Major Countries Embarking on Self-Help Survival

Lee Chang-yong, Governor of the Bank of Korea, is delivering opening remarks at a press briefing held by the Foreign Correspondents' Club on the afternoon of the 18th at the Press Center in Taepyeong-ro, Jung-gu, Seoul. Photo by Joint Press Corps

Lee Chang-yong, Governor of the Bank of Korea, is delivering opening remarks at a press briefing held by the Foreign Correspondents' Club on the afternoon of the 18th at the Press Center in Taepyeong-ro, Jung-gu, Seoul. Photo by Joint Press Corps

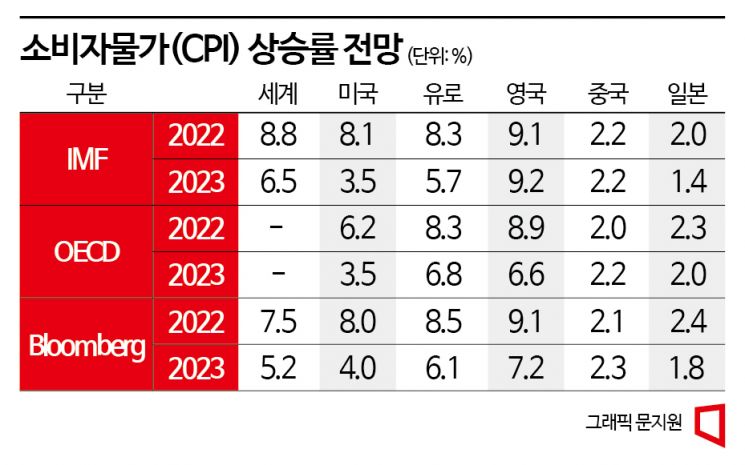

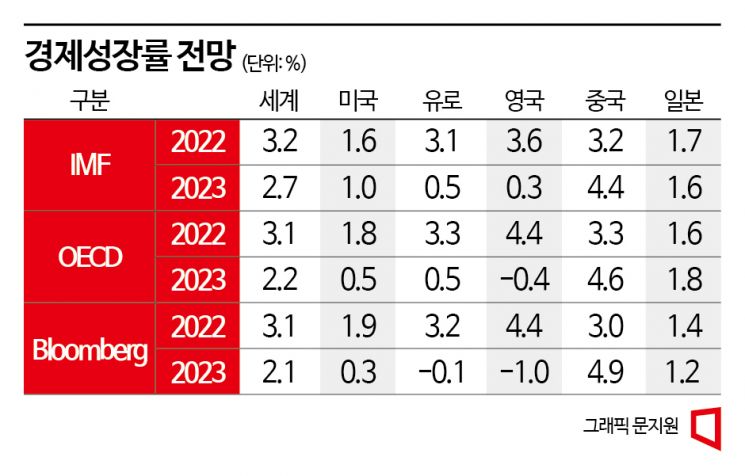

[Asia Economy reporters Seo So-jung and Moon Je-won] As a global economic recession is expected to intensify this year, major central banks operating monetary policies are facing deep concerns. Although the tightening stance of each central bank is maintained following the U.S. Federal Reserve's (Fed) successive base rate hikes, the presence of different variables by country requires a delicate balancing act between the economy and inflation. With the prolonged Russia-Ukraine war and ongoing economic uncertainty due to volatility in energy prices such as international oil, factors beyond inflation?such as China's reopening (resumption of economic activities), employment, and weather?are emerging, making the calculations of each central bank even more complex.

Laughing and Crying with China's Economy... Bank of Korea's Utmost Concern

According to the Bank of Korea (BOK) on the 26th, the growth trajectory of the Korean economy this year is expected to be largely influenced by the speed of economic recovery in China, which has a high export dependency. The reason for focusing on the ripple effects on the domestic economy is that China's reopening has been progressing faster than expected recently. China's reopening positively impacts Korea's growth primarily through the recovery of exports to China and the expansion of domestic travel by Chinese tourists, but on a global scale, it is likely to increase inflationary pressures and exacerbate Europe's energy problems. If raw material prices rise, the pace of slowdown in the domestic consumer price inflation rate may also decelerate.

At a press briefing with the Seoul Foreign Correspondents' Club on the 18th, BOK Governor Lee Chang-yong cited the possibility of China's economic normalization as one of three hopeful factors this year, while also expressing concerns. Governor Lee said, "If China's economic recovery accelerates, there is a risk of pushing up oil prices, and localized political conflicts could worsen, impacting exports." Especially, if China's economic retaliation intensifies due to U.S.-China tensions, the decline in exports could become even more significant. Furthermore, while consumption is expected to rebound strongly with China's reopening and production and logistics disruptions are resolved, leading to gradual recovery in the manufacturing sector, if China's economy reopens with a greater focus on domestic services, it may partially limit the impact on Korean exports.

Kim Woong, Director of the BOK's Research Department, recently wrote on a blog, "The future growth trajectory of our economy will mainly be influenced by the speed of China's economic recovery, the degree of economic slowdown in the U.S. and Europe, and the recovery trend in domestic consumption." He added, "Although China's economy is expected to normalize rapidly from the second quarter, downside risks such as variant outbreaks and delayed real estate market recovery remain." The BOK forecasts that if economic activities gradually normalize after China's reopening, China's growth rate this year will be in the mid-4% range. However, due to uncertainties related to the timing of normalization and the behavior of economic agents, the growth rate could range from the high 3% range to the mid-5% range depending on the situation.

Employment in the U.S., Energy in Europe Are Key Variables in Monetary Policy

In the U.S., the labor market is emerging as a key variable in monetary policy. Although the pace of monetary tightening is being adjusted as inflationary pressures ease somewhat, the tight labor market situation continues, creating significant uncertainty regarding the Fed's terminal interest rate level and its duration. Currently, the U.S. labor market is unusually hot. According to the employment situation report released earlier this month, nonfarm payrolls increased by 223,000 in December last year. The unemployment rate fell by 0.1 percentage points from 3.6% in the previous month to 3.5%, marking the lowest level since the late 1960s. Despite the low unemployment rate, labor supply has decreased, causing ongoing labor shortages. With private employment indicators showing strength, concerns are rising that the Fed's monetary tightening will inevitably continue.

Yang Seok-jun, Head of Foreign Exchange Operations at the BOK, predicted, "The Fed will raise the policy rate further in the first half of this year, pushing the terminal policy rate above 5%. Afterwards, it will maintain a restrictive monetary policy stance until inflation stabilizes and keep the policy rate steady until the end of this year." Lee Hyun-ho, Investment Operations Department Head at the BOK's Foreign Exchange Operations, assessed, "As the U.S. labor market experiences some easing of demand-supply mismatches due to reduced labor demand amid global economic slowdown, the unemployment rate is expected to rise to the mid-4% range by the end of this year. However, if high inflation persists for a long time, the Fed's terminal rate may rise, leading to higher unemployment."

The European Central Bank (ECB) has seen inflation slow somewhat recently due to warm weather, but uncertainties remain large due to the Ukraine war and China's economic recovery, so concerns over rate hikes are expected to continue. According to Eurostat, the statistical office of the European Union (EU), the Eurozone's consumer price index (CPI) rose 9.2% year-on-year in December last year, marking a decline in the rate of increase for two consecutive months. This was influenced by warmer-than-expected weather reducing heating demand, causing the energy price increase rate to slow from 41.5% in October last year to 25.7%. With inflation easing and the Eurozone's economic growth expected to deteriorate significantly this year, it is not easy for the ECB to raise interest rates. The ECB has already raised its base rate by 2.5 percentage points over four times since July last year, imposing considerable economic burdens.

However, excluding energy, the inflation rate for food, alcohol, and tobacco remains high at 13.8%, continuing to rise compared to the previous month, leading many to argue that a tighter monetary policy is still necessary to stabilize prices. If the Ukraine war prolongs and the European energy crisis, including natural gas, spreads further, or if China's economic recovery pushes international oil prices up again, inflation in Europe could surge further. During China's COVID lockdowns, it was easier to secure energy sources replacing Russian supplies, but with China's demand expected to rise significantly, this will become more difficult.

Currently, the 9.2% inflation rate is still excessively high compared to the ECB's inflation target of 2%. ECB President Christine Lagarde recently stated at the World Economic Forum in Davos, Switzerland, "Inflation remains high," and "We will maintain our current path." NH Investment & Securities forecasted in a report that "the ECB is expected to raise the base rate by 0.5 percentage points at each monetary policy meeting until March."

Japan's Key Issue: Whether to Shift to a More Accommodative Monetary Policy

The Bank of Japan (BOJ) is also facing significant concerns over whether and when to shift to a more accommodative monetary policy this year. Since 2013, during former Prime Minister Shinzo Abe's administration, the BOJ has pursued ultra-low interest rates and large-scale monetary easing to stimulate the economy, but recently, side effects from excessive yen depreciation have emerged, making it difficult to maintain this stance. The BOJ implements a yield curve control (YCC) policy by purchasing unlimited government bonds to keep the 10-year government bond yield near 0%, which requires enormous government funds. This month, when the 10-year government bond yield exceeded the upper limit of 0.5%, the BOJ reportedly purchased trillions of yen worth of bonds.

However, such excessive intervention by the BOJ has distorted the bond market, causing the 10-year government bond yield to lose its function as an economic indicator, and some corporate bond issuances have been canceled, hindering capital procurement. Particularly, the excessive yen depreciation has raised import prices, pushing Japan's consumer price inflation to its highest level in 41 years, and last year's trade deficit exceeded 19 trillion yen, increasing economic burdens. Consequently, the market expects the BOJ to raise the 10-year government bond yield cap further from 0.5% to 0.75% following last month's increase from 0.25% to 0.5%. Some even speculate about the possible abolition of the YCC policy.

With BOJ Governor Kuroda Haruhiko scheduled to retire in April, a policy shift is likely thereafter. However, with Japan's government bond balance exceeding 1,000 trillion yen, it is not easy to raise rates hastily. It is analyzed that a 1 percentage point increase in Japan's interest rates would raise government bond interest costs by a staggering 6.6 trillion yen by 2025. A BOK official said, "Even if the BOJ changes its policy, it is unlikely to lead to a sudden tightening or abandonment of bond purchases." Lee Ji-pyung, a special professor at Hankuk University of Foreign Studies, explained, "Due to strong selling pressure from investors on government bonds, the BOJ will inevitably have to raise interest rates to some extent."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)