Resumption of Economic Activities with With Corona

Record High Consumption of 15.8 Million Barrels per Day

Q3 Expected to Reach 1.1 Million Dollars

Raw Material Prices Including Copper Also Soar

[Asia Economy Reporter Lee Ji-eun] As China lifts its lockdown policies to curb the spread of COVID-19 and resumes economic activities, oil consumption is expected to increase. Following the rise in demand from China, the world's second-largest oil importer, oil prices, which stabilized after the Russia-Ukraine war, could surge starting from the second quarter.

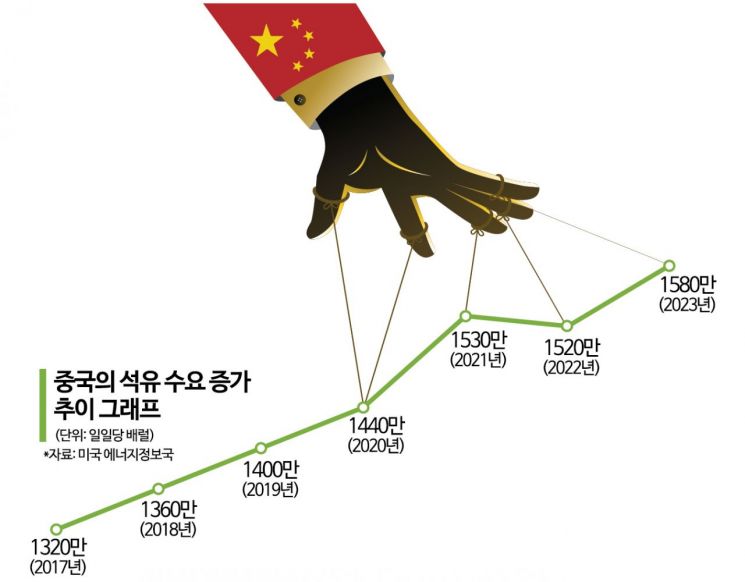

On the 12th (local time), Bloomberg analyzed data from 11 Chinese consulting firms and estimated that China's daily oil demand could rise to 15.8 million barrels this year. This is an increase of 800,000 barrels compared to last year, marking an all-time high.

China's easing of quarantine policies and resumption of economic activities appear to have significantly influenced the increase in demand. As of 2021, China ranks as the world's second-largest crude oil importer after the European Union (EU). Considering this share, Bloomberg explained that China's crude oil import volume acts as a major factor influencing international oil prices, comparable to the production cut decisions by the Organization of the Petroleum Exporting Countries Plus (OPEC+) and Western sanctions against Russia.

Energy consulting firm Energy Aspect added, "China's second-quarter demand offsets the reduced crude oil demand in Europe caused by decreased heating needs due to this spring's above-average temperatures." While Europe's mild weather has lowered heating demand, contributing to the stabilization of international energy prices, China's expanding crude oil demand could push energy prices upward.

The full-scale rebound in oil prices is expected to begin in the second quarter when the effects of China's zero-COVID policy subside. Experts predict that pent-up consumer sentiment within China will recover, leading to increased logistics movement and a sharp rise in fuel consumption.

Etienne Lin, head of refining research at global consulting firm Wood Mackenzie, stated, "Especially as the number of international flights gradually increases, crude oil demand will recover rapidly," adding, "Global crude oil demand is expected to increase by 970,000 barrels per day this year." The International Energy Agency (IEA) also forecasted an increase in crude oil demand by 1.7 million barrels per day this year, which is 100,000 barrels more than previous estimates. OPEC projected an even higher increase of about 2.2 million barrels per day compared to the IEA's forecast.

Accordingly, Brent crude, which fell to $83 per barrel in September last year, is expected to rise to $110 per barrel by the third quarter. Brent crude prices surged to nearly $140 per barrel in March last year following the outbreak of the Russia-Ukraine war. Since then, from September last year, Brent crude stabilized in the low $80 range, and West Texas Intermediate (WTI) crude fell below $80, regaining stability. However, depending on the expansion of demand from China, oil prices could stir again.

Jeff Currie, head of Goldman Sachs Global Commodities Research, recently told Bloomberg TV, "If China and other Asian countries completely lift COVID-19 restrictions, Brent crude could reach around $110 per barrel by the third quarter."

With expectations of China's 'reopening,' not only crude oil but also commodities such as copper and iron ore, which have recently surged in price, are expected to continue their rally this year. On the 11th, the international copper price briefly surpassed $9,000 per ton on the London Metal Exchange, marking the first time since June last year.

However, there is also analysis that the rise in oil prices may be a short-term phenomenon. The relaxation of China's quarantine policies could lead to a prolonged surge in COVID-19 cases due to increased mobility. This could result in a contraction of economic activities. Gao Minggu, an energy analyst at the state-owned China SDIC (State Development & Investment Corporation), said, "Usually, after easing quarantine policies, transportation and mobility increase sharply," adding, "If confirmed cases rise due to this, mobility decreases again, and it may not recover to peak levels."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.