Record High ELB Issuance Last Year

Soared Due to Year-End Retirement Pension Fund Demand

[Asia Economy Reporter Lee Seon-ae] Despite warnings from the Financial Supervisory Service (FSS) to be cautious about investments due to the possibility of principal loss, the warnings have not been effective. This concerns derivative-linked bonds (ELB·DLB). It has been revealed that derivative-linked bonds (ELB·DLB) recently recorded the highest issuance volume ever on a monthly and quarterly basis.

Derivative-linked bonds (ELB·DLB) are a separate category of derivative-linked securities (ELS·DLS) that guarantee the principal. Depending on the nature of the underlying assets, they can be classified into equity-linked derivative bonds (ELB), which use stocks or stock indices as underlying assets, and other derivative-linked bonds (DLB), which use interest rates, commodities, credit, etc., as underlying assets. Fundamentally, these products aim to avoid the risk of principal loss while seeking returns higher than bank savings or deposit interest rates, but if the issuer goes bankrupt, there is a risk of losing principal and interest.

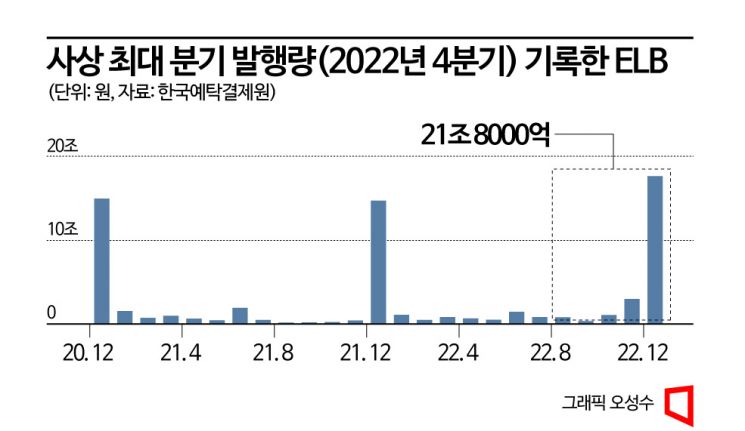

According to the Korea Securities Depository on the 10th, the issuance volume of equity-linked derivative bonds (ELB) in the fourth quarter of last year was 21.8 trillion won, marking the highest quarterly issuance volume ever. Nearly 18 trillion won was issued in December alone, setting the highest monthly issuance volume on record. The issuance volume of other derivative-linked bonds (DLB) in the fourth quarter of last year was 7 trillion won. DLB also set a record for the highest monthly issuance volume with 2.8 trillion won issued in December alone.

The surge in ELB issuance is attributed to the shift of funds into retirement pensions. Jeon Gyun, a researcher at Samsung Securities, explained, "Every year at the end of the year, refinancing of retirement pensions has been concentrated, but last year set a record for the highest issuance ever. In particular, the issuance volume of ELB in December last year was 17.6 trillion won, an 18% increase compared to the previous record of 14.8 trillion won in December 2020."

Following the Legoland incident, short-term money market instability surfaced due to real estate project financing (PF) and asset-backed commercial paper (ABCP). As a result, market interest rates in the fourth quarter of last year were 3 to 4 times higher than the one-year retirement pension rates. From the perspective of retirement pension providers, there was concern that if they could not offer relatively high interest rates, most retirement pensions might flow to other financial companies. Consequently, securities firms actively engaged in retirement pension sales using ELB, which is interpreted as the reason for the record-high ELB issuance in December last year.

The issuance volume of DLB in the fourth quarter of last year increased to 2.6 times that of the previous quarter (2.7 trillion won). Compared to the same period last year (3.4 trillion won), it doubled. Especially in December last year, DLB issuance reached nearly 3 trillion won, marking the highest level since DLB data began to be compiled.

The sharp increase in DLB issuance was due to the overlap of rising market interest rates and issuance for retirement pensions. As the Bank of Korea and major central banks rapidly raised benchmark interest rates to control inflation risks, market interest rates surged worldwide. The rise in benchmark rates and the consequent spike in government bond yields increased bond market volatility to levels comparable to the 2008 global financial crisis. Researcher Jeon analyzed, "As routine bond investments became highly risky, demand for DLB investments, which can expect relatively high short-term returns, increased accordingly. The growing demand for DLB investments that can be included in retirement pension funds toward the end of the year also had a significant impact." The fact that DLB issuance in November last year was also recorded at 2.6 trillion won indicates strong investment demand for retirement pensions.

The FSS sounded a warning about the increase in derivative-linked bond issuance. As securities firms competitively issued derivative-linked bonds, the FSS sent a guidance letter on the 15th of last month advising caution against incomplete sales related to ELB and DLB. It also promptly released a "Notice on Precautions When Investing in Derivative-Linked Bonds," warning that investing in derivative-linked bonds may result in failure to receive principal and interest repayments.

The FSS’s proactive approach is interpreted as stemming from concerns that the increase in sales of these products could potentially trigger turmoil in the money market if mishandled. Based on last year's annual issuance volume, ELB recorded a record high of 29.6 trillion won, and DLB recorded the second highest at 13.2 trillion won.

Derivative-linked bonds are principal-guaranteed products but are not covered by depositor protection. Legally, the investment funds are not required to be separately deposited and are not segregated from the issuer’s (securities company’s) proprietary assets. These bonds, issued on the credit of securities firms, may result in loss of principal and returns in the worst case of issuer bankruptcy. The stability of the underlying assets and the possibility of principal and interest repayment are unrelated. Although designed based on the stock prices of reputable companies, the repayment of principal and interest depends on the issuer’s payment capacity. It is also important to remember that early redemption incurs redemption costs. If early redemption is requested, the amount paid will be reduced by the redemption costs, which may result in principal loss.

The FSS emphasized, "Investors should be aware that derivative-linked bonds inherently carry the risk that principal and interest may be partially or fully unpaid, and there is a risk of damage due to investors’ lack of understanding. Investors should carefully invest only after fully understanding the product’s profit and loss structure, underlying assets, issuer’s credit rating, liquidity risk, payment capacity, and soundness indicators through prospectuses and explanations from sellers."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.