Trading at $9,100 per ton... Non-ferrous Metal Index Rises

"China Demand Expansion... Will Surpass $11,000"

[Asia Economy Reporter Minji Lee] As expectations for China's reopening (resumption of economic activities) grow and forecasts for increased demand for non-ferrous metals strengthen, copper prices are rising sharply. Copper, known as 'Doctor Copper' for being a leading economic indicator, is used across manufacturing sectors such as automotive and construction. There is a judgment that if China shows full-fledged movements for economic growth, supply shortages are also expected. Experts predict that copper prices, which fell in the second half of last year due to global economic recession concerns, will reach historically high levels this year.

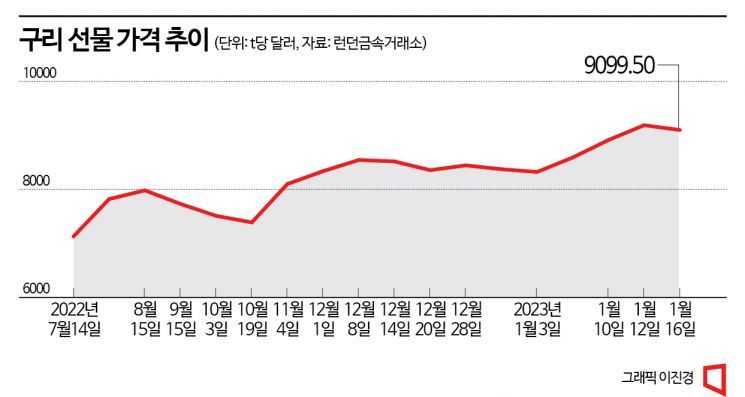

According to the London Metal Exchange (LME) on the 17th, the price of 3-month copper futures closed at $9,099.50 per ton as of the previous day, rising more than 9% compared to a month ago. Compared to three months ago ($7,662.50), it surged about 20.7%. Copper, which was trading below the $8,500 level last month, showed a steep upward trend this month, soaring close to the $9,200 level. The return of copper to the $9,000 level is the first since June last year, and compared to July last year when concerns about a global economic recession caused demand to drop and prices fell to around $7,100, it has surged more than 30%. The main reason for the sharp rise in copper prices is the outlook for increased demand from China.

Other non-ferrous metals mainly used in manufacturing showed similar trends. All these metals have about half of their demand coming from China. Looking at the trend of the non-ferrous metals index (LMEX), calculated by the LME by indexing futures prices of six non-ferrous metals (including aluminum, copper, zinc, lead, nickel, and tin), it rose more than 8% from 3,915.30 a month ago to 4,272.60 on the 13th. From the 1st to the 11th of last month (local time), the index fell about 14%, from 5,209.60 to 4,474.50.

The returns of derivatives (ETF·ETN) affected by copper price fluctuations are also showing an upward trend. The ‘KODEX Copper Futures ETF,’ which tracks copper futures prices traded on the New York Commodity Exchange (COMEX), rose 9.3%, and the ‘Samsung Leverage Copper Futures ETN,’ which aims to deliver twice the return of the copper futures index, increased about 14%. As physical demand for copper also grows, the ‘TIGER Copper Physical ETF,’ which invests in securities issued by copper storage warehouse operators, rose about 3%, and on the 16th, it recorded an intraday high of 10,265 won, the highest in three months. Copper-related stocks such as Igusanup rose 7% since the beginning of the year, while LS and Poongsan increased by 2.8% and 3%, respectively.

Experts expect the trend of rising non-ferrous metal prices to continue, reflecting demand expectations from China. Since the Chinese government is actively working to stimulate the real estate market, copper demand in the construction industry is expected to increase further. The weak dollar and European sanctions on Russian non-ferrous metals also support copper prices.

Considering these factors, NH Investment & Securities raised its copper price forecast for this year to $10,000, adjusting the band upward by up to $4,000 from the previous forecast range of $7,000 to $9,500. Hwang Byung-jin, a researcher at NH Investment & Securities, said, “After the Chinese New Year (after January 27), China will begin to actively secure copper inventories,” adding, “Recently, investors in the futures market have been closing net short positions on non-ferrous metals, so an expansion of net long positions is also expected.” However, some opinions suggest that the momentum from China alone may not continuously push copper prices higher. Kim Sohyun, a researcher at Daishin Securities, added, “For non-ferrous metal prices to continue rising, it is necessary not only to have demand from China but also to see improvements in the economic conditions of major countries such as the United States and Europe.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.