Survey on Office Lease Outlook This Year for 89 RSquare Employees

[Asia Economy Reporter Kim Min-young] Due to the economic slowdown, the office lease market in Gangnam, Seoul, is expected to perform worse than in previous years. Currently, major business districts in Seoul are booming, with natural vacancy rates hovering around 5%, but this trend is expected to change.

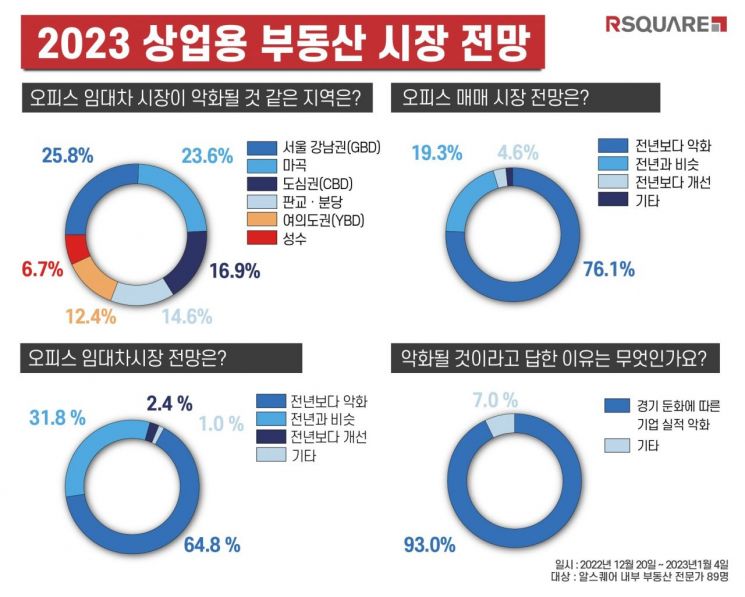

On the 11th, RSquare, a commercial real estate data specialist company, conducted a survey over 16 days from December 20 last year to January 4 this year, targeting 89 market experts and employees. The results showed that 65.2% responded that the office lease market atmosphere would "worsen compared to last year." Those who answered "similar to last year" accounted for 31.5%, while only 2.2% said it would "improve."

Among experts who predicted an increase in vacancies due to the worsening office lease market, 93.1% cited "deterioration of corporate performance due to the economic slowdown" as the reason. Although office rents are expected to rise this year due to steep interest rate hikes, companies are seen as lacking the capacity to bear these costs.

The majority of respondents believed that most office lease markets in major areas of Seoul and the metropolitan area would struggle. When asked about regions expected to worsen, the largest share of experts (25.8%) pointed to Seoul’s "Gangnam area." Given the area's characteristics, with many IT companies and startups located there, a decline in their performance is expected to reduce leasing demand. Following that, "Magok," "Central Business District (CBD)," "Pangyo and Bundang," and "Yeouido Business District (YBD)" accounted for 23.6%, 16.9%, 14.6%, and 12.4%, respectively.

The office sales market atmosphere is also challenging. Eight out of ten respondents (76.4%) forecast that the business conditions this year will worsen compared to the previous year. As the biggest factor influencing the market, seven out of ten (75.3%) cited "interest rates." The "startup downturn" due to the investment market slump accounted for 21.3%.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)