period ends remains unsold. The comprehensive real estate tax aggregation exclusion amount requirement for purchase rental housing developers who rent houses for more than 15 years will also be relaxed. Accordingly, in the metropolitan area, the official price requirement will rise from the existing 600 million KRW or less to 900 million KRW or less. In non-metropolitan areas, it will increase from the existing 300 million KRW or less to 600 million KRW or less.

Top Tax Rate 5.0% → 2.7%

The Ministry of Economy and Finance prepared these measures based on the judgment that the excessive tax burden on public housing developers could lead to housing instability for ordinary citizens. It explained that the comprehensive real estate tax burden on public housing developers such as LH could be passed on to tenants through rent increases. A Ministry of Economy and Finance official said, "Recently, the burden of monthly rent has increased the hardship of ordinary citizens, making the active role of public housing developers supplying public housing more important," adding, "(However) the comprehensive real estate tax burden on public housing developers has not normalized because the heavy tax system for multiple homeowners was partially maintained in last year's regular National Assembly."

This is why the Ministry of Economy and Finance proposed easing the comprehensive real estate tax despite concerns about reduced tax revenue. According to the Ministry, applying the basic progressive tax rate instead of the heavy progressive tax rate to public housing developers and others is expected to reduce tax revenue by more than 40 billion KRW annually. This is the result of the top comprehensive real estate tax rate for public housing developers dropping nearly by half from the existing 5.0% to 2.7%. The Ministry plans to push for amendments to the Comprehensive Real Estate Tax Act focusing on lowering tax rates for public housing developers through a special session of the National Assembly next month.

Effectiveness for Tenants is 'Questionable'

The key issue is the effectiveness perceived by tenants. The original rationale for the Ministry of Economy and Finance to reduce the comprehensive real estate tax burden on public housing developers such as LH lies in 'housing stability for ordinary citizens.' The government expects that as it collects less tax from public housing developers, the burden on tenants should also decrease.

However, the Ministry of Economy and Finance has not presented a clear stance. Jo Man-hee, Director of Property and Consumption Tax Policy at the Ministry, said at a pre-briefing on the 25th, "If LH, SH, etc., supply public housing at a loss, sustainability is impossible," adding, "(However) the reduction of tenant burden cannot be legally enforced through tax law." He also added, "Related ministries such as the Ministry of Land, Infrastructure and Transport may provide administrative guidance."

Meanwhile, through this measure, the Ministry of Economy and Finance also plans to expand the scope of capital gains tax exemption special cases. Specifically, for a single homeowner who temporarily acquires one move-in or pre-sale right, the disposal deadline for applying the capital gains tax exemption special case will be extended from within 2 years to within 3 years from the completion date of the new house. The disposal deadline for capital gains tax exemption special cases for replacement housing due to reconstruction and redevelopment will also be extended from within 2 years to within 3 years from the completion date of the new house.

The Ministry of Economy and Finance stated, "This measure takes into account the recent sluggish housing transactions, which have made it difficult for actual demanders to dispose of their previous homes," and added, "We will push for amendments to the Enforcement Decree of the Income Tax Act next month to allow retroactive application from those who transfer after the 12th of this month."

View of Gyeonggi Gwangmyeong Korea Land and Housing Corporation (LH) Gwangmyeong Siheung Project Headquarters. [Image source=Yonhap News]

View of Gyeonggi Gwangmyeong Korea Land and Housing Corporation (LH) Gwangmyeong Siheung Project Headquarters. [Image source=Yonhap News]

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)