Oxfam Releases Report Ahead of Davos Forum

1 in 10 People Worldwide Suffer from Hunger

"We Must Implement Measures Like Wealth Tax to Address Inequality"

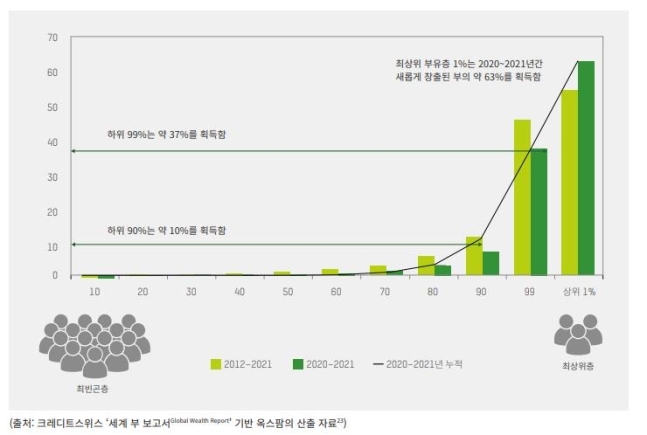

Analysis revealed that over the past two years, during the COVID-19 pandemic that swept the world, 63% of the newly created wealth was captured by the top 1% super-rich. The amount they claimed was nearly twice that of the remaining 99%.

International relief and development organization Oxfam announced on the 16th, coinciding with the opening of the Davos Forum, in its report titled "Survival of the Richest" that inequality is worsening amid the simultaneous increase of extreme wealth and poverty for the first time in 25 years.

According to the report, despite the pandemic crisis, $42 trillion of new wealth was created worldwide over the past two years, of which $26 trillion (63%) went to the global top 1% super-rich. The share for the remaining 99% was only $16 trillion.

During this period, while the bottom 90% struggled to earn one dollar of newly created wealth, the wealth of billionaires in the top 1% increased by approximately $1.7 million each. Oxfam pointed out that over the past decade, both the number of billionaires worldwide and their wealth have doubled.

In particular, the wealth of billionaires surged last year as profits in the food and energy industries rapidly increased. The profits of 95 energy and food companies more than doubled last year, and these companies distributed 84% ($257 billion) of the additional $306 billion in profits to wealthy shareholders.

The Walton Family, owners of half of Walmart, earned $8.5 billion (approximately 10.55 trillion KRW) last year, and the wealth of Gautam Adani, owner of an Indian energy company, increased by $42 billion (approximately 52.1 trillion KRW) in just the past year.

The proportion of newly created wealth acquisition (percentage of the total) [Image provided by Oxfam]

The proportion of newly created wealth acquisition (percentage of the total) [Image provided by Oxfam]

In the United States, United Kingdom, and Australia, it was pointed out that more than half of the severe inflation was caused by the excessive profits of such companies. However, while the wealth of billionaires surged, at least 1.7 billion workers worldwide live in countries where wage growth lags behind inflation, and more than 820 million people?one in ten globally?are suffering from hunger, according to the analysis.

In response, Oxfam urged governments worldwide to take action to reduce inequality, including taxing the wealthy. Oxfam stated that decades of tax cuts for corporations and billionaires have deepened inequality, and in many countries, the poor face higher tax rates than billionaires. They called for systematic and extensive tax increases to reclaim public funds and profits gained through corporate and billionaire profiteering.

As a specific example, Oxfam cited Elon Musk, the richest person in the world. Musk’s "effective tax rate" between 2014 and 2018 was only 3%, whereas Ever Christine, a flour trader in Uganda earning $80 a month, faced a tax rate of 40%.

Oxfam also pointed out that only 4 cents of every tax dollar comes from wealth taxes, and half of billionaires live in countries with no inheritance tax on direct descendants. This results in $5 trillion in wealth being passed to the next generation tax-free?more than the entire GDP of Africa. They also highlighted that the average tax rate on capital income, which constitutes most of the rich’s income, is 18%, slightly above half the tax rate on labor income in most countries, which is problematic.

Furthermore, Oxfam criticized that although taxes on the wealthy were much higher in the past, over the past 40 years, countries worldwide have pursued tax cuts on rich incomes while increasing taxes on goods and services, thereby increasing the burden on the poor and significantly worsening inequality.

Moreover, they proposed that imposing a wealth tax of 2% on millionaires, 3% on those with assets over $50 million, and 5% on billionaires could generate an additional $1.7 trillion (approximately 2,111 trillion KRW) annually, which could lift 2 billion people out of poverty and fund global plans to end hunger.

Gabriela Bucher, Executive Director of Oxfam International, emphasized, "The wave of tax cuts for the top wealthy over the past 40 years has lifted only luxury yachts, not all boats," adding, "Taxing the super-rich and large corporations is the way out of the current dual crisis, and now is the time to break the myth that tax cuts for the wealthy will create a trickle-down effect."

Meanwhile, the World Bank (WB) forecasts that inequality and poverty will increase at the fastest rate since World War II. The poorest countries are spending four times more on debt than on healthcare services, and three-quarters of governments worldwide plan to cut $7.8 trillion from public sector spending on health, education, and other areas over the next five years due to austerity measures.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.