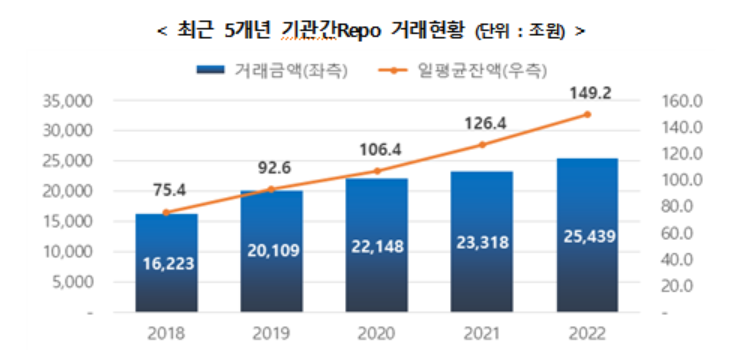

Last Year, Inter-Institution Repo Transaction Amount Reached 2,550 Trillion Won... 9% Increase Compared to Previous Year

[Asia Economy Reporter Minji Lee] Last year, due to the government's large-scale liquidity supply to alleviate the short-term money market crunch, inter-institution repurchase agreement (Repo) transactions recorded the highest level in five years. A repo is a bond issued by financial companies with the condition of repurchasing it later with added interest.

According to the Korea Securities Depository on the 16th, last year's repo transaction amount was 2,543.9 trillion won, an increase of 9.1% compared to the previous year. The average daily balance was 149.2 trillion won, up 18% from the previous year. Compared to five years ago, it has roughly doubled, showing a continuous growth trend.

Based on last year, the monthly average balance was highest in December at 177.5 trillion won, and especially on December 22, it recorded an all-time high of 183.7 trillion won. The Depository stated, "The growth of the repo market became prominent after the third quarter, reflecting concentrated funding demand due to instability in other short-term financial markets such as the commercial paper (CP) market and liquidity supply by financial authorities." In particular, the Bank of Korea's liquidity supply of about 20 trillion won to the short-term money market through repo purchases in November last year was effective.

The average daily balance by transaction period was 93.4 trillion won (62.5%) for 1-day, 25.7 trillion won (17.2%) for 7 to 10 days, and 21.9 trillion won (14.7%) for over 10 days. Due to the mandatory holding system for cash assets, the proportion of 1-day transactions decreased compared to the previous year, while the proportion of transactions over 7 days increased.

By industry, based on the average daily selling balance (fund borrowing), domestic securities companies were the largest at 61.1 trillion won (40.9%), followed by asset management companies at 44.5 trillion won (29.9%), and domestic securities company trust accounts at 18.3 trillion won (12.2%). In particular, in the insurance sector, which falls under other industries, repo sales increased significantly after the third quarter, growing from an average balance of 2.5 trillion won in November to 7 trillion won in December. The Depository explained, "This is because insurance companies sought liquidity through repo transactions following the temporary relaxation of the retirement pension borrowing limit and clarification of repo sales permissions by financial authorities at the end of November."

Based on the average daily buying balance (fund lending), asset management companies were the largest at 47 trillion won (31.5%), followed by domestic bank trust accounts at 38.5 trillion won (25.8%), and domestic banks at 19.9 trillion won (13.3%).

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)