OECD Forecast Released

WSJ "US, Slow Congressional Approval... Outlook Gloomy"

[Asia Economy Reporter Haeyoung Kwon] The Organisation for Economic Co-operation and Development (OECD) has projected that the implementation of the global minimum tax, scheduled for next year, will increase global tax revenues by $220 billion annually (approximately 272 trillion KRW). This figure exceeds previous estimates. While South Korea has begun amending related laws in response to the OECD's urgent call for swift action to implement the minimum tax, countries with many multinational corporations such as the United States and the European Union (EU) are hesitating, casting doubt on whether the system will be implemented as originally promised in January next year.

On the 18th (local time), the OECD released a report analyzing the economic impact of the digital tax agreement, stating that "tax revenues resulting from the reform of the global tax system are higher than initially expected."

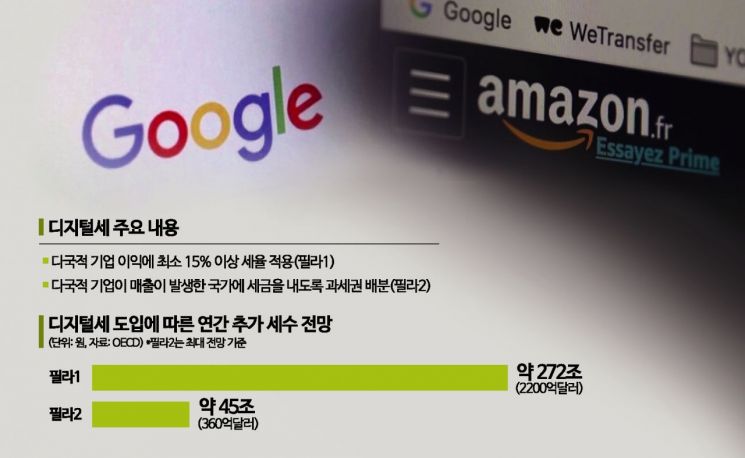

The global minimum tax is a system that applies a minimum tax rate of 15% or more on the profits of multinational corporations. If a specific country applies a tax rate lower than the minimum tax, other countries gain the right to tax. Multinational corporations meeting the criteria, such as Samsung Electronics and SK Hynix, must pay at least 15% corporate tax regardless of the market in which they operate worldwide. Previously, the OECD and the Group of Twenty (G20) agreed on two pillars (Pillar 1 and Pillar 2) of the international tax system reform, known as the "digital tax," under the Inclusive Framework (IF). The minimum tax corresponds to Pillar 2. Pillar 1 involves allocating taxing rights to countries where global companies with a certain level of revenue generate sales.

According to the OECD's forecast, the introduction of the global minimum tax will enable governments worldwide to secure an additional $220 billion annually, equivalent to 9% of multinational corporations' corporate tax revenues. This amount is $70 billion (approximately 87 trillion KRW) higher than the OECD's initial estimate of $150 billion (approximately 186 trillion KRW). It also significantly exceeds the International Monetary Fund's (IMF) forecast of $150 billion. The OECD explained that the forecast increased due to recent growth in multinational corporations' profits. If taxing rights are allocated to countries where sales occur, annual tax revenues are expected to increase by approximately $13 billion to $36 billion (about 16 trillion to 45 trillion KRW).

The OECD emphasized that all countries must swiftly implement measures to introduce the digital tax. The OECD stated, "The rapid, efficient, and broad implementation of measures is expected to significantly increase potential tax revenues," adding, "This will stabilize the international tax system, enhance tax certainty, and prevent the spread of unilateral digital services and trade disputes."

The pace of digital tax adoption varies by country. The OECD noted that South Korea has legislated the global minimum tax, and the United Kingdom and Canada have included it in their budgets. In contrast, in the United States, discussions have stalled amid criticism from Republican lawmakers who argue that it is disadvantageous to American companies. Other countries, including EU member states, have also expressed opposition or reservations.

Due to opposition, the OECD postponed the digital tax implementation schedule from this year to next year, but even this is considered precarious. The Wall Street Journal (WSJ) reported, "(In the case of the United States) last year, efforts to pass it through Congress failed, and with Republicans controlling the House in January, the outlook for next year looks even bleaker." Domestically, concerns have been raised that South Korean companies could suffer losses due to the legislation of the global minimum tax. The National Assembly passed the "International Tax Adjustment Act Amendment" last month to implement the global minimum tax, but the business community worries that the faster pace of legislation compared to other countries could disadvantage South Korean companies operating overseas. The government has stated that while other countries will likely find it difficult to delay implementation beyond next year, it intends to adjust the pace by monitoring the situation in major countries.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)