Despite Year-Start Household Loan Quota Reset,

Savings Banks, Capital Companies, and Toss Under 'Inspection'

Due to Rising Funding Rates and Borrower Credit Decline

[Asia Economy Reporter Kwon Hyun-ji] Secondary financial institutions such as savings banks and capital companies are still struggling to ease lending restrictions easily in the new year. Due to soaring funding costs and increased risk from borrowers' declining creditworthiness, they are not actively expanding credit. With the possibility of the Bank of Korea raising the base interest rate further in the first half of this year, the 'loan freeze' for low-income and low-credit households is expected to continue for the time being.

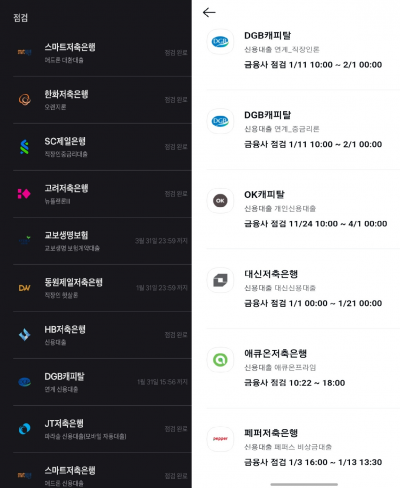

Loan brokerage platforms Toss (left) and KakaoPay credit loan inquiry screens (Photo by Toss, KakaoPay capture)

Loan brokerage platforms Toss (left) and KakaoPay credit loan inquiry screens (Photo by Toss, KakaoPay capture)

According to the financial sector on the 12th, many savings banks such as Welcome, Pepper, Daishin, and JT are either not accepting loan applications on loan brokerage platforms like Toss and KakaoPay, citing 'under inspection,' or are not operating loans even if the status is 'inspection completed.' The situation is similar for capital companies. Lotte, DGB, and Welcome Capital have also suspended loan operations on external platforms.

While each company's application (app) still handles credit operations, savings banks have significantly reduced their lending capacity considering that many users come through external platforms. The share of loans handled through loan brokerage platforms exceeds half of the total loans of savings banks. Only a few large-scale savings banks such as SBI and OK are operating normally on external platforms.

The financial sector had expected the contraction trend in savings banks' lending, which began in the second half of last year, to ease with the new year. Typically, savings banks temporarily suspend loan operations at the end of the year to comply with the total growth rate guidelines for household debt management set annually by financial authorities, and then resume once the new year's loan quota resets. The current new year loan winter is quite different from last year's early resumption of loan operations by most savings banks and capital companies immediately after the new year began.

One reason for the slow normalization of lending by savings banks is the deterioration of profitability due to rising funding costs. With the legal maximum interest rate capped at 20%, and funding costs rising to around 12% per annum, it has become impossible to make a margin, leading to blocking loans coming from external platforms that also charge fees.

The decline in creditworthiness of vulnerable borrowers also has a significant impact. As the economic downturn reduces their repayment ability, savings banks have raised loan thresholds to manage risks. According to the Korea Deposit Insurance Corporation, as of the end of the third quarter last year, the delinquent amount of 79 savings banks nationwide was 3.4344 trillion won, an increase of over 400 billion won compared to the previous quarter (2.9772 trillion won). The number of banks with rising delinquency rates compared to the previous quarter reached 40% (32 banks), increasing the risk of insolvency among savings banks.

An official from a small savings bank said, "We will decide on resuming loans after monitoring the situation further," adding, "With borrowers' credit conditions worsening and funding costs rising, we are under pressure from both sides, so we are cautious."

The savings bank industry expects this trend to continue for the time being if the Bank of Korea raises the base interest rate further. However, since financial authorities have pointed out the issue of loan suspensions in the secondary financial sector and hinted at intervention, some banks are expected to resume lending. Another savings bank official said, "Since financial authorities are requesting the resumption of loans, funds will be released soon," but also admitted, "It is true that there are concerns about profitability."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.