Transaction of LG Energy Solution Employee Stock Ownership on the 30th

3.39% of Total Issued Shares... About 23% of Circulating Shares

[Asia Economy Reporter Kwon Jaehee] Amid concerns such as economic recession, Tesla-driven electric vehicle demand slowdown, and increased distribution volume, LG Energy Solution's stock price has declined, and employee stock ownership plan (ESOP) shares will be released at the end of this month. It is expected that the stock price will fluctuate once again ahead of the lock-up release. Currently, LG Energy Solution's stock price is about 50% higher than the initial public offering (IPO) price. Those holding ESOP shares face a complex decision whether to sell immediately for profit-taking or to hold on believing in future value.

According to the Korea Exchange, on the 19th, LG Energy Solution closed at 456,000 KRW. This is about a 27% decrease compared to last year's peak price of 624,000 KRW (closing price on November 11, 2022), but approximately 50% higher than the IPO price of 300,000 KRW.

LG Energy Solution will mark its first anniversary of listing on the 27th, right after the Lunar New Year holiday. Accordingly, shares held by the ESOP will be tradable starting from the 28th; however, since the 28th is a market holiday (Saturday), actual trading will begin on the 30th.

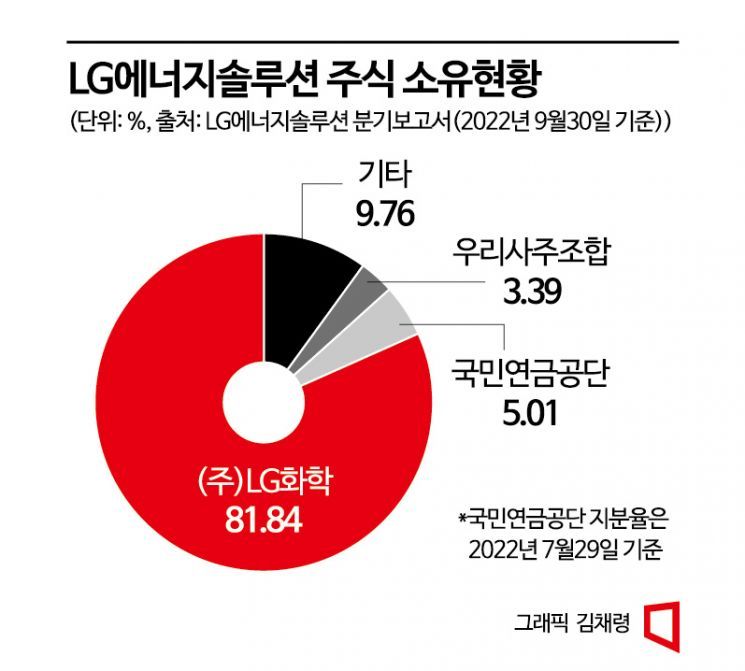

At the time of LG Energy Solution's listing, a total of 8.5 million shares were allocated to the ESOP, with a final subscription competition rate of 0.95 to 1. The ESOP shares amount to 7.925 million shares, representing 3.39% of the total issued shares. Additionally, LG Chem holds 81.84%, and the National Pension Service holds 5.01% of LG Energy Solution shares. Considering that the actual circulating shares account for 13.15% of the total shares, about 23% of the circulating shares will be released into the market.

In the market, it is expected that not all of LG Energy Solution's lock-up shares will be released, but since the current stock price is about 50% higher than the IPO price, many shareholders with profit-taking intentions are anticipated. Considering that employees could be allocated between 100 million KRW to 400 million KRW worth of shares depending on their years of service at the time of the IPO, shareholders holding shares up to the 400 million KRW limit could realize an evaluation gain exceeding 200 million KRW.

However, some believe that since LG Energy Solution's future value is significant, the stock price will rise further, and not many shares will be released. According to financial information provider FnGuide, the target stock prices from seven securities firms that issued LG Energy Solution reports this year range from 600,000 KRW to 718,000 KRW. The securities industry sees potential for additional price increases.

Researcher Anna Lee from Yuanta Securities set the target price for LG Energy Solution at 718,000 KRW. Researcher Lee stated, "This year, with the full-scale mass production in the U.S., LG Energy Solution's external growth will be substantial," and added, "The stock price will rebound significantly after the ESOP overhang issue is resolved on the 30th."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.