Surging Demand Expected for Electric Vehicle Battery Materials

Lotte Gains Battery Material Synergy through Iljin Acquisition

Korea Zinc Secures Supply Chain Partnership with LG

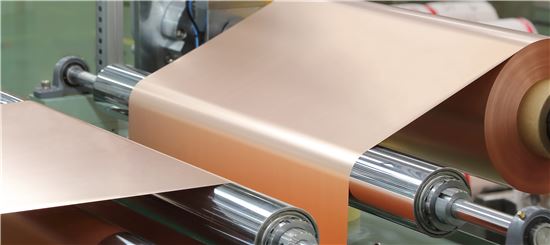

Iljin Materials announced that it has successfully developed the secondary battery electrofoil 'I2S' for next-generation electric vehicles, which can significantly enhance driving performance, and has started sales.

Iljin Materials announced that it has successfully developed the secondary battery electrofoil 'I2S' for next-generation electric vehicles, which can significantly enhance driving performance, and has started sales.

[Asia Economy Reporter Oh Hyung-gil] The copper foil market, made by rolling copper into thin sheets, is heating up. SKC maintains the world's number one market share, but Lotte and Korea Zinc have thrown their hats into the ring. The demand for copper foil, a key material for electric vehicle batteries, is explosively increasing, leading to fierce competition.

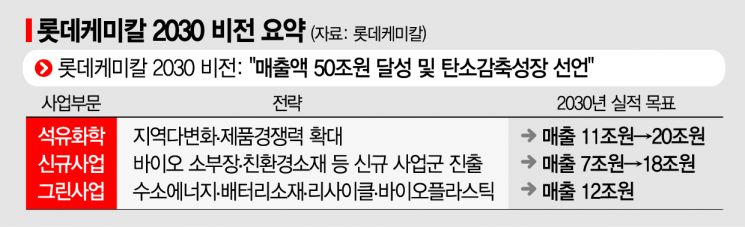

Lotte Chemical is set to officially acquire Iljin Materials next month. To diversify its battery materials business, Lotte Chemical signed a stock purchase agreement (SPA) last November to acquire 53.5% of Iljin Materials' shares for about 2.7 trillion KRW. Subsequently, the Fair Trade Commission approved Lotte Chemical's acquisition of Iljin Materials on the 10th of this month. The acquisition process is considered to have passed the critical stage.

Lotte Chemical faced criticism that funding support to Lotte Construction, which is experiencing a liquidity crisis, might cause problems in acquiring Iljin Materials. However, it early recovered funds from Lotte Construction, removing uncertainties.

However, the debt dependency ratio due to years of investment increased from 16.0% at the end of 2021 to 17.9% in the first half of last year. There are concerns that borrowing additional funds for the Iljin Materials acquisition could further burden financial stability.

From a business perspective, Iljin Materials can create synergy effects in securing customers with Lotte Chemical affiliates that have entered the battery materials business. Lotte Chemical established 'Lotte Battery Materials USA' to promote and oversee its battery materials business in the U.S., declaring entry into the cathode foil business. The acquisition entity of Iljin Materials is Lotte Battery Materials USA.

Additionally, Lotte Chemical is also pushing to build a cathode foil production base, 'Lotte Aluminum Materials USA,' near Elizabethtown, Kentucky, in collaboration with Lotte Aluminum. Domestically, it produces separator materials (PE) and plans to secure a battery electrolyte organic solvent production facility within the Daesan plant by the end of this year.

Iljin Materials is the second-largest copper foil manufacturer in Korea, with an estimated global market share of around 5%. For Lotte, this means having the advantage of supplying battery materials such as cathode foil, electrolyte, and separator as a package.

The target customer is believed to be LG Energy Solution. Since it is competing with SK in batteries, there is a high possibility of seeking suppliers other than SKC, the main supplier.

Korea Zinc has also entered the copper foil competition. It has strengths in non-ferrous metal smelting technology and raw material procurement. Korea Zinc's subsidiary K-JAM completed the construction of an electrolytic copper foil production plant at the Ulsan Onsan smelter in August and plans to produce 13,000 tons of copper foil annually starting this year. Expansion to 30,000 tons per year is also planned by 2025.

Notably, in June last year, it established Korea Precursor in a joint venture with LG Chem and is constructing a precursor plant, the raw material for cathode materials, aiming for mass production in the second quarter of 2024.

In November, it signed a comprehensive business cooperation agreement with LG Chem to discover battery raw materials and exchanged treasury shares worth 257.6 billion KRW to build a strategic partnership. It is also evaluated to have secured a favorable position in LG's supply chain.

The market size for copper foil used in anode current collectors in batteries is expected to continue growing. SNE Research forecasts that global demand for battery copper foil will increase nearly threefold from 265,000 tons in 2021 to 748,000 tons in 2025.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)