Number of Domestic Golf Courses to Decline from 2027

Due to Changed Golf Course Classification System and Strict Permits

Seoul Metropolitan Area Share Expected to Rise, Busan and Gyeongnam Areas to Decrease

As the number of domestic golf courses enters a 'stagnation period,' an analysis has emerged that the proportion occupied by the Seoul metropolitan area will decrease while the proportion occupied by the Busan-Gyeongnam region will increase. This is because the number of golf courses in the Seoul metropolitan area has reached saturation, whereas the Busan-Gyeongnam region has relatively more available space and can operate year-round.

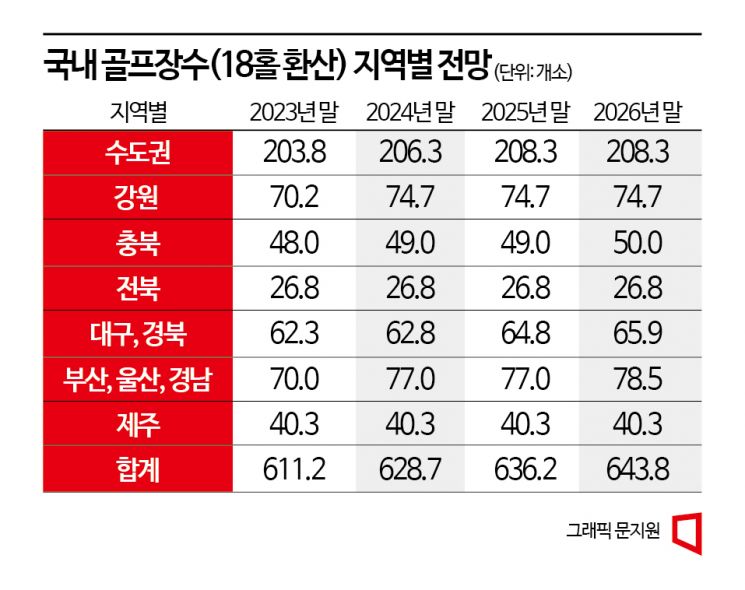

According to the 'Leisure White Paper' published on the 23rd by the Korea Leisure Industry Research Institute, the number of domestic golf courses is expected to steadily increase until the end of 2026, thanks to the COVID-19 boom. The number of operating golf courses (converted to 18 holes, including military golf courses) is projected to rise from 573 at the end of 2021 to 611.2 at the end of 2023, and to 643.8 by the end of 2026. This represents an increase of 70.8 courses (12.4%) over five years. However, this growth trend is expected to sharply decline starting in 2027.

First, the new golf course classification system is likely to have a significant impact. In November last year, the government announced through the administrative notice 'Notice on Designation of Public Golf Courses' as part of the revised Enforcement Decree of the Sports Promotion Act that to be classified as a public golf course, the admission fee must be 34,000 KRW lower than the non-member price of member golf courses. To continue receiving tax benefits as a public golf course, operators must lower green fees to the government-notified level or change to a non-member golf course, which would require bearing a higher property tax rate than before (land 0.2~0.4%, buildings 0.25%). Accordingly, non-member golf courses are expected to see reduced profitability due to diminished tax benefits. Additionally, public golf courses will also experience decreased profitability as they lower admission fees.

The difficulty in securing land due to strict licensing requirements has also played a role. According to current regulations, private sports facilities such as golf courses and ski resorts cannot proceed with projects unless 100% of the land is secured. Considering that constructing an 18-hole golf course requires a large-scale land area of over 300,000 pyeong (approximately 991,735 square meters) in mountainous terrain, meeting licensing requirements is extremely challenging. Industry insiders explain that there are many cases where projects cannot start because the remaining 5% of land is not secured despite having purchased 95% of the site.

While the number of new golf courses is decreasing, the 'Seoul metropolitan area concentration' phenomenon of golf courses is expected to ease. By region, the number of golf courses in the Seoul metropolitan area is projected to increase by 11, from 197.3 at the end of 2021 to 208.3 at the end of 2026, whereas the Busan-Gyeongnam region is expected to increase by 15.5, from 63 at the end of 2021 to 78.5 at the end of 2026, the largest increase among all regions.

Accordingly, the proportion of golf courses in the Seoul metropolitan area will decrease by about 2%, from 34.4% at the end of 2021 to 32.4% at the end of 2026, while the proportion of golf courses in the Busan-Gyeongnam region will slightly rise from 11% at the end of 2021 to 12.2% at the end of 2026.

Seo Cheonbeom, director, said, "Due to the decline in profitability of public golf courses and stringent licensing requirements, the growth in the number of domestic golf courses is likely to slow down starting in 2027." However, he added, "Based on the geographical advantage of a rich golf population and the ability to operate year-round, the number of golf courses in the Busan-Gyeongnam region will show the largest increase."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)