Supply-Demand Instability Subsides, Institutional Demand Increases

Credit Spread, a Corporate Bond Investment Indicator, Significantly Narrows

Experts Forecast "Trend of Decline to Continue"

[Asia Economy Reporter Minji Lee] Korea Electric Power Corporation (KEPCO) has been actively issuing bonds since the beginning of the year, amid a sharp decline in interest rates. The average market yield (Minpyeong) of private bonds has entered the 3% range, returning to levels seen in August last year. This is attributed to the combined effect of abundant liquidity from institutions at the start of the year and uncertainty in interest rates. The corporate bond issuance market is also continuing its 'sold-out' streak, receiving orders in the trillion-won range.

According to the investment banking (IB) industry on the 13th, KEPCO confirmed the issuance of bonds worth a total of 440 billion KRW (AAA) in the previous day's auction. This includes 110 billion KRW in 2-year bonds and 330 billion KRW in 3-year bonds. The auction attracted funds of 330 billion KRW and 750 billion KRW respectively, totaling 1.08 trillion KRW. KEPCO has issued bonds four times this year, with a total procurement amount reaching 670 billion KRW.

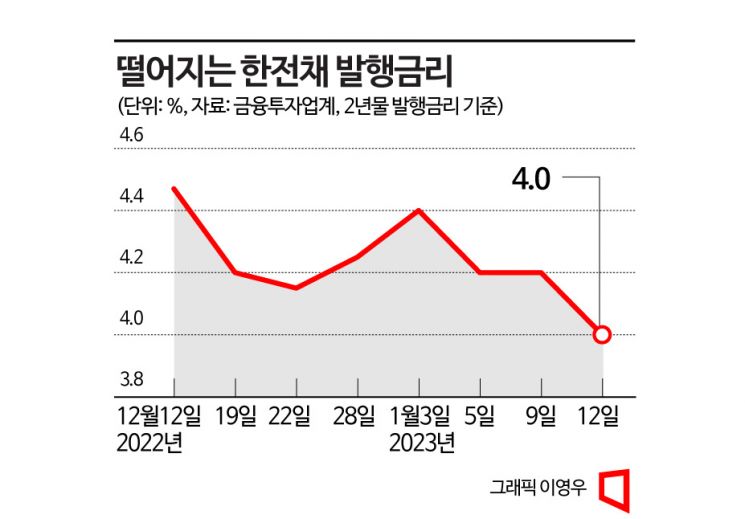

The decline in issuance yields has become more pronounced during this period. The 2-year bond yield fell to 4.0%, and the 3-year to 4.08%, down 20 basis points (1bp = 0.01 percentage point) each compared to the issuance yields of 4.2% and 4.28% recorded on the 9th. Looking at the 2-year yield, it rose from 4.15% on the 22nd of last month to 4.40% on the 3rd of this month, but then dropped to 4.2% on the 5th and 9th, continuing its downward trend. The 3-year yield shows a similar pattern. Although the yield (based on 2-year bonds) rose when the year-end electricity rate increase was set lower than market expectations, the influx of institutional liquidity at the start of the year reversed the interest rate trend.

Notably, the Minpyeong yield, which influences issuance yields, has fallen into the 3% range. As of the 11th, the reference date for this issuance, KEPCO's 2-year and 3-year Minpyeong average yields were 3.971% and 4.088%, respectively. In the previous auction, the 2-year and 3-year Minpyeong average yields were 4.218% and 4.378%, respectively. The 2-year Minpyeong average yield jumped from the high 3% range in August to the high 5% range, then entered the 4% range for the first time in mid-last month. The rapid pace of the yield decline has resulted in a drop of more than 1 percentage point in less than a month.

In the secondary market, the yield spread between KEPCO bonds and government bonds has narrowed significantly. As of the previous day, the 3-year government bond yield was 3.466%, while the 3-year KEPCO bond yield was 4.081%, showing a difference of 61.5 basis points. Although this is higher than the level a year ago (30-40bp), it is much narrower compared to over 160bp recorded in November last year.

Bond market insiders analyze that the downward trend will continue, given the sharp rise in KEPCO bond yields previously. The resolution of electricity rate uncertainties and the expectation that this year's operating deficit will be smaller than last year's are also factors contributing to the decline in yields.

Polarization in the Bond Market... Non-Investment Grade Bonds Unpopular

Not only KEPCO bonds but most companies entering the issuance market recently are continuing to issue corporate bonds under more relaxed conditions than before. The government's liquidity supply effect to stabilize the bond market is reflected in the market, and the improved funding conditions of institutions and the resolution of interest rate uncertainties have reduced corporate interest burdens.

In the issuance market, on the 10th, Hyundai Steel (AA-) and CJ ENM (AA-) received funds amounting to 1.805 trillion KRW and 760 billion KRW, respectively, from corporate bond demand forecasts of 200 billion KRW and 170 billion KRW. Hyundai Steel plans to increase issuance by 350 billion KRW, having set issuance yields about 70 basis points lower than the Minpyeong average yield. The decline in secondary market yields is also continuing. The credit spread (the difference between the 3-year corporate bond yield with credit rating 'AA-' and the government bond yield of the same maturity), an indicator of institutional corporate bond investment sentiment, shrank by 50 basis points from 174bp a month ago to 123bp as of the previous day. The average secondary market yield for 3-year corporate bonds fell significantly to 4.69% from 5.35% a month ago.

Hwa-jin Lee, a researcher at Hyundai Motor Securities, explained, "The exchange rate, which had been a burden on the base interest rate decision, has dropped to the 1240 KRW range, and inflation has slowed, along with easing concerns over Europe's energy crisis, which strengthened credit. From a supply-demand perspective, buying by pension funds and retirement pension operators, as well as institutional bargain hunting, have rapidly stabilized the market."

As high-grade bonds, including public bonds, show strength, attention is focused on whether A-rated non-investment grade bonds can take over. However, bond market experts assess that it will take time for warmth to spread. This is because concerns over the creditworthiness of construction companies rated A, due to performance deterioration from economic slowdown and project financing (PF) risks, have not disappeared.

Eun-gi Kim, a researcher at Samsung Securities, said, "A-rated bonds face not only fundamental concerns but also less support from public corporate bond support policies compared to during COVID-19. Policies supporting A-rated public corporate bonds, like the Special Purpose Vehicle (SPV) for low-credit corporate bonds and commercial paper (CP) purchases, need to be introduced to resolve this imbalance."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)